Does Solar Hurt Property Values?

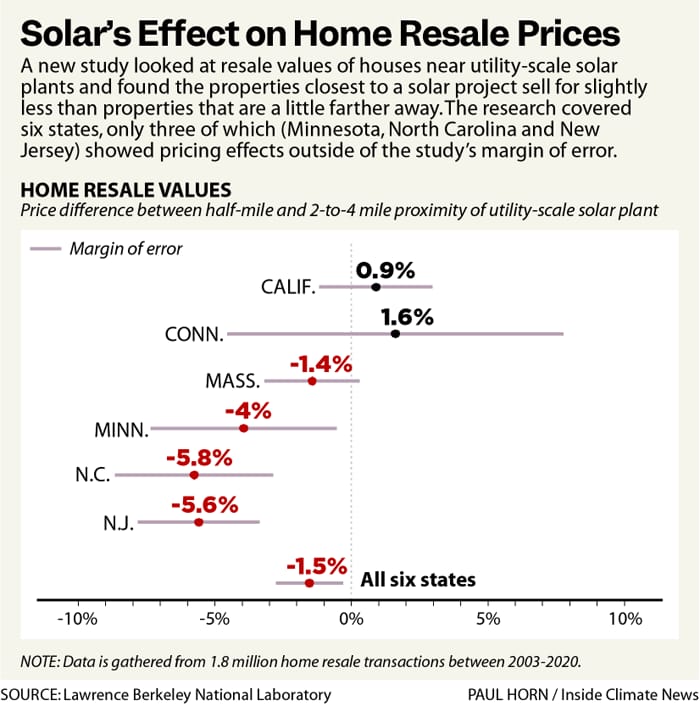

Solar advocates say utility-scale solar projects don’t hurt property values, opponents say they do, and a new report from the Lawrence Berkeley National Laboratory says, Well, kind of.

The study analyzed 1.8 million home sales between 2003 and 2020 near solar farms in six states. It found that houses within a half-mile of a utility-scale solar farm have resale prices that are, on average, 1.5 percent less than houses just a bit farther away. While Minnesota, North Carolina, and New Jersey showed diminished property values, California, Connecticut, and Massachusetts had price changes within the margin of error.

The study accounted for differences in property features, inflation, and other factors in order to isolate the effect of proximity to solar. But the study did not include any of the financial benefits of solar for landowners and communities, which may include payments from the developer and a decrease in local taxes.

Ben Hoen, one of the co-authors and a research scientist at the Lawrence Berkeley Lab, told Inside Climate News that the numbers are clear, but more research is needed to better understand what’s going on.

“We have a sense of the ‘what,’ but we don’t know the ‘why,’” Hoen said.

The report is the largest done on utility-scale solar’s impact on property values to date.

CPUC to Investigate Winter Gas Price Hike

The California Public Utilities Commission (CPUC) has launched an investigation into the recent surge in natural gas prices that led to skyrocketing bills this winter for many customers in the state, particularly in the San Diego area.

“The investigation will examine the reasons natural gas commodity prices took off in January, whether the gas market was manipulated, review if utilities effectively communicated with their customers about the impacts higher prices would have on their bills, and find ways to avoid similar price spikes in the future,” reports the San Diego Union-Tribune.

But, it’s worth noting that about 90% of California’s natural gas comes from outside the state, and the CPUC does not have authority to regulate natural gas prices or producers.

“I appreciate that the commodity prices are not under our jurisdiction, nor controlled by the utilities, and that the utilities do not make a profit off of the gas,” commissioner Genevieve Shiroma said. “However, we must question whether market fundamentals are sound and what additional circumstances influence the market.”

FERC’s Christie: Capacity Markets “Not Alright”

Federal Energy Regulatory Commission’s Mark Christie has raised concerns about major reliability challenges in multi-state capacity markets.

“The capacity markets are not all right,” commissioner Mark Christie said during FERC’s monthly meeting as reported by Utility Dive. “There are fundamental problems specifically in the multi-state capacity markets – ISO New England, MISO, and PJM – that are directly leading to serious reliability problems.”

Commissioner Christie called for solutions to the serious reliability problems in the affected areas, noting the market design failures in PJM and MISO, which were exposed during Winter Storm Elliott in December 2022.

“The real issue I think we’re going to have to address at FERC is whether these multi-state capacity markets, including New England, can deliver what we expect them to deliver, which is reliable power, at prices that people can afford,” Christie said.

The challenges facing PJM come as almost 40 GW of generating capacity—enough to power 30 million homes—could retire by 2030, as we reported last week. A fair chunk of those retirements are driven by state and federal environmental law.

Commissioner Allison Clements voiced her concern about ISO-NE. Even though it appears New England escaped this winter without major catastrophes, “the system continues to operate on a knife’s edge during extreme winter weather events,” she said. “It is not enough to sit by with our fingers crossed for mild winters each year.”

Both Commissioners seem to be echoing the views fellow commissioner James Danly wrote in a letter to the House Energy and Commerce Committee last fall: “Federal and state policies, by mandate or subsidy, have spurred the development of weather dependent generation resources which are driving dispatchable resources into insolvency. These policies warp price signals in the markets, destroying the economic conditions required for the orderly entry, exit, and retention of sufficient capacity with the needed characteristics to ensure system stability. The thinner and thinner reserve margins resulting from these incentives render the electric system ever more susceptible to instability in the face of any contingency—weather being but one possibility,” wrote Danly.

He continued: “Many policy makers, however, do not seem moved by the warnings of NERC and the markets. In response to MISO’s concerns about its capacity shortfalls, Illinois lawmakers shrugged and argued that ‘MISO should re-evaluate and revamp its interconnection rules to accelerate new renewable capacity interconnections.’ It does not seem that these same lawmakers have given any thought to the cost of ensuring a reliable system before enacting laws shutting down dispatchable generation.”

FERC intends to hold a forum on PJM’s markets and another on ISO-NE in June 2023.

Like what you’re reading? Click the button to get Grid Brief right in your inbox!

Conversation Starters

Europe’s green energy policies are hung up on nuclear. “The battle over nuclear energy's role in the EU's renewable energy future is far from over, with Germany, Spain, and other EU countries fighting to keep nuclear energy from counting when it comes to calculating renewable energy targets,” reports Oilprice.com. “France has made it clear that low-carbon hydrogen derived from nuclear energy should indeed count toward the bloc's renewable energy tarts. Spain, Germany, Denmark, Austria, Ireland, Luxembourg, and Portugal, strongly disagree. On Thursday, the group sent a letter to the rotating EU presidency, arguing that renewable targets should not include nuclear.”

More of France’s refinery capacity is coming offline. “Four out of six French refineries are stopping operations or plan to stop by Monday, 20 March, as industrial action deepens over planned changes to pension rights,” reports Argus. “Workers and union officials said refineries are shutting as a response to the government forcing through its pensions law, using a parliamentary clause known as 49:3.”

Italian energy company, Eni, just made a discovery offshore of Mexico. “Eni announces a new discovery on the Yatzil exploration prospect in Block 7, located in the mid-deep water of the Cuenca Salina in the Sureste Basin, offshore Mexico. According to preliminary estimates, the new finding may contain around 200 million barrels of oil (MBoe) in place,” according to the company’s press release. “Yatzil-1 EXP is the second commitment well of Block 7 and the eight successful one drilled by Eni in the Sureste Basin. It is located approximately 65 kilometers off the coast, and 25-30 km away from other discoveries. The well was drilled by the Valaris DPS5 Semisub rig in a water depth of 284 meters and reached a total depth of 2,441 meters. Yatzil-1 EXP found in excess of 40 meters of net pay sands with good quality oil in the Upper Miocene sequences with excellent petrophysical properties confirmed by an extensive subsurface data collection.”

Crom’s Blessing