Thai Coal Producer Seeks US Shale

Banpu, Thailand’s top coal producer, plans to boost its investments in American shale.

The Bangkok-based company is looking to pivot away from coal and towards natural gas. “There remains a vast potential of power and natural gas business in the US that can help Banpu achieve its shift away from coal,” Chief Executive Officer Somruedee Chaimongkol said.

The company also plans to acquire more power assets in Texas and to invest in renewable energy in China, Japan, and Australia.

“Somruedee said in June that Banpu is aiming to reduce the proportion of revenue it generates from coal from around two-thirds now to 50% by 2025,” reports Bloomberg. “The company will replace those earnings with a mixture of natural gas production and power generation, as well as green technologies including solar and carbon capture, she said at the time.”

Banpu plans to list its US natural gas unit, BKV Corp., on the New York Stock Exchange this year.

Pemex Aims to Repay Debts

Mexico's state oil company, Pemex, is preparing to pay its debts on its own this year. If oil prices plunge, it will turn to the government, rather than the market, according to sources in touch with Reuters.

“The strategy comes after a lengthy back and forth between Pemex and the finance ministry over who will pay the company's mountain of debt, which at $105 billion makes Pemex the world's most indebted oil company,” reports Reuters. “President Andres Manuel Lopez Obrador's administration had committed in 2021 to help Pemex with its debt payments to free up company funds for investment in exploration and production with the aim of ultimately boosting output - a core goal of the government.”

After the market imposed a sky-high rate on bonds Pemex issued in January, the company is determined to avoid the market, forcing a recalibration. Pemex plans to use its own cash and to stop carrying out any more debt refinancing operations in the markets—as long as oil prices remain high.

Pemex says that it has to pay back $8 billion this year and $8.7 billion next year.

"President Andres Manuel Lopez Obrador has always said that if necessary ... more support will be given," one of the sources told Reuters. "If oil prices drop a lot, well below budgeted, then perhaps direct injections would have to be sought to pay off the debt."

Pemex paid as few as eight coupons of different bonds that became due in January, plus $1.1 billion for the remainder of one issued in 2013.

EV Charging Network: Made in America?

The Biden administration is betting big on electric vehicles. To help them along, the administration has announced measures to expand the US electric vehicle (EV) charger network and support the manufacturing of EV components in America.

“The latest set of actions is expected to help the Administration’s EV sales goals by building a national network of 500,000 electric vehicle chargers along America’s highways and in communities and have EVs make up at least 50% of new car sales by 2030,” reports Oilprice.com. “Under the Bipartisan Infrastructure Law, $7.5 billion will be invested in EV charging, $10 billion in clean transportation, and more than $7 billion in EV battery components, critical minerals, and materials, the White House said today.”

As part of the plan, all EV chargers funded by the Bipartisan Infrastructure Law must be built in the America, with at least 55% of their components manufactured domestically by July 2024. Tesla will open part of its Supercharger network to non-Tesla EVs, and Hertz and BP plan to build a national network of EV fast-charging infrastructure.

Like what you’re reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

The jet fuel market is getting tight. “A surge in the number of passengers looking to travel via air is creating a tight jet fuel market that is pushing up costs for airlines and those looking to purchase flights,” reports Oilprice.com. “Behind the U.S. jet fuel squeeze is a hoard of willing airline passengers who are looking to travel post-pandemic, after movements were restricted. According to the latest data from the Energy Information Administration (EIA), there were 36.532 million barrels of kerosene-type jet fuel in the United States as of February 10—the lowest for this time of year since 1985, but up 714,000 barrels from the week prior.”

At long last, Vito’s up and running. “Fourteen years after its discovery, Shell subsidiary Shell Offshore's long-awaited Vito deepwater field has started producing what will eventually be a peak output of 100,000 barrels of oil equivalent a day into its new production hub in the US Gulf of Mexico, the company said Feb. 16,” reports S&P Global. “Discovered in 2009 and sited in the Mississippi Canyon area roughly 150 miles southeast of New Orleans, the Vito field stretches across four blocks at a depth of more than 4,000 feet of water, Shell said in a statement. Current recoverable resources from Vito are projected at about 290 million boe.”

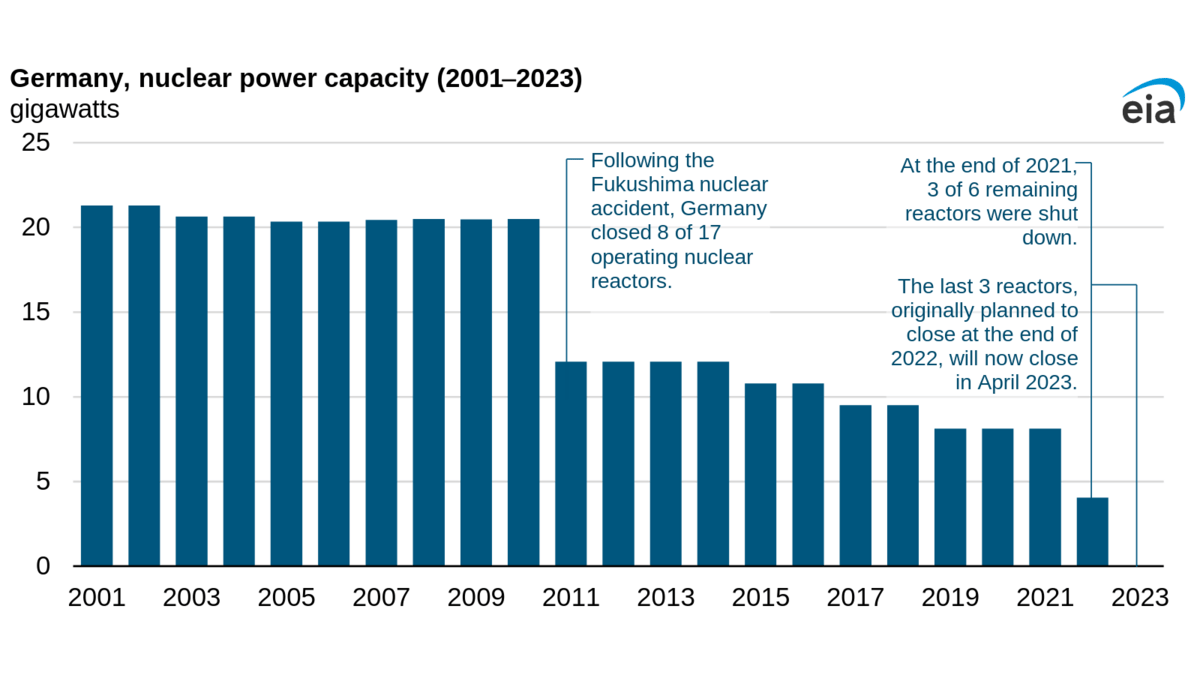

The sad tale of the death of nuclear in Germany, as told by the Energy Information Administration: “Nuclear energy has been a source of much debate and political discord in Germany since the 1970s, particularly after the Chernobyl disaster in 1986. Despite growing opposition to nuclear power in Germany, the exact timeline for the country’s exit from nuclear power has shifted and been subject to several policy reversals. Following the Fukushima nuclear accident in Japan in 2011, the German government ordered the immediate shutdown of 8 of the country’s 17 operating nuclear reactors and announced a plan to completely phase out all nuclear power by the end of 2022. From 2012 to 2022, another 14 reactors were shut down, including 3 at the end of 2021,” reports the EIA. “Although the German parliament approved the decision to keep the three remaining nuclear reactors operating through the winter, the extension stipulates that the reactors will be shut down by April 15, 2023, and that it will not grant any further extensions to the operating life of the reactors.”

Crom’s Blessing