Welcome to Grid Brief! Here’s what we’re looking at today: why Gulf Coast states have ramped up LNG exports, EV company Lordstown Motors files for bankruptcy, coal stays king in China, and more.

Texas and Louisiana: LNG Export Champs

Between 2012 and 2022, overall demand for natural gas in America has seen a 43% increase, equivalent to 34.5 billion cubic feet per day (Bcf/d). Much of that has come from the Gulf states Texas and Louisiana, which experienced remarkable growth in demand, with a surge of 116% or 16.0 Bcf/d.

This growth was primarily fueled by the rising need for feedgas to support liquefied natural gas (LNG) exports. LNG exports began in 2016 through the Sabine Pass LNG export terminal in Louisiana, followed by other terminals in both states, which contributed to the substantial expansion in natural gas demand.

The second most important factor for natural gas demand growth was the increased utilization of natural gas for electricity generation, spurred by the transition from coal to gas and the growing demand for air conditioning, the EIA notes.

In the Midwest region, total natural gas demand witnessed a 35% increase during the same period. Most of this growth came from a more than doubling of natural gas consumption in the electric power sector. In the Northeast region, natural gas demand experienced a growth of 36% between 2012 and 2022 for the same reason.

“Natural gas consumption in the electric power sector increased almost every year in the last five years because summers have gotten warmer, which has increased air-conditioning demand. The summer months last year were the third warmest on record in the United States, resulting in increased demand for air conditioning and higher natural gas-fired electric power generation in the U.S. Lower 48 states,” reports the EIA.

The Southern region, excluding Louisiana and Texas, has the highest natural gas consumption in the United States, particularly in the industrial and electric power sectors. On the other hand, the Northeast and West regions have the lowest natural gas consumption.

Lordstown Motors Files For Bankruptcy

American electric vehicle startup Lordstown Motors has filed for bankruptcy.

Lordstown’s shares tumbled 35% on the news. While Lordstown isn’t the first EV startup to go bankrupt, it’s significant because the company was vying against Detroit’s established automakers in pricey pickup trucks.

"The bankruptcy of Lordstown signals that the days of successful EV startups is in the rear-view mirror," Thomas Hayes, chairman at hedge fund Great Hill Capital, said. "Moving forward it will be Tesla and the traditional incumbents ... that will duke it out for market share."

The company is also suing Chinese manufacturing company Foxconn.

“Foxconn previously invested about $52.7 million in Lordstown as part of the agreement, and currently holds an 8.4% stake in the EV maker. Lordstown contends Foxconn is balking at purchasing additional shares of its stock as promised and misled the EV maker about collaborating on vehicle development plans,” reports Reuters. “Foxconn, formally called Hon Hai Precision Industry and best known for assembling Apple's iPhones, has said Lordstown breached the investment agreement when the automaker's stock fell below $1 per share.”

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

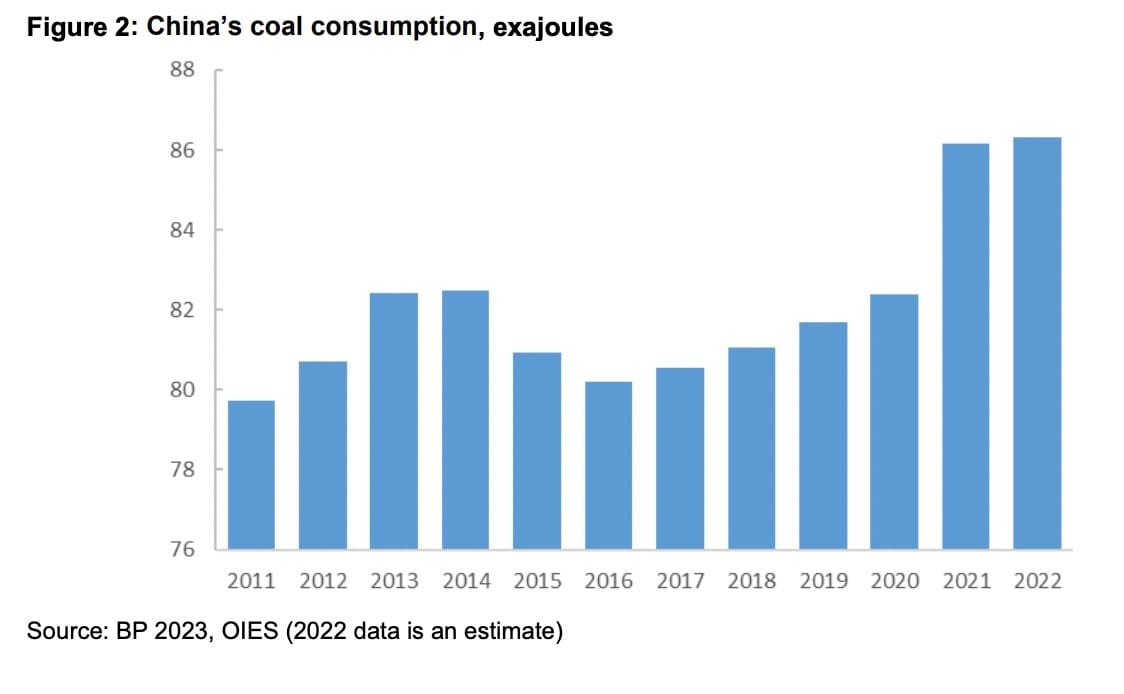

Despite its massive nuclear investments and substantial investments in renewables, China remains the world’s largest consumer and producer of coal—and that’s not likely to change in the near term according to a new report from the Oxford Institute for Energy Studies.

“Coal is used in China predominantly for electricity and heat generation, accounting for 60 per cent of total coal use, and industry representing an additional 33 per cent in 2020,” reads the report. “With large domestic reserves, China has been able to limit its dependence on imported coal to around 10 per cent of total supplies.”

Coal is readily available, cheap, and well-suited to China’s drive for greater economic growth. China’s primary energy consumption has grown by nearly 4 billion tons of standard coal between 2000 (1.5 billion tons) and 2022 (5.4 billion tons), making up 26.5% of global primary energy consumption.

Coal has also given China energy security.

“Notwithstanding its environmental commitments, China’s abundant domestic coal reserves provide a significant hedge against energy insecurity. China’s reliance on imported coal is likely to remain limited and even to fall considerably,” the report reads. “As the share of coal imports is already limited and will gradually decline, this paper does not discuss the outlook for coal imports or their geopolitical implications, but rather focuses on oil and gas demand and imports. Coal is therefore not a geopolitical vulnerability for China. On the contrary, it offers China optionality and supply security, even though this comes at an environmental cost.”

Yet the pollution costs have been intense; China now aims to start phasing out coal. However, Chinese coal is unlikely to disappear anytime soon for one major reason: the country’s renewables investments incentivize coal production. If China wants off the coal train, it will have to phase it out using nuclear, just like Ontario.

Conversation Starters

Italy goes big on LNG. “Italy backs a €500 million loan in order to secure more natural gas,” reports Bloomberg’s Stephen Stapczynski. “Mercuria got the credit facility guaranteed by Italy in exchange for increasing gas/LNG supply. It’s the latest deal by a European nation to guarantee credit for fuel imports amid energy security push.”

Brazil wants an energy transition. “Brazil aims to pass a regulatory framework for offshore wind and green hydrogen by the end of this year, the country's energy minister told Reuters on Tuesday, as Latin America's largest nation seeks to unlock new sectors to power its energy transition,” reports Reuters. “Leftist President Luiz Inacio Lula da Silva has staked his international reputation on overhauling Brazil's environmental credentials, which took a beating under his far-right predecessor, former President Jair Bolsonaro. Lula and his advisers have embraced the transition to a green economy as a focus of their state-driven development policies. As part of those efforts, Energy Minister Alexandre Silveira highlighted an upcoming auction for transmission lines to transport solar and onshore wind energy from the country's northeast to power stations down south. With a floor of 16 billion reais, the auction could unlock 200 billion reais ($41.79 billion) in investments, he said.”

The EU doesn’t like Uzbekistan’s commercial ties to Russia. “The latest set of European Union sanctions aimed at exerting pressure on Russia includes two companies based in Uzbekistan among the list of entities seen lending support to the ongoing invasion of Ukraine,” reports Oilprice.com. “Their inclusion among the 87 companies added on June 23 to an ever-growing list of enterprises found by the EU to be enabling the Russian military-industrial complex comes a few months after they were featured in a similar list drawn up by the U.S. government.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.