RMI's Chinese Connection

The Rocky Mountain Institute, which was responsible for the shoddy study on youth asthma and gas stoves that kicked off major disagreement last week, seems to have ties to the Chinese government.

In 2013, RMI worked with China's National Development and Reform Commission to create a report that could help the country swap its existing appliances and generators with "clean energy technologies." "The commission went on to set climate goals that included energy reduction targets," reports the Washington Free Beacon. "When local provinces in 2021 failed to meet those targets, the commission pushed them to implement electricity rations, prompting 'dimmed traffic lights that cause chaos' and 'half-cooked rice in rice cookers.'"

But that's not all. One of the RMI's board members, Wei Ding, founded the Chinese private equity firm Broad River Capital after a stint as chairman of the China International Capital Corporation, an investment bank partly owned by the Chinese government. "Former CICC executives include Chinese leader Xi Jinping's vice president and right-hand man, Wang Qishan, while the corporation's website highlights its 'deep participation in China's economic reforms and development' and goal to 'serve the nation,'" reports the Free Beacon. "The Rocky Mountain Institute also sits on the China Clean Transportation Partnership, a Chinese green energy nonprofit whose founding members include China's National Development and Reform Commission and Ministry of Transport."

RMI was founded by Amory and Hunter Lovins in 1982. Amory has been a champion of renewable energy and one of the leading green energy theorists since the seventies. Hunter was a co-author on the Club of Rome's Malthusian Limits to Growth report. Amory also advised Germany on its energy policy, which resulted in deep dependence on Russia gas flows. To learn more about Amory Lovins's impact on American energy, you can read my piece on the rise and fall of the grid here.

California PUC Opens Vote on Diablo Canyon Extension

The California Public Utility Commission has voted to open to consider extending the operations of the 2.2-GW Diablo Canyon nuclear power plant.

The rulemaking stems from the SB 846 legislation approved last September, which among other things required regulators to issue a decision by the end of 2023 on new retirement dates for Diablo's reactor units. SB 846 was a departure from the previous commitment to closing the plant by 2025.

"This reversal largely boiled down to two factors, according to the office of California Gov. Gavin Newsom – delays to new renewable energy and storage projects, thanks to global supply chain disruptions, as well as a new $6 billion federal program that could help support the nuclear plant," reports Utility Dive. "Under SB 846, Diablo Canyon Unit 1 could be kept running through Oct. 31, 2029, and Unit 2 until Oct. 31, 2030. In November, PG&E applied to the U.S. Nuclear Regulatory Commission to keep the plant running until 2030."

The decision will be based on factors like whether or not the Nuclear Regulatory Commission grants Diablo a lifespan extension, and whether there are adequate new zero-carbon and renewable resources in the state to replace the Diablo Canyon plant without jeopardizing grid reliability.

Not everyone is happy about a potential life extension for Diablo.

“The rush to keep Diablo Canyon running beyond 2025 is not only dangerous, but will set back California’s drive to make solar and wind the prevailing sources of electricity in the state,” Ken Cook, president of the Environmental Working Group, said in a revealing statement. Apparently, the EWG sees Diablo Canyon's emissions-free energy as an obstacle to wind and solar. Last August, wind and solar couldn't keep up with demand as the Californian grid teetered on the brink of blackouts. Natural gas supplied 60%+ of generation during those moments.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Offshore leases in the Gulf of Mexico are getting closer to auction. "The Bureau of Ocean Energy Management (BOEM) has announced that it has issued its Final Supplemental Environmental Impact Statement (EIS) for two upcoming Gulf of Mexico (GOM) Outer Continental Shelf oil and gas lease sales to comply with the Inflation Reduction Act (IRA) of 2022," reports Rigzone. "Lease Sale 259 and Lease Sale 261 are mandated by the IRA to be held no later than March 31 and September 30, respectively, BOEM highlighted in an update sent to Rigzone. The Final Supplemental EIS includes an expanded greenhouse gas (GHG) analysis and provides an analysis of monetized impacts from these estimated GHG emissions, BOEM noted in the update."

Russian crude flows to China and India are repatterning the market. "The insatiable appetite for discounted Russian cargoes from India and China has offered enough bandwidth to Middle Eastern suppliers to cater to the needs of other Asian oil importers that have that slashed their purchases from the largest non-OPEC supplier since the invasion of Ukraine last February," reports S&P Global. "With India becoming the largest buyer of Russian crude in late 2022 and China posting close to double-digit growth in Russian inflows over January-November, refiners in South Korea, Japan and Thailand are finding it easier to procure term and spot crude supplies from Middle Eastern producers, refinery and trading sources told S&P Global Commodity Insights."

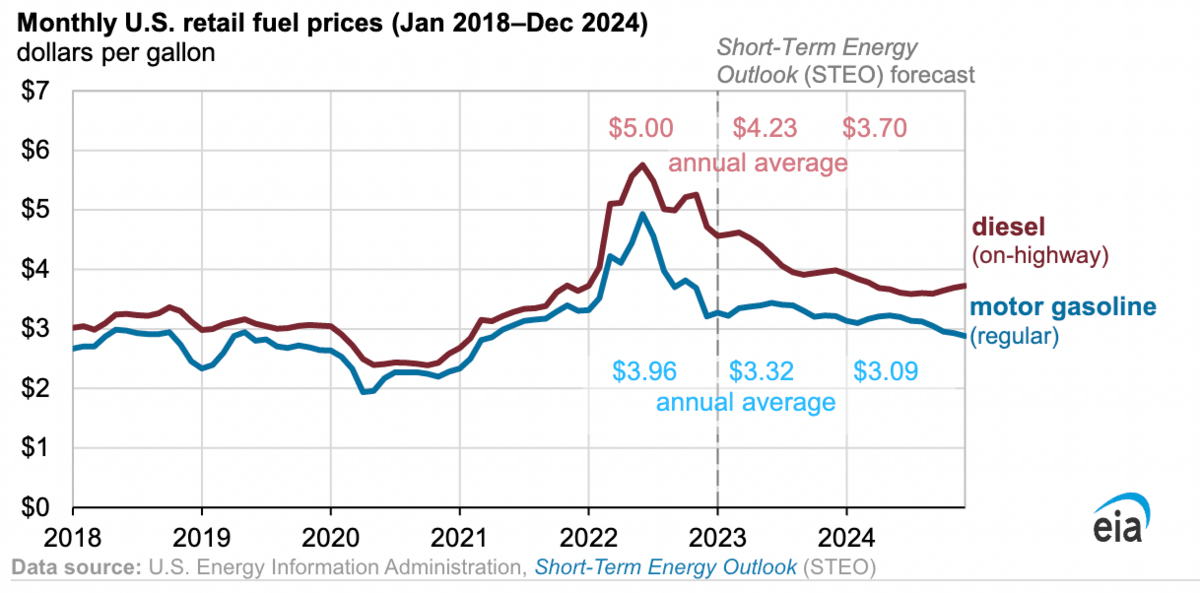

The Energy Information Administration expects gasoline and diesel prices to decline. "We forecast that retail prices for regular-grade gasoline will average $3.32 per gallon (gal) in 2023 and continue to decrease to average $3.09/gal in 2024, down from $3.96/gal in 2022," reports the EIA. "We expect on-highway diesel prices to decrease to average $4.23/gal in 2023 before decreasing further to $3.70/gal in 2024. These forecast price decreases are based on our expectation of lower demand growth for diesel and motor gasoline with continued high production of those products."

Crom's Blessing