Welcome to Grid Brief! Here’s what we’re looking at today: PG&E’s big year for low emissions, MISO’s interconnection queue remains dominated by renewables and batteries, and more.

PG&E: Greenhouse Gas Free In 2023

Last year, the California utility PG&E provided its retail customers with 100% emissions free electricity.

“In 2023, 34% of PG&E's total electricity delivered to retail customers—residential customers and businesses to whom the company directly sells electricity—came from specified eligible-renewable resources, including solar and wind power, small hydroelectric generation and biopower,” the utility said in a press release. “PG&E retail customers also received 53% of their electric deliveries from carbon-free nuclear power generated by Diablo Canyon Power Plant, and 13% from large hydroelectric power.”

Solar makes up the majority of PG&E’s renewable power generation and the utility is adding hefty amounts of battery storage.

“As of March 2024, PG&E has brought online a total of more than 2,100 megawatts of new incremental battery storage capacity, with an additional 772 megawatts planned in 2024 and 687.5 megawatts planned in 2025. PG&E has more than 3.5 gigawatts of total battery energy storage under contract,” the utility added.

Next month, California’s Public Utility Commission may vote to reject PG&E’s attempt to spin off a separate company with 5.6 GW in in non-nuclear generation in the hopes of raising more capital.

MISO’s Interconnection Queue

The Midcontinent Independent System Operator’s recent Grid Interconnection Queue reveals that renewable energy and battery storage are still the leaders in the applicant pool.

“Preliminary results include 600 applications representing approximately 123 GW of new generation across the MISO footprint – 115 GW (or 93 percent) of which are wind, solar, storage or hybrid resources,” the grid operator said in a press release. “If all the projects submitted this year are accepted as valid applications, the MISO queue would increase to 348 GW. MISO’s all-time system peak load is 127 MW.”

The 2023 results are lower than 2022’s, which boasted 900 projects at 171 GW of generation, a volume so burdensome the grid operator had to “to submit Tariff filings to the Federal Energy Regulatory Commission (FERC) to improve the quality and timeliness of the project approval process.”

Earlier this year, MISO’s CEO John Bear said that transition to renewable energy is “posing material, adverse challenges to electric reliability.”

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

India surges as solar panel exporter. “Rystad Energy’s latest data reveals renewable energy installations in India surged to a record 7.1 gigawatts (GW) in March, more than doubling the previous record of 3.5 GW set in March 2022. The increase in installations helped India reach its highest-ever annual installed capacity of 18.5 GW for the fiscal year ending on 31 March 2024,” reports Oilprice.com. “The growth was primarily driven by solar installations, up 23% on levels from the 2023 financial year, driven by the commissioning of numerous projects within India's inter-state transmission system network and ultra-mega solar park schemes. In particular, states such as Gujarat, Rajasthan, Madhya Pradesh and Maharashtra have contributed to this expansion. Notably, Adani Green, the renewable energy arm of Indian conglomerate Adani Group, made significant strides in the first quarter of 2024 by installing approximately 1.6 GW of solar capacity in the Kutch district of Gujarat. This initiative is part of a wider hybrid renewable energy park that will see up to 30 GW of combined solar and wind capacity installed in Khavda in the coming years.”

US solar panel manufacturers want protective tariffs. “Some of the world's largest solar equipment makers on Wednesday asked President Joe Biden's administration to impose steep tariffs on panels and cells from four Asian countries in order to protect billions of dollars in investments in U.S. manufacturing,” reports Reuters. “Seven companies - Korea's Hanwha Qcells, Switzerland's Meyer Burger , Norway's REC Silicon and U.S. companies First Solar Inc, Convalt Energy, Mission Solar and Swift Solar - are behind the petitions filed with the U.S. Department of Commerce and the International Trade Commission, they said in a statement. The American Alliance for Solar Manufacturing Trade Committee is accusing Chinese companies with factories in Malaysia, Cambodia, Vietnam and Thailand of flooding the U.S. market with panels priced below their cost of production. That has caused prices to collapse by more than 50%, threatening their U.S.-made products, they said.”

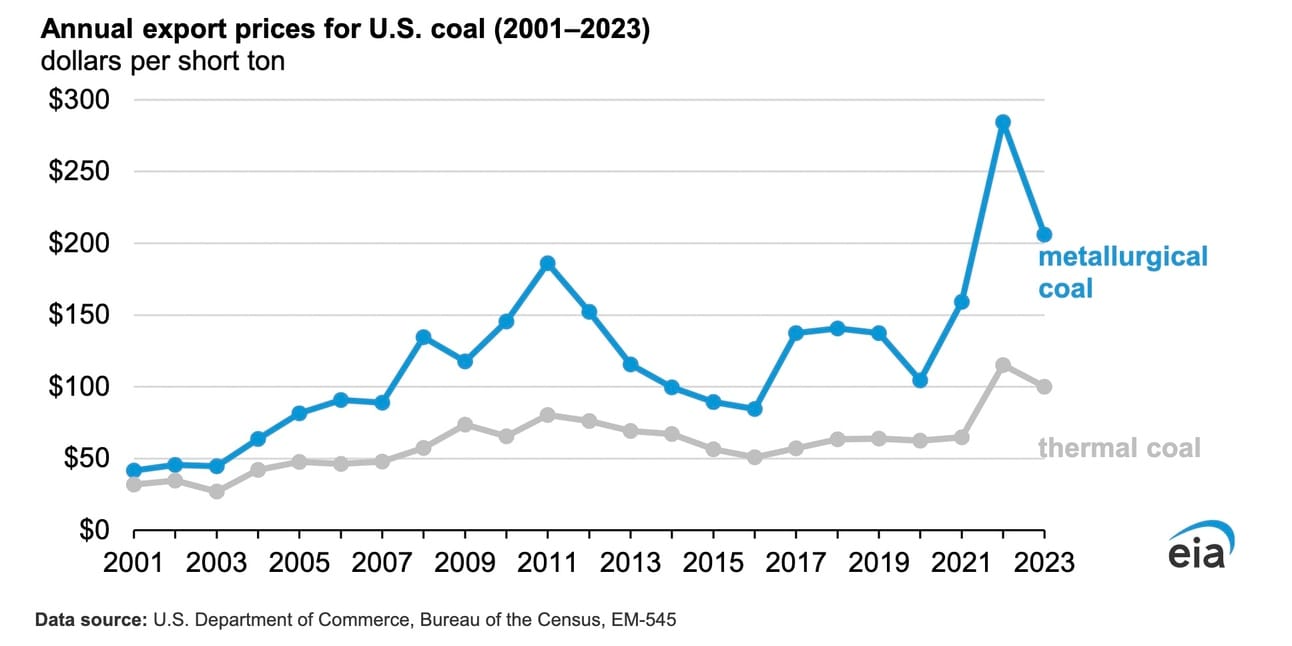

America’s metallurgical coal has been trading at a premium. “U.S. coal used for the steelmaking process has sold for more than double the price of U.S. coal used as a fuel for electricity generation in six of the last seven years, underscoring a historical trend,” reports the Energy Information Administration. “U.S. metallurgical coal, used primarily as a raw material in the steelmaking process, historically has sold into export markets at prices higher than those for U.S. thermal coal, a major fuel for electricity generation. From 2001 to 2023, U.S. metallurgical coal sold at an average premium of 90% to the price of thermal coal.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!