Electricity policy is drifting out of abstraction and into contact with physics.

A new national analysis shows retail electricity rates have remained broadly stable in most states over the past decade, even as investment surged. At the same time, federal reliability authorities are issuing emergency orders to keep aging plants online, demand forecasts are jumping sharply on new data-center load, and nuclear policy is moving downstream from slogans to fuel, scale, and supply chains.

This issue looks at what the numbers actually say, where the system is holding, and where it’s being quietly propped up.

Major Stories

MARKETS & PRICING

New Analysis Finds Retail Electricity Rates Largely Stable

A new analysis from EEI and CRAI finds that real (inflation-adjusted) retail electricity rates remained flat or declined in 33 states between 2013 and 2023, even as utilities increased grid investment by more than 40% over the same period.

Nationally, average real retail rates fell by roughly 2% over the decade. Where rates rose meaningfully, increases were concentrated in parts of the Northeast and California, driven primarily by capacity costs, transmission investment, and policy-driven resource changes, not fuel volatility.

The report also highlights a growing disconnect between rates and bills. In many regions, higher total bills reflect increased usage and fixed charges rather than higher per-kilowatt-hour prices.

Why It Matters - The data complicates claims that the U.S. is already in a generalized electricity affordability crisis. Price pressure is real, but it is regional, structural, and increasingly tied to capacity and infrastructure—not runaway energy rates.

Grid Take - Rates are holding because the system has absorbed massive investment without collapsing retail pricing. The risk isn’t what has already happened—it’s whether future demand growth arrives faster than the system can build.

RELIABILITY

DOE Expands Use of Emergency Orders During Winter Stress

Craig Station Units 1 and 2 in Colorado

The Department of Energy expanded the use of emergency authority during recent winter conditions, including an order keeping Craig Station Units 1 and 2 in Colorado available past their planned retirement. The justification was not energy shortages, but local reliability services, including voltage support and system stability.

Tri-State filings acknowledge that replacement resources currently cannot replicate all of the grid services provided by the retiring coal units, even where nameplate capacity exists.

This follows similar DOE actions earlier this winter in Texas, New England, and PJM-connected regions.

Why It Matters - Emergency orders are being used not to meet peak demand, but to cover gaps between planned retirements and replacement capability.

Grid Take - When emergency authority becomes routine, it’s a signal that planning timelines and operating realities are no longer aligned.

POLICY & INVESTMENT

Trump Administration Quietly Preserves Select Renewable Spending

Despite rhetoric critical of renewable mandates, the administration preserved funding for grid-connected wind, solar, and transmission upgrades in recent appropriations, with emphasis on interconnection and reliability rather than capacity targets.

The spending focuses on infrastructure that reduces congestion and improves system performance, rather than accelerating deployment quotas.

Why It Matters - This is less a pivot toward renewables than an acknowledgment that grid bottlenecks (not generation ideology) are binding.

Grid Take - Reliability spending survives political cycles because physics outlasts rhetoric.

NUCLEAR

Right-Sizing Reactors as Demand Growth Accelerates

A new study from the Nuclear Innovation Alliance argues that reactor scale—not just technology—is becoming the limiting factor in nuclear deployment.

Large reactors still offer lower per-unit costs, but 300–600 MW designs reduce siting risk, financing exposure, and construction timelines. The study emphasizes that deployment rate, not levelized cost, is now the binding constraint as demand growth accelerates.

The analysis pairs closely with DOE’s expanded efforts to rebuild domestic nuclear fuel supply, including enrichment and HALEU availability, aimed at supporting both existing plants and advanced designs.

Why It Matters - You can’t scale nuclear on paper if fuel, construction pace, and load alignment don’t match.

Grid Take - The nuclear conversation is finally shifting from aspiration to throughput.

FORECASTS

NERC Raises 10-Year Peak Demand Outlook by 24%

NERC’s latest long-term assessment raises the U.S. summer peak demand forecast 24% higher than last year’s outlook, driven primarily by data centers and large industrial loads.

Multiple regions are now flagged for emerging capacity shortfalls by 2027–2028, with transmission delays and permitting timelines identified as the primary risk multipliers.

Why It Matters - Demand growth is no longer hypothetical, and it’s arriving faster than planning assumptions.

Grid Take - The grid doesn’t fail when forecasts rise. It fails when build timelines don’t move with them.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

The Conversation

Quick Signals

Retail electricity rates have stayed flatter than the politics suggest.

Emergency reliability authority is filling planning gaps, not demand gaps.

Demand forecasts are rising faster than interconnection queues are clearing.

Nuclear policy is shifting from reactors to supply chains.

Grid investment is accelerating, but timelines remain the constraint.

Things to Read

Cato Institute – The Case for Consumer-Regulated Electricity

A market-first argument for parallel private grids as a pressure valve on regulated systems. “…environment of experimentation and rivalry was gradually replaced by a model of regulated monopolies, justified by questionable concerns over duplication, reliability, and consumer protection.”And a Podcast Version – Glen Lyons & Travis Fisher on Off-Grid Utilities

A grounded discussion of data-center scale load, regulatory mismatch, and market-based supply solutions.City & State NY – Is Public Power the Key to Energy Affordability?

A political case worth reading skeptically, especially on cost assumptions.TechBriefs – We Need More Power Soon: Is Nuclear the Answer?

A practical engineering perspective that avoids policy abstraction.Technical.ly – Pennsylvania’s grid faces growing pressure as PJM timelines lag behind data center investment

A clear-eyed look at how data center demand is exposing transmission and interconnection bottlenecks in PJM

Chart of the Day

Electricity Rates vs. Inflation

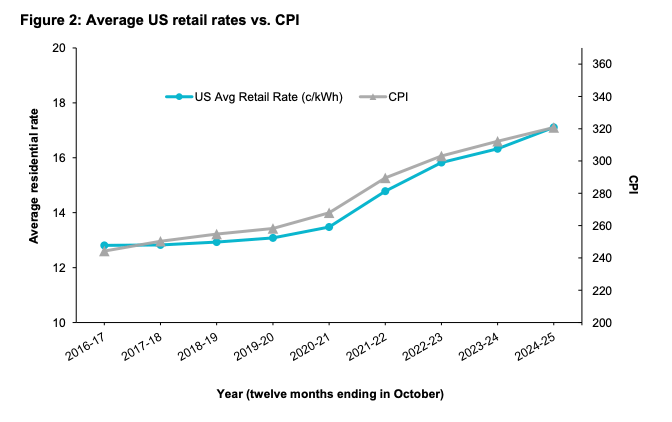

Retail Rate Trends in the U.S., Edison Electric Institute & Charles River Associates, February 2026. Average U.S. residential electricity rates (cents per kWh) compared with Consumer Price Index (CPI); CPI indexed to 1982–84 = 100.

Data sources: U.S. Energy Information Administration (EIA); U.S. Bureau of Labor Statistics (BLS).

This chart compares average U.S. residential electricity rates with overall consumer inflation over the past decade. The takeaway is quieter than the politics: electricity prices have risen, but not faster than the broader cost of living.

From 2016 through 2025, average retail electricity rates increased from roughly 12.7¢/kWh to about 17¢/kWh, tracking closely with CPI rather than outpacing it. In real terms, that means electricity has remained a relatively stable household expense even as utilities poured capital into grid hardening, transmission, and reliability upgrades.

That stability matters because today’s affordability debate is being driven less by historical rate behavior and more by future expectations: accelerating demand, tighter capacity margins, and longer build timelines. The data show a system that has absorbed investment without runaway prices so far — but one now entering a more fragile phase as demand growth accelerates.

Grid Take

The electricity affordability story isn’t about what rates have already done. It’s about whether the system can keep absorbing new demand without breaking the relationship between prices and inflation. History says it’s possible. Timelines will decide whether it stays that way.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!