Report: The Rail Strike and American Energy

America’s rail workers may decide tomorrow if they will strike for better working conditions. Tensions have been building in the rail industry since 2019 when their last contract expired. According to the Surface Transportation Board, railroads cut their workforce by a third--some 45,000 jobs--in the last six years. The crew shortages have put a huge burden on the remaining workers and performance has suffered along with them. “Overall on-time performance for the big four U.S. Class I railroads has fallen from a pre-pandemic average of 85% to just 67% in the last week of May 2022, as crew shortages continue to plague rail service,” reports Trains. The Wall Street Journal reports that the biggest stumbling block isn’t pay, but attendance. One rail worker said this about his grievances: “As a railroad worker I've lived in my car, worked nights weekends holidays [sic], missed my kids games, birthdays, fought fires, walked miles in blizzards, seen lives lost, never knowing when I'll be home, given my health, these are reasons I deserve a fair contract.”

Earlier in the summer, Biden appointed an emergency board to mediate between labor and management to no avail. The White House is now trying to broker a deal before 12:01 am on Friday when the strike or lockout begins. Many of the smaller unions in the sector have announced deals in line with the administration’s emergency board suggestions. However, two holdouts remain: the Transportation Division of the International Association of Sheet Metal, Air, Rail, and Transportation Workers (SMART-TD) and the Brotherhood of Locomotive Engineers and Trainmen. These unions comprise a whopping 60% (70,000 people) of the rail system’s workforce. The Association of American Railroads estimates that a strike could cost $2 billion a day.

About a third of US freight moves through the American rail system. While many sectors of the economy will feel the impact of the strike, the electricity sector is particularly exposed. Nearly 70% of American coal moves by rail and coal makes up for one-fifth of America’s electricity. What impact will a rail strike have on the American electricity sector? Here’s what Grid Brief, with analysis from the Radiant Energy Group, has found.

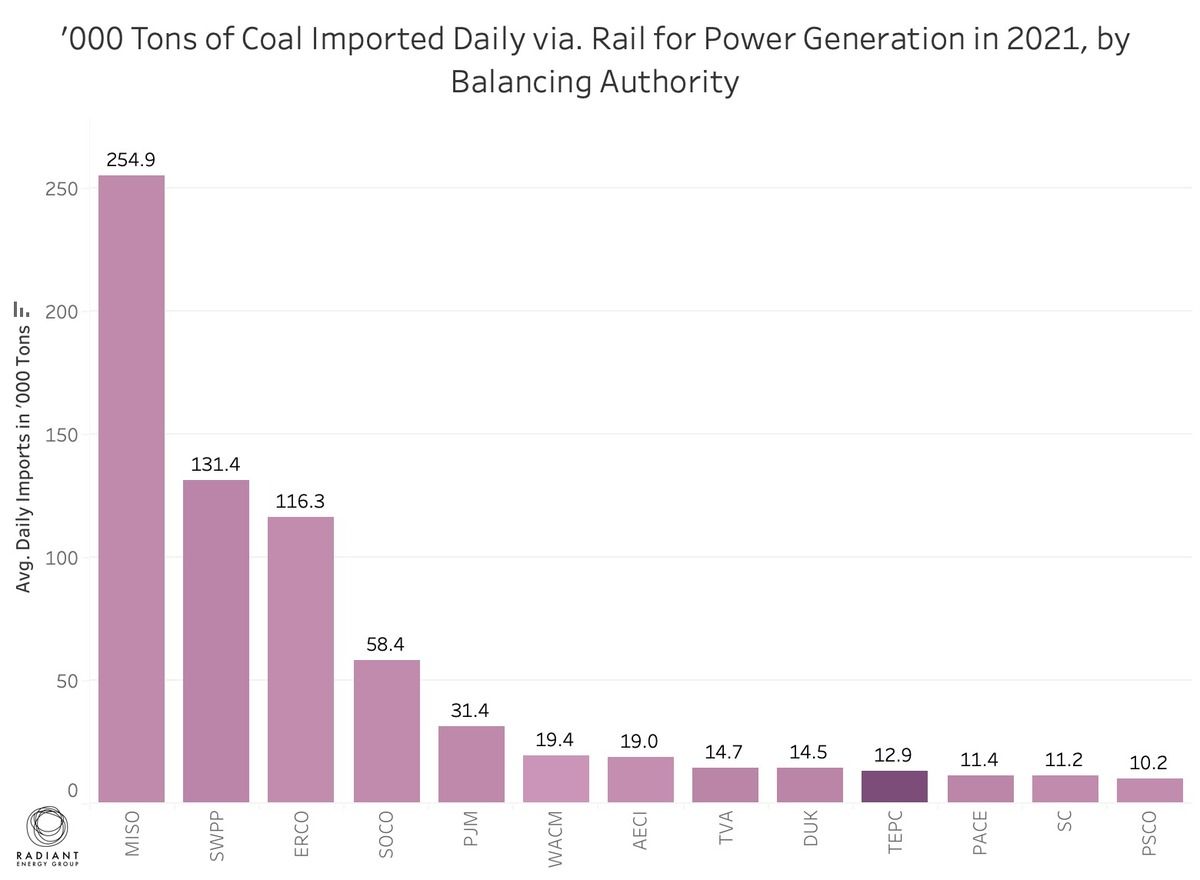

The regions most reliant on rail for coal are the Midwest, Texas, and the Southeast.

Rail dependence on coal strongly overlaps with dependence on coal for electricity generation by state.

Not all balancing authorities within these regions are the same, however. The Midcontinent Independent System Operator, which stretches from the top of Minnesota to the bottom of Louisiana, is the most reliant on coal for electricity. Last year it imported 93 million tons (or 6200 train loads) of coal by rail. MISO has also been one of the regions struggling the most with reliability--and one where winter sees demand rise.

MISO also depends on imports from PJM (covering much of the southeast and northern Illinois), which imported the fifth most coal by rail last year. The Southwest Power Pool, second in last year’s coal by rail imports, often imports power from MISO.

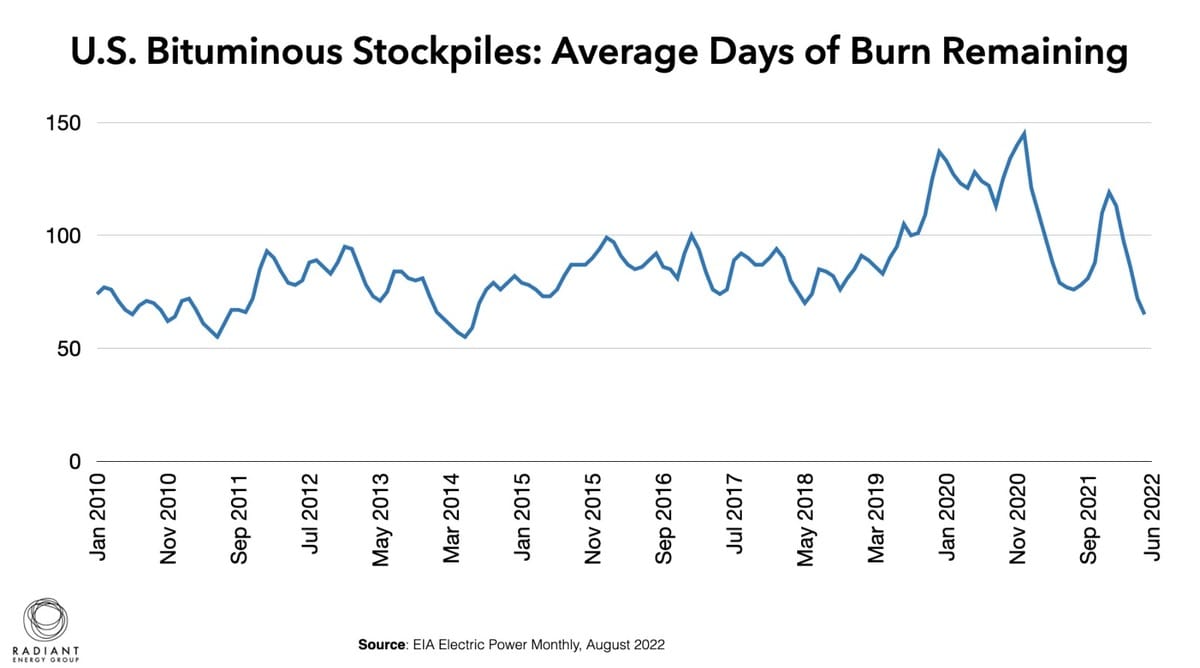

Yet coal plants tend to have one to three months' worth of coal in storage. The strike will come when it’s neither too hot nor too cold. And the burn rate for coal is about average for this time of year.

“Although coal stockpiles have fallen sharply in the last two years, a majority of power plants continue to maintain enough storage to weather a month-long disruption to supply,” said Sid Bagga, a data scientist at Radiant Energy Group. "But even absent the threat of immediate outages, coal generators will likely respond to the supply cutoff by raising their bids in electricity markets.” A prolonged strike could force already high electricity prices upward.

When we look at coal mining, the picture darkens. The coal industry has been vocal about the risk the strike poses to them. “Ongoing rail service issues continue to threaten coal deliveries, impeding the delivery of essential fuel as utilities work to shield consumers from soaring natural gas prices and build up stockpiles to ensure they have the fuel security needed for the winter,” National Mining Association CEO Rich Nolan said. Ernie Thrasher, CEO of Xcoal Energy & Resources, America’s biggest coal exporter, said, “No coal is going to move until these guys go back to work.”

According to a report from AAR, “Because coal mines typically only have storage capacity equal to a few days of output, many of the approximately 38,000 employees of the coal mining industry could face layoffs in the early stages of a rail shutdown.”

As for utilities, the major industry trade group, the Edison Electric Institute, said, “U.S. freight rail is critical to…our sector, and a network shutdown of any length would have far-reaching effects not only on the economy but also on our ability to source critical equipment and material.” S&P Global reports that 75% of the coal that went to utilities for the first half of 2022 moved by rail.

Moving away from coal, New England is vulnerable when it comes to natural gas, crude, and other fuels, which it receives via rail due to a lack of pipeline capacity. "New England receives most of the natural gas it uses to heat homes and light stoves by rail [...] making it vulnerable to a stoppage," reports Reuters. ISO-NE, the region's grid operator, often relies on oil for winter reliability.

If the strike becomes protracted, then more problems blossom. Railroads already struggle to deliver on time and a strike will add new complications to ordering and scheduling. As we learned during Covid, no industrial sector--least of all logistics--works like an on/off switch. A long strike could interfere with winter reliability plans for multiple balancing authorities and grid operators.

The window of time between the “emergency” and “crisis” phase of a rail strike is slim. And it hinges on how the situation is handled.