Two stories, one theme: the age of “extra” capacity is over. PJM’s own modeling says storage must scale fast to keep costs tolerable as AI load and retirements pile up; New York’s operator is waving a red flag about thin margins in the city and on the Island starting next summer. Meanwhile, the Army is done waiting—Project Janus brings small reactors to bases for resilience and wartime logistics.

PJM: Batteries or Bill Shock

The U.S. Energy Storage Coalition’s Brattle study pegs PJM’s needs at 16 GW of storage by 2032, 23 GW by 2040, and 43 GW by 2045—on top of ~17 GW of new gas and slower-than-planned thermal retirements. Why? Peak grows ~30 GW by 2032, gas turbine lead times and component backlogs drag, and queue reform can’t conjure firm supply on demand. Four-hour storage is the cheapest reliability plug, but Brattle is blunt: retain conventional firm resources and add gas—or storage requirements rise further.

On top of the supply scramble, PJM’s market monitor asked FERC to reject a PECO–Amazon transmission service agreement for a massive PA data-center campus until it proves no cross-subsidy or reliability harm; the monitor says data centers drove $16.6B of $30.8B in the last two capacity auctions. Translation: the “bring your own power” era is arriving in PJM, and big loads will carry bespoke interconnection risk, revenue guarantees—and political heat.

Why it matters: Absent a storage surge, Brattle warns customers could see ~30% cost increases largely via capacity prices. Expect more utility-load TSAs, state pressure on PJM governance, and parallel fast-track paths for dispatchable resources while the queue grinds.

NYISO: Reliability Margins Go Thin, Fast

NYISO’s latest STAR and draft Comprehensive Reliability Plan flag deficits starting 2026 in NYC (6–8 peak summer hours/day), 2027 on Long Island, and 2030 in the Lower Hudson Valley—driven by peaker retirements under DEC’s NOx rule, load growth (data centers, manufacturing), aging plants, and sluggish new build. The fixes everyone’s watching: 1,250 MW Champlain Hudson Power Express (hydro from Québec, due May 2026), 816 MW Empire Wind (~2027, wobbly timeline), and ~1,300 MW Propel NY for LI (2030).

Zach Smith at NYISO says the system could need “several thousand megawatts of new dispatchable generation” in the next decade depending on demand and retirements. Environmental groups counter that tens of GW of clean projects are stuck in the queue and storage + transmission should come first. Either way, NYISO projects a tripling of emergency-action hours by 2034 without timely in-service dates.

Bottom line: NYC/LI are tight until new wires and firmable supply land. Expect more must-run peakers, interim service orders, and fierce fights over what counts as “dispatchable” under state law.

Army: Nine Bases, Nine Reactors

Under Project Janus, the Army plans to install small nuclear reactors on nine U.S. bases by 2027–2028, aiming for base-islanded resilience and eventually air-mobile units for forward power. DIU is partnering to tap commercial microreactor designs that can ride a C-17 or flatbed and deliver multi-MW. A Trump EO directs DoD to have Army-regulated reactors operating by Sept. 30, 2028.

Why you care: DoD is a premium, creditworthy offtaker. If Janus hits schedule, it jump-starts domestic fuel, manufacturing, and licensing pathways that commercial buyers (mines, data centers, ports) can ride.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

The Economist — The high costs of Spain’s renewables revolution

Spain’s cheap wind/solar is now a victim of its own success: curtailment and volatility are biting; more batteries (and flexible demand) are the next gating items.WSJ — AI data centers are building their own power plants

From West Texas gas to campus fuel cells, hyperscalers are BYO power while the grid catches up—expect TSAs and “reliability-backed” interconnections to become standard.

Today’s Chart

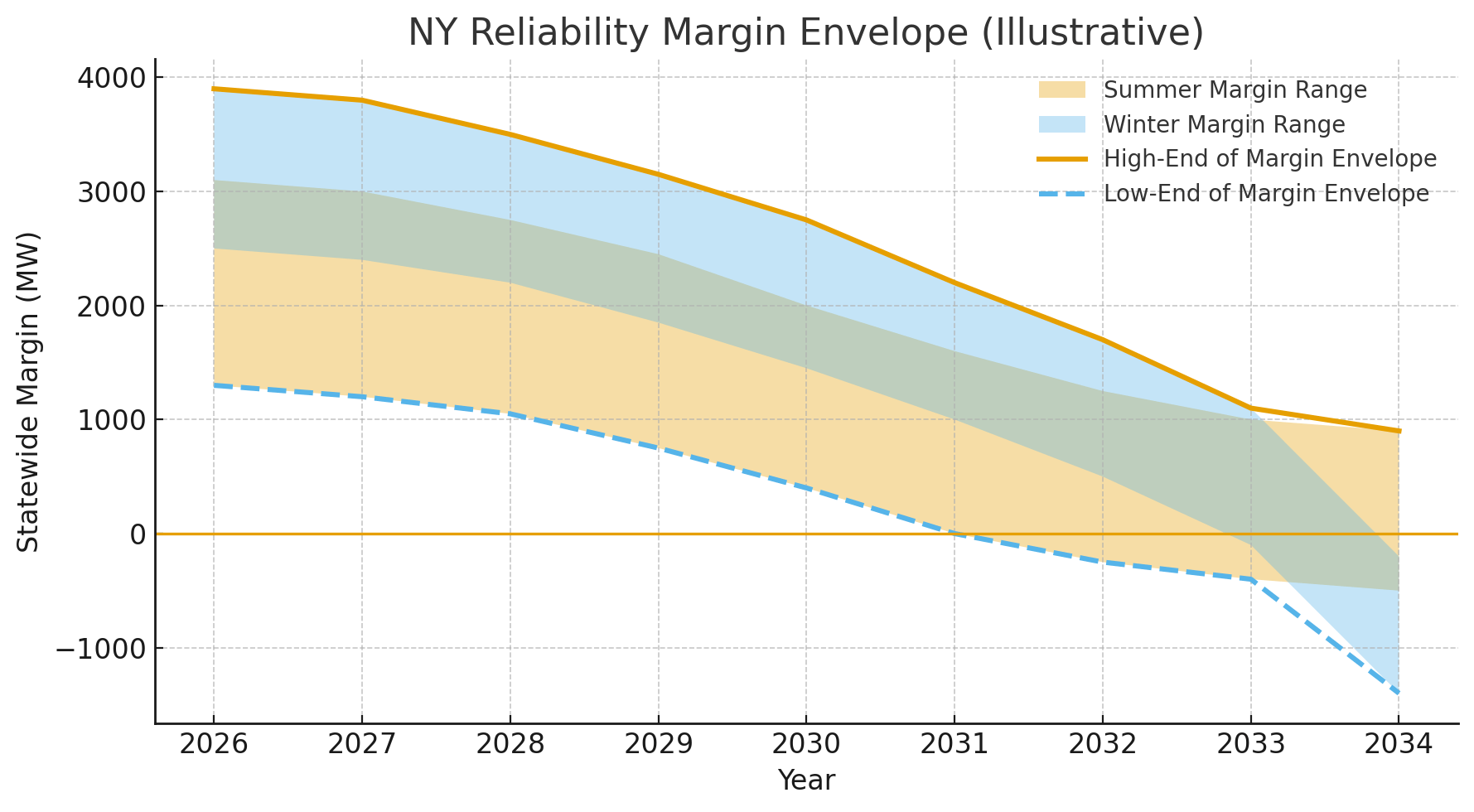

New York’s margin envelope shrinks to zero—and beyond.

The shaded bands show summer (red) and winter (blue) margins sliding from modestly positive in 2026–2028 to negative by the early 2030s in the low-case (dashed) path.

This aligns with NYISO’s warning: without CHPE, Empire Wind, and LI transmission—and new dispatchable MW—NYC/LI face multi-hour shortfalls on peak days.

Compare to PJM: their own modeling says batteries + firm resources must scale quickly to avoid capacity price spikes. Different markets, same bottleneck: timely in-service dates for firmable supply.

Good Bet

Grid-scale storage in PJM (4-hour class) — Developers with interconnection head starts or colocated rights (e.g., retrofits at retiring thermal sites) should see premium revenues as capacity/ancillary scarcity deepens.

Bad Bet

Unbacked hyperscale load counting on “standard” service — Large data centers entering PJM/NYISO without firming, TSAs, or on-site generation face higher security deposits, bespoke revenue guarantees, and schedule risk that eat the IRR.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!