JD Power’s new analysis makes something painfully clear: in much of the United States, weather is no longer an occasional grid stressor — it’s a permanent budget category. Utilities are spending record amounts on storm recovery, vegetation management, undergrounding, and wildfire mitigation, and those costs are flowing directly into monthly bills. Add a Supreme Court case that could redefine who controls the energy agencies, plus PJM’s increasingly blunt dependence on gas, and you have a grid entering a new era of hard truths and harder prices. Welcome to GridBrief, where we at least tell you the quiet parts out loud.

JD Power Report:

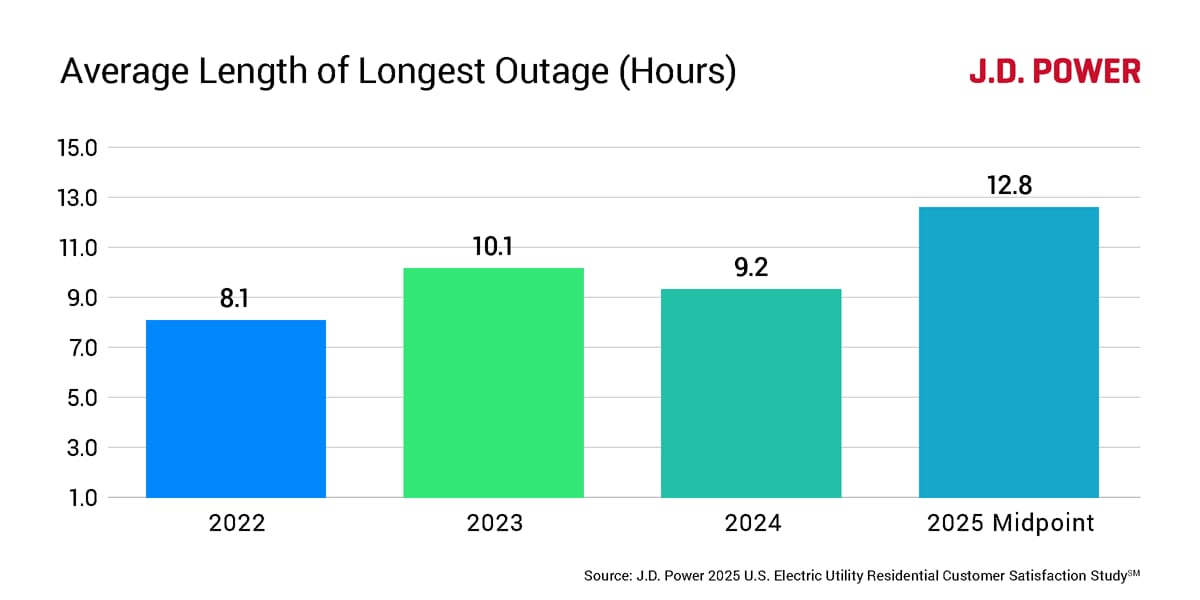

JD Power’s new national outage survey captures something utilities have tiptoed around for years: weather is now the primary cause of disruption in the U.S. power system.

48% of all outages in the first half of 2025 were caused by extreme weather.

In the South, the longest outages averaged 18.2 hours, and when a real disaster hit, the average outage reached 95 hours — four straight days.

For context, EIA says the typical American in 2022 lost power for 5.6 total hours across the entire year.

This isn’t just volatility; it’s the compounding effect of aging infrastructure meeting load growth and deferred upgrades. Utilities are now operating a grid built for a different era. The bill is arriving in the form of outages that last longer and spread wider than customers expect — and regulators so far have no coherent plan to reverse the trend.

The Coming Fight Over Executive Power at FERC

A legal fight is taking shape in Washington that could redraw the boundaries between the White House and independent energy regulators. At issue: whether the Supreme Court will revisit Humphrey’s Executor, the precedent that prevents presidents from removing commissioners at agencies like FERC, the EPA, and the EIA without cause.

Why it matters for the grid:

If the Court weakens Humphrey’s, FERC could tilt more directly toward the policy priorities of whichever administration is in power — accelerating or stalling transmission, gas pipelines, LNG approvals, or generator interconnection with far less friction.

EPA rulemakings could shift more rapidly, especially on power plant standards.

EIA’s independence—long a stabilizing force for data quality—could come under political influence.

Utility lawyers, state regulators, and large generators are already gaming out both scenarios: a stronger executive with cleaner lines of accountability, or a politicized energy bureaucracy whipsawed every four years. Either way, the outcome will shape investment decisions across the entire power sector.

Gas Generators Are Demanding a Seat at the Table

NRG, LS Power, and a coalition of gas-fired plant owners are pressing FERC to impose stricter backup requirements on hybrid resources in PJM — especially wind paired with batteries. Their argument: Batteries are not a “firm” substitute for natural gas during multi-day low-wind periods, and the market shouldn’t pretend otherwise.

This is part of a broader fight over what counts as reliable capacity as data center load surges. Wind-plus-storage is gaining political support, but the developers of traditional thermal plants aren’t wrong about the physics: a 4-hour battery can smooth a ramp; it cannot carry a region through a lull that lasts a weekend. Expect this to escalate into a major rulemaking that defines reliability expectations for the next decade.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Wired — Valar Atomics Hit Criticality

A small nuclear start-up has achieved what dozens of others have promised: actual criticality.

Why read: Because the nuclear renaissance won’t hinge on press releases — it’ll hinge on which of these companies can translate a lab milestone into a grid-connected machine. This is one to watchBarron’s — GE Vernova’s Nuclear Moment

Analysts think GE Vernova is undervalued given its nuclear backlog and global pivot to firm power.

Why read: Big-cap nuclear exposure is rare, and Vernova may be the only U.S. player with scale, manufacturing, and political wind at its back.RealClearEnergy — AI as a Nuclear Deployment Accelerator

AI models are helping utilities and regulators sift through siting, safety, and licensing bottlenecks.

Why read: If nuclear builds are going to speed up, it won’t be from speeches — it’ll be from shaving months off the bureaucratic gauntlet. AI is finally entering the critical path.

Good Bet: Gridspertise (ENEL’s digital grid spin-off)

If disaster-normalized pricing is the new reality, utilities desperately need better real-time sensing, outage prediction, and flexible load control. Gridspertise is already selling AI-driven distribution automation in Europe and quietly entering U.S. partnerships.

If AI eats the grid, this is one of the vendors holding the fork.

Bad Bet: Gas Exit Narratives in PJM

Anyone betting on a near-term “clean break” from gas in PJM is ignoring what FERC itself just affirmed: reliability math wins every time. Policy can say “transition”; the market still says “keep the turbines warm.”

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!