Welcome to Grid Brief. Here’s what we’re looking at today: S&P Global’s numbers on wind and solar for Q3 of this year, Japan is considering more subsidies to speed up its nuclear restarts, and more.

S&P Global: US Wind and Solar Q3

Here’s what Q3 has looked like for renewable energy, according to a new report from S&P Global.

Solar

In the first quarter of 2023, new solar energy installations dropped by 34% compared to the same period the previous year, amounting to 1,587 MW. This decline is part of the solar energy sector's recovery from a turbulent phase in 2022, where installed capacity fell by 22% due to challenges like supply chain bottlenecks, trade restrictions, and the reduction of renewable energy tax credits.

“But activity is increasing following the August 2022 passage of the Inflation Reduction Act, which gave developers a decade's worth of certainty that they can count on tax equity in raising cash for new solar energy farms,” reports S&P Global. “The sector's five-year project pipeline grew to 199,492 MW by the end of the first quarter. In the fourth quarter of 2022, developers had plans to build 180,592 MW worth of solar power capacity from 2023 to 2027. 26,009 MW are under construction, 9,244 MW are in advanced development, and 106,000 MW are in early development, while 58,239 MW have been announced.”

The majority of newly completed capacity in the first quarter originated from NextEra Energy Inc., which successfully finished 13 projects, each with a capacity of 75 MW. These midsize solar farms were part of Florida Power & Light Co.’s community solar program. Florida, the leader of the Southeastern pack, boasted an installed statewide solar capacity of 7,300 MW.

Wind

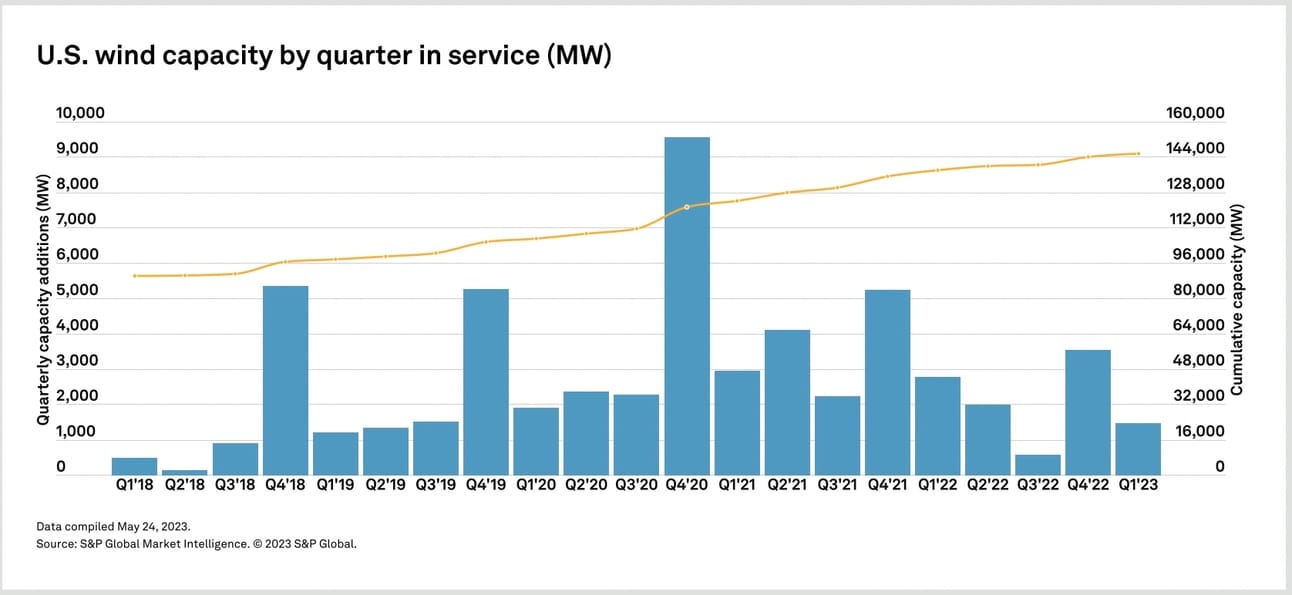

Wind power capacity installed in Q1'23 in the US witnessed a substantial 47% decline compared to the same period the previous year. But there was a 5% increase in the five-year pipeline for wind power projects from Q4'22.

During Q1'23, developers activated 1,472 MW of wind power capacity, while Q4'22 saw 2,785 MW connected to US power grids. Development activity is still sluggish, with a continuous downward trend in installations for nine consecutive quarters.

The last time installations increased on a yearly basis was in the final quarter of 2020. For the entire year of 2022, wind installations plummeted by 56% compared to 2021.

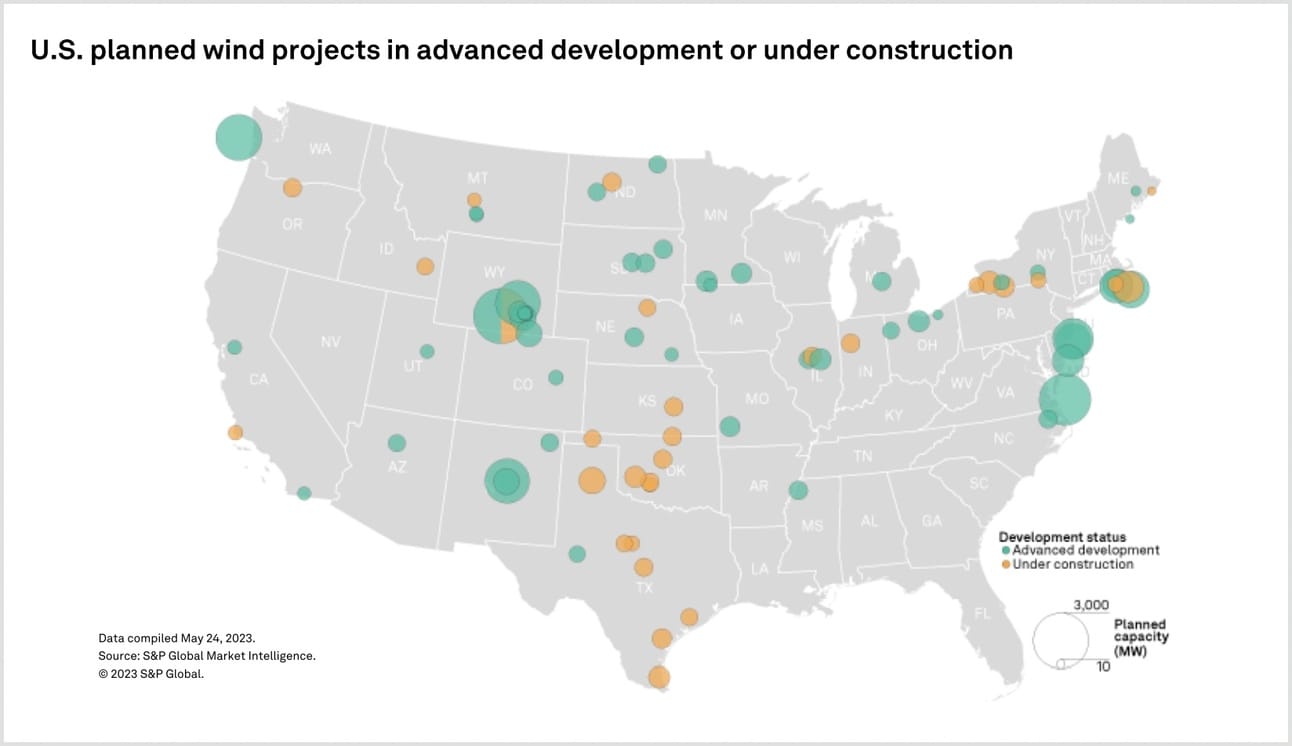

“The industry's pipeline of projects that will come online between 2023 and 2027 increased 5% to 81,265 MW of capacity, from the fourth quarter of 2022 when developers had a total of 77,220 MW of planned capacity,” reports S&P Global. “The US wind energy pipeline now includes 17,667 worth of announced capacity; 38,319 MW of capacity in early development; 19,173 MW of capacity in advanced development; and 6,106 MW of capacity under construction.”

The ten largest wind and solar developers in the US aim to construct a total of 95,808 MW of capacity over a five-year period until 2027, which is slightly higher than the planned 93,476 MW reported at the end of Q4 2022. Among these, the top wind developers account for 38,659 MW in their combined wind project pipeline.

Notably, NextEra Energy Inc. had retained its crown as the largest owner of planned wind and solar installations in the US, with a comprehensive project pipeline of 18,811 MW.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Japan Considers Subsidies for Idling Nuclear

The Japanese government is considering subsidies to help speed up nuclear power plant restarts.

“Under the proposed plan, existing nuclear plants would be able to participate in an auction next year to receive subsidies for necessary upgrades to meet the country’s safety standards, according to documents from the Ministry of Economy, Trade and Industry,” reports Bloomberg. “Projects selected would then get a subsidy for 20 years to help cover costs, the document said.”

Japan may cover the program by hiking rates for households and businesses. Right now, the plan for the auction is to bolster renewable projects and cut the carbon footprint of fossil fuel plants to help the country meet its decarbonization goals.

A significant number of Japan's nuclear reactors continue to be offline primarily due to stringent safety regulations. The costly retrofits required for earthquake resistance and tsunami countermeasures pose a potential obstacle to restarting some facilities.

In response, the government is stepping up its efforts to get more reactors running again to reduce reliance on expensive fossil fuel imports, strengthen power supplies, and mitigate pollution.

Conversation Starters

China is making its grid more flexible. “China is introducing more flexible power transmission arrangements into its national grid system, helping to avoid a repeat of the outages that plagued parts of the country last year, according to central government officials,” reports Reuters. “In response to decreased output from hydropower plants, authorities have ‘rationally optimised’ power transmission between provinces to send more power to the country's drought-stricken southwest, Guan Peng of the National Development and Reform Commission told a press conference on Wednesday.”

VW is going big on Chinese EVs. “Volkswagen AG plans to invest $700 million in Xpeng Inc. and jointly develop electric vehicles in China as the German automaker fights to halt a sales slide in its most important market,” reports Bloomberg. “VW will eventually hold a 4.99% stake in the Chinese company via a capital increase and is getting an observer board seat, it said Wednesday. Its Audi premium brand will deepen ties with VW’s long-term partner SAIC Motor Corp Ltd. to also bolster its EV lineup.”

Kurdistan reaches a partial agreement with Iraq on oil. “The semi-autonomous region of Kurdistan is partially honoring the recent deal with the federal government of Iraq to supply crude from the region to Iraqi, an unnamed source told Argus on Wednesday. The Kurdistan Regional Government (KRG) supplies 50,000 barrels per day (bpd) of crude oil to Iraq’s northern refineries, as part of the Iraq-Kurdistan deal under which the semi-autonomous region should deliver at least 400,000 bpd to the Iraqi storage tanks at the Ceyhan port in Turkey for sale to the international markets by Iraqi state oil marketing firm SOMO,” reports Oilprice.com. “If the crude cannot be exported from the Turkish port of Ceyhan on the Mediterranean – as is the case currently – it should be directed to Iraqi refineries, including those in northern Iraq, Argus notes. The KRG has been handing over 50,000-60,000 bpd of oil to Baghdad since the middle of June as part of the budget deal under which the federal government of Iraq will be responsible for exporting Kurdistan’s crude oil. SOMO is now in charge of marketing Kurdistan’s crude, after the region had sold the oil independently for years.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.