Polish Fertilizer and Ammonia Production Halts

Energy prices have gotten so high in Europe that Poland's major fertilizer and ammonia producer has stopped its production of the former and thinned its production of the latter.

“'The current situation in the natural gas market that determines the profitability of production is exceptional,” Grupa Azoty said in a statement. The company did not hint at how long they would maintain this posture.

"Polish Agriculture Minister Henryk Kowalczyk told state radio that Azoty has enough inventory to provide fertilizers for the autumn sowing season," reports Bloomberg. "He said he hoped the gas market would stabilize because Poland 'needs to think about spring sowing' as well."

But the problem isn't just confined to Europe. Last month, the International Fertilizer Association reported that farmers facing high prices and tight supplies may slash their fertilizer usage by as much as 7%--the most since 2008. "That risk curbing harvests as the world grapples with a cost-of-living crisis and worsening hunger," Bloomberg reported at the time.

“If European farmers import more products from other exporters, then for the more fragile agricultural markets in sub-Saharan Africa, South Asia, and parts of Latin America, this will make the global market tight,” a senior IFA official told Bloomberg.

Ameren Missouri Delays Coal Plant Closure

Ameren's 1,195 MW Rush Island coal plant was set to close at the beginning of September. Now it will likely keep running until 2025 to provide the Midcontinent Independent System Operator with reliability.

"Shuttering the plant near Festus, Missouri, could cause severe voltage stability problems, leading to cascading power outages, the [MISO] said in an application for a 12-month system support resource agreement that can be renewed annually," reports Utility Dive. "The contract will be paid for by load-serving entities that benefit from keeping the plant running."

Ameren has suggested limiting the plant's dispatch to serve peaks rather than baseload until MISO can build the transmission needed to ease the plant's retirement. The Public Utility Commission in Missouri must approve the plan to keep Rush Island running.

In April, MISO announced the potential for rolling blackouts across the upper Midwest after its recent capacity auction signaled the region might lack sufficient capacity during the hottest days of the summer. Then, in June, MISO published a report that evidenced its shortfalls could persist for years. As I've written elsewhere, "MISO has lost 3,200 megawatts to plant retirements in the last year, and it expects increasing shortfalls in the coming years: 1,230 megawatts this year; 2,600 next year; and 10,900 by 2027—a shortfall as great as the electricity use of the entire state of Minnesota."

MISO also said that renewables additions and demand response programs would not be sufficient to make up for the loss of Rush Island.

Diesel Profit Margins Hit 30-Year High

Diesel premiums over crude are the highest they've been in thirty years for late summer.

"The diesel crack spread, which represents the profit generated by turning a barrel of crude into diesel, approached $70 a barrel on Monday for the first time since June to stand at the highest for this time of year in records going back to 1986," reports The Rigzone. "The so-called crack spread was below $20 a barrel the same time last year. Demand is set to grow this winter with the US northeast likely burning more diesel for heating amid soaring natural gas prices."

Natural gas prices are set to stay high due to increasing exports to Europe, the continuation of low flows from Russia, and America's general reliance on natural gas for electricity supply. This summer America saw record highs in natural gas use for electricity.

"In July 2020, the Henry Hub natural gas price averaged $1.77 per million British thermal units (MMBtu)," reports the EIA. "This July, the natural gas price averaged $7.28/MMBtu. Typically, higher natural gas prices reduce natural gas price competitiveness relative to other sources, especially coal."

Coal is unlikely to make for a usual cheap backstop because low coal stocks and high coal prices have dissuaded a pivot from natural gas to coal. This dynamic will worsen and deepen if America's rail workers strike next month, as a third of America's coal travels via rail.

Thus, diesel will likely remain in the offing as the days get colder.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

European gas prices have surged amid Russian gas flow uncertainties. "The TTF month-ahead price soared close to Eur300/MWh early Aug. 22, reaching as high as Eur295/MWh at 1200 GMT, on renewed concerns that Nord Stream flows may not return after the work," reports S&P Global. "The contract was last assessed at Eur247.50/MWh on Aug. 19, according to Platts price assessments by S&P Global Commodity Insights, with prices having hit record highs every day last week."

An American college has just submitted an application for an experimental molten salt nuclear reactor to the Nuclear Regulatory Commission. "Abilene Christian University (ACU) has applied to the US Nuclear Regulatory Commission (NRC) for a construction license for a molten salt research reactor (MSRR), to be built on its campus in Abilene, Texas, as part of the Nuclear Energy eXperimental Testing (NEXT) laboratory. ACU plans for the MSRR to achieve criticality by December 2025," reports World Nuclear News.

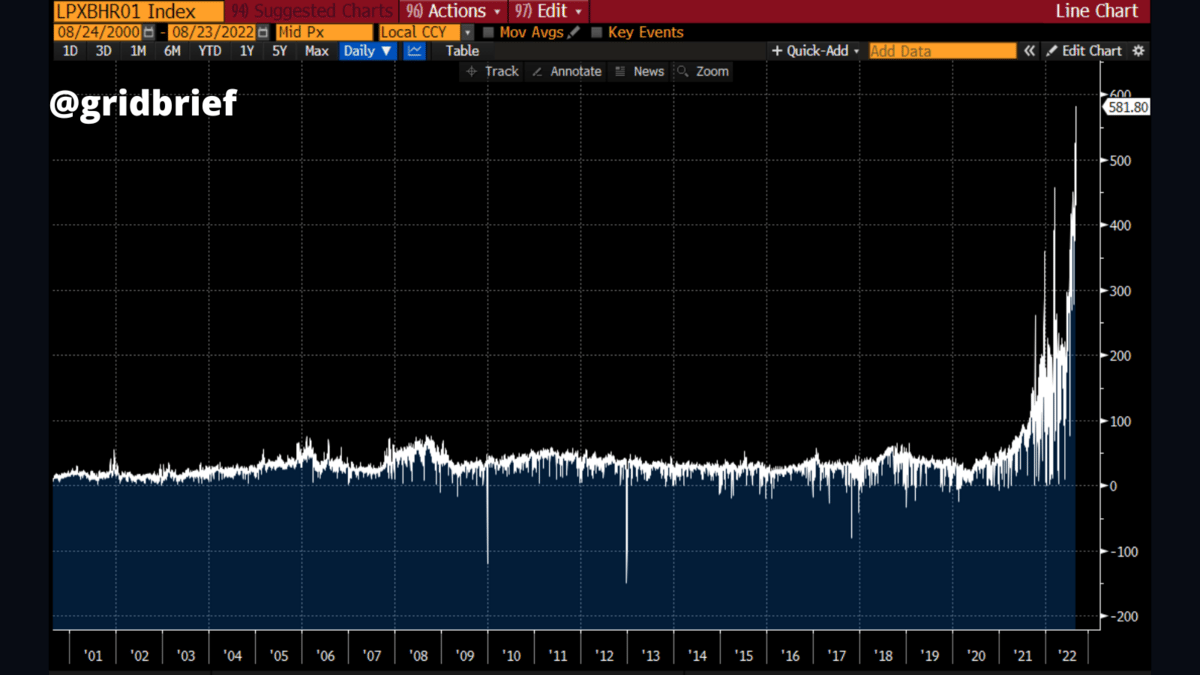

German daily day-ahead electricity prices look particularly scary right now. To put this price spike in perspective, they never closed above €100 in 2021. Now they're approaching €600.

Crom's Blessing