Siemens Energy Weathers Stock Plunge Over Wind Turbines

Siemens Energy warned that sales and margins would be on the low side this year. Why? Worsening problems at its wind turbine division, Siemens Gamesa, which is getting hammered by supply chain problems.

Here's a cruel irony: "Results at Siemens Gamesa, which in January issued its third profit warning in nine months, mask a solid performance at Siemens Energy's business focused on coal- and gas-fired power stations and turbines," Reuters reports.

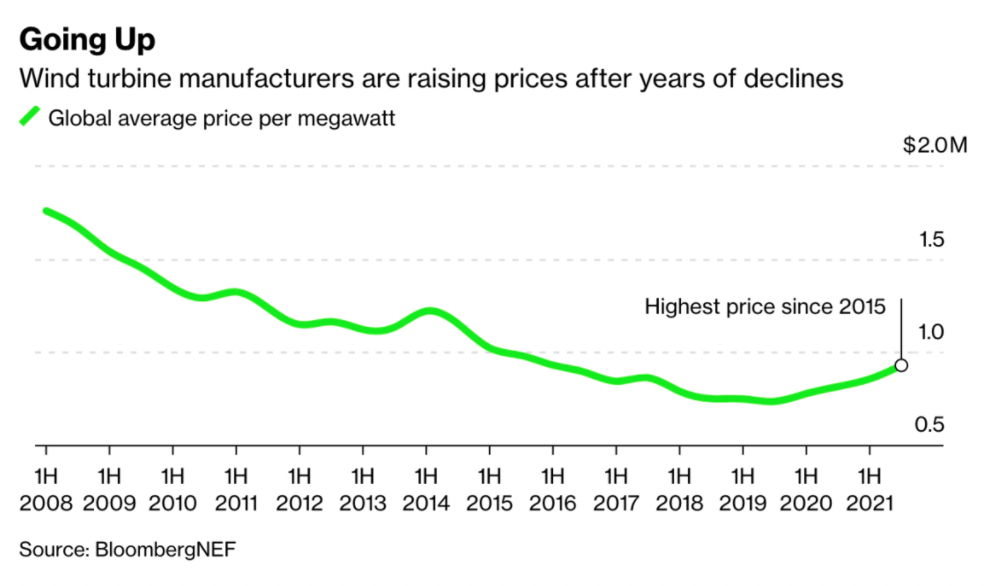

Siemens isn't alone. General Electric and Vestra are also feeling the pain. High raw materials prices, changes in subsidy structures, years of turbine price pressure, and a grueling race to build bigger and bigger machines have put the hurt on the whole industry.

“What I’m seeing is a colossal market failure. The risk is we’re not on track for net-zero [emissions] -- and the other risk is the supply chain contracts, instead of expanding," said Ben Backwell, chief executive officer of trade group Global Wind Energy Council earlier this year.

Reuters reports, "Siemens Energy, which released preliminary second-quarter results last month, said it swung to a 252 million euro ($265 million) net loss in the period due to the problems at Siemens Gamesa, compared with a 31 million profit last year."

You can't make wind turbines with wind turbines, nor solar panels with solar panels. If energy prices stay high, so will steel prices--along with everything else. We might be witnessing the end of the "cheap to build and deploy" business case for wind.

Frightening Words From OPEC

“I am a dinosaur," said Saudi minister Prince Abdulaziz bin Salman on Tuesday in Abu Dhabi, "but I have never seen these things. The world needs to wake up to an existing reality. The world is running out of energy capacity at all levels.”

Abdulaziz bin Salman has been attending OPEC meetings since the 1980s.

"The prince’s UAE counterpart Suhail al Mazrouei, said that without more investment across the globe, OPEC+ wouldn’t be able to guarantee sufficient supplies of oil when demand fully recovers from the coronavirus pandemic," Bloomberg reports.

According to Bloomberg, the UAE and the Saudis are some of the only ones left sinking serious cash into upping their fossil fuel production capacity by the end of the decade.

But there's some serious tension between OPEC and its importers. OPEC sees the market as balanced. They don't see that it's their duty to supply the West and Japan with all the oil they no longer want to buy from Russia. The other side takes the opposite tack.

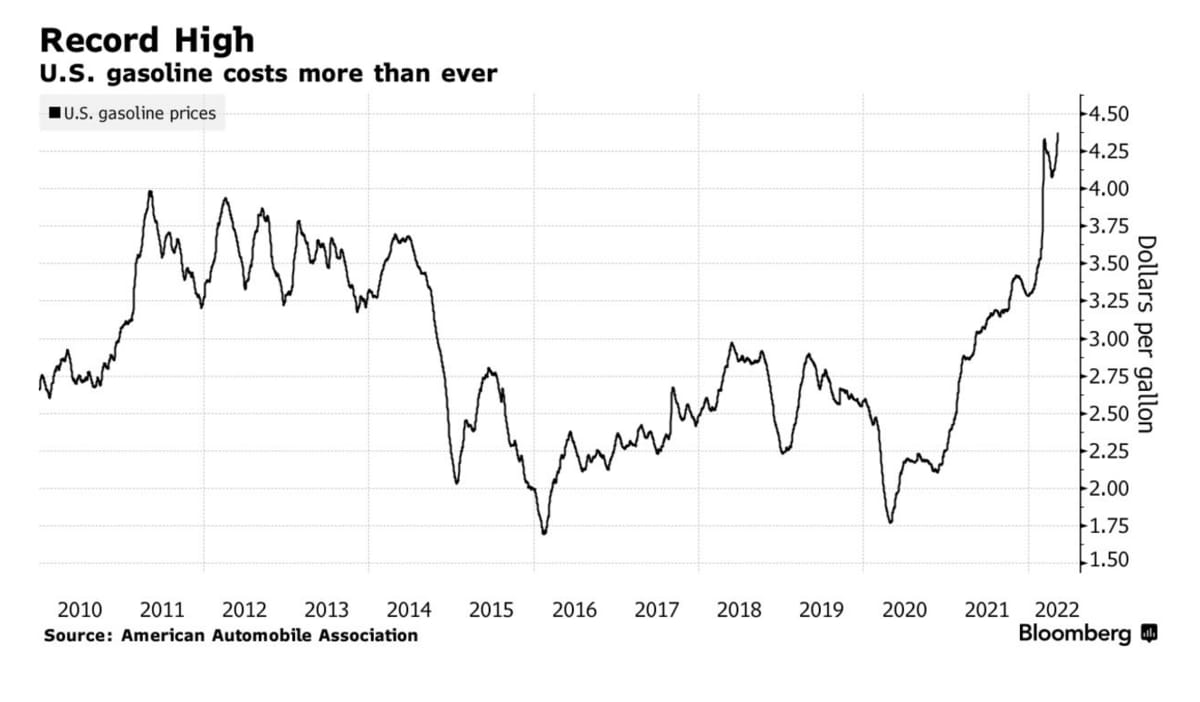

Crude has jumped more than 35% to around $105 a barrel this year--no one's happy about it. Yet it is hard to say that this is just a blip, a freak occurrence. Underinvestment in the fossil fuel sector is a real problem. It's worth getting a view of what underinvestment will really impact. The short answer is: everything.

I find this chart helpful for visualizing that.

I understand that many people are worried about climate change. That's a completely legitimate concern. But I assure you: an abrupt stop to fossil fuel production will hit harder and faster and realer than whatever the IPCC is putting in their press releases.

Russia's Retaliatory Sanctions

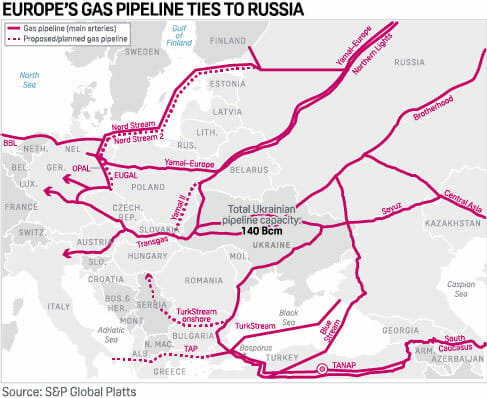

The EU's push to put together a Russian energy embargo seems caught in quicksand. Russia, on the other hand, is doling out sanctions of its own. It has just sanctioned EuRoPol Gaz SA, owner of the Polish section of the Yamal-Europe gas pipeline.

"The 2,000+ kilometer Yamal-Europe pipeline runs from Torzhok in Russia to Frankfurt, Germany, with the Polish section accounting for over 680 kilometers and housing five compressor stations," reports Oilprice.com

Russia moved on the sanctions after both Poland announced that it is forgoing renewal of its 10 billion cubic meters Yamal contract with Gazprom and Poland's PGNiG Upstream Norway AS announced it plans to get an extra 0.5 bcm from Norway to make up for the Yamal loss. Poland is dropping the Yamal contract because it refuses to pay for Russian gas in rubles.

Oilprice.com reports, "This natural gas will be delivered through the Baltic Pipe, which is scheduled to come online in October this year."

Russia's retaliatory sanctions seem poised to catch Poland in the interim while Europe frets over gas prices, especially given Ukraine's recent stoppage of Russian gas flows due to Russian occupation.

Russia has also sanctioned Gazprom Germania, one of the 30 targets of the sanctions.

The EU will have a hard time drumming up enough support for its oil embargo to respond--embargos need unanimous and Hungary has been less than forthcoming with its support for the idea due to how dependent it is on Russian energy. "Hungary is now holding out for a hand-out in the form of hundreds of millions of dollars, which is said will be necessary to realize a full ban on Russian oil without economic devastation," reports Oilprice.com.

Like what you're reading? Subscribe to get Grid Brief sent to your inbox.

Conversation Starters

Everyone hates Auxin, the company responsible for the tariff probe into America's solar imports. Canary Media sent a reporter out to their HQ--here's what he found.

This week the Senate Judiciary Committee approved a "NOPEC" bill. The bill is designed to bill designed make way for lawsuits against OPEC members for market manipulation. OPEC members and the American Petroleum Institute think this is a bad idea--the market doesn't need more chaos. Don't like $100 per barrel? Try $200. Or $300.

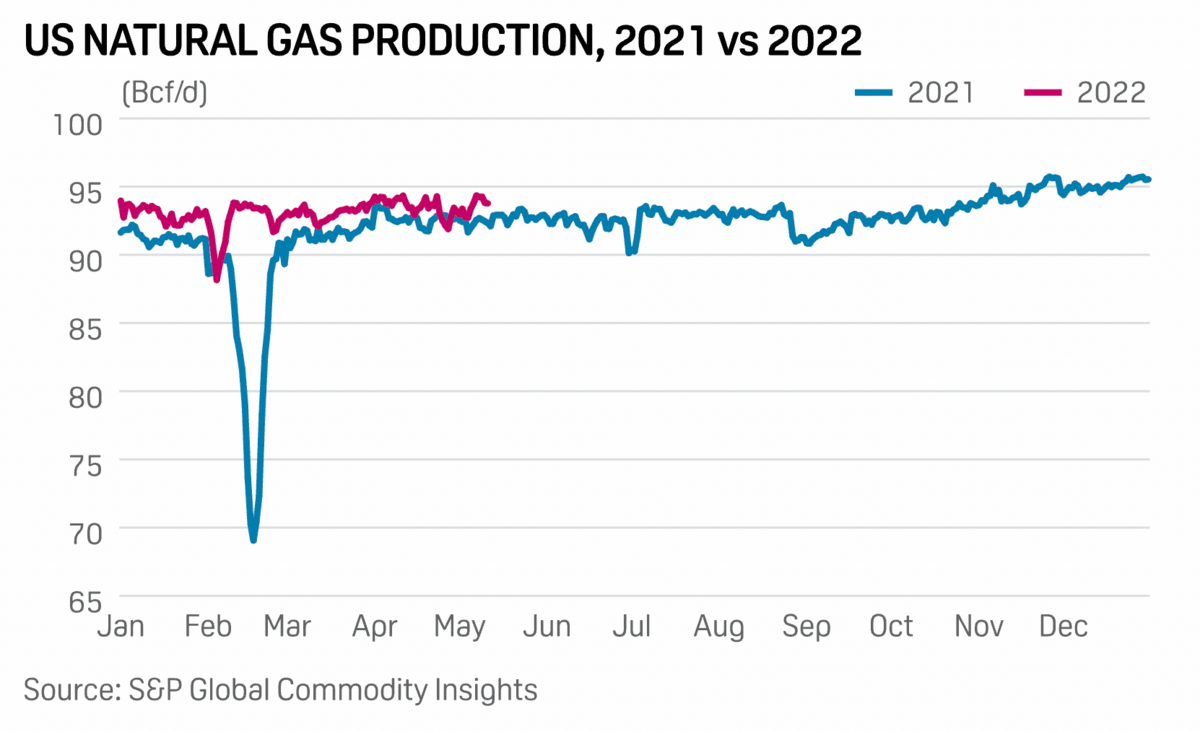

According to the Natural Gas Supply Association's 2022 summer outlook, American natural gas production should outpace demand.

Crom's Blessing

Greek God of Iron Pyrros Dimas on the cover of Milo.