A deep winter storm spanning much of the United States is putting the electric grid under real stress. Demand is high, outages are visible, and reserve margins are thin across multiple regions.

What’s notable isn’t just what failed — it’s what held, how it held, and which institutions quietly stepped in to keep the system upright. This issue tracks the grid in motion: under weather pressure, policy pressure, and structural constraint.

Major Stories

WEATHER EVENTS

Historic Winter Storm Stress-Tests the U.S. Power Grid

A historic winter storm is pushing electricity demand to seasonal highs across much of the United States while constraining generation availability and damaging local distribution systems. From Texas through the Plains, Midwest, Mid-Atlantic, and Northeast, grid operators entered elevated operating conditions simultaneously — a rare, system-wide stress test occurring with prices already high and reserve margins thin.

What’s emerging is not a single failure story, but a set of overlapping realities that explain how the system is holding together — and where it is fragile.

Dispatchable Generation Is Carrying the System

During peak hours across the Eastern Interconnection, natural gas, coal, nuclear, and oil supplied roughly 85–90% of total generation. These resources were available at 80–95%, with most outages tied to scheduled maintenance rather than weather-related failures. This reliability allowed operators to meet rising load even as conditions deteriorated.

Renewables Underperformed Installed Capacity

Across regions with roughly 200 GW of installed wind and solar, real-time output during peak demand fell closer to 30–40 GW, or about 15–20% availability. Calm conditions in the Plains, winter performance limits, and the loss of solar after sunset sharply reduced contribution during the hours when demand was highest.

Outages Were Largely Distribution-Driven

The most visible failures occurred at the distribution level. Ice accumulation and falling trees caused widespread outages in parts of Tennessee and the Southeast, with more than 130,000 customers losing power in some areas. These outages were not caused by generation shortfalls, but they amplified public sensitivity during a high-price period.

DOE Activated Emergency Reliability Authority

The Department of Energy issued emergency orders directing specific natural gas, coal, and oil units in PJM, MISO, ERCOT, and New England to remain online through the storm. This prevented retirements and ensured capacity stayed available during peak conditions. Separately, federal officials coordinated with large data center operators to ensure on-site backup generation was ready — an unusual step that reflects how seriously load risk is now being treated.

Load Growth Is Colliding With Weather Risk

This storm arrives as baseline electricity demand is already rising due to data centers and electrification. Operators are now managing peak weather events on top of a higher structural load floor, shrinking the margin for error even when the system performs as designed.

Why It Matters - This storm shows which resources actually deliver during stress, which institutions still have leverage in emergencies, and how thin the buffer has become between “operating normally” and invoking extraordinary authority.

Grid Take

The grid held because dispatchable capacity existed and federal emergency authority was used to keep it online. That combination is doing more reliability work right now than price signals, mandates, or aspirational capacity targets. The uncomfortable implication is that removing firm supply before replacements are proven available doesn’t just raise costs, it forces the system to rely more heavily on emergency powers to function at all.

NUCLEAR

Westinghouse Megadeal Signals Nuclear Supply Chain Revival

Westinghouse Electric is finalizing a major transaction aimed at revitalizing critical parts of the nuclear supply chain, including fuel services, reactor components, and long-lead manufacturing capacity. The deal is designed to stabilize production for both existing reactor fleets and planned new builds at a moment when global nuclear demand is accelerating.

The timing matters. Much of the Western nuclear supply chain atrophied over decades of low build rates, while Russia and China expanded state-backed manufacturing, fuel processing, and export capability. Rebuilding that capacity in the U.S. and allied markets requires capital, skilled labor, and long-term order visibility — not just licensing reform.

Industry analysts note that even with faster approvals, new nuclear projects remain constrained by component availability, enrichment capacity, and specialized manufacturing bottlenecks. This deal addresses those constraints directly.

Why It Matters - Approvals don’t build reactors. Supply chains do.

Grid Take - The nuclear conversation is shifting from aspiration to execution. That’s slower, less visible work — and far more consequential.

STATE POLICY

Chevron Expands Venezuelan Oil Shipments to U.S. Refineries

Chevron has chartered its largest tanker fleet in more than a year to move Venezuelan crude to U.S. refineries under a special U.S. license, signaling a material increase in sanctioned-country supply flowing into the domestic refining system.

The company has secured 11 tankers, capable of shipping roughly 150,000 barrels per day, up from about 123,000 bpd the prior month. Cargoes are bound for U.S. facilities optimized for heavy crude, including refineries operated by Phillips 66, Valero, Marathon Petroleum, and Chevron itself.

The increase comes amid tight global crude markets, elevated winter demand, and limited heavy-crude alternatives following years of geopolitical disruption. While Venezuelan volumes remain modest in global terms, they are highly valuable for specific U.S. refinery configurations.

Why It Matters - Incremental barrels matter most when systems are tight.

Grid Take - Energy security often advances through narrow exceptions, not sweeping policy reversals.

MARKETS & PRICING

Forward Contracts Re-Enter the Rate Volatility Debate

After two years of sharp electricity price swings, policymakers in several markets are revisiting long-term forward power contracts as a way to limit retail bill volatility. The approach shifts utilities and governments toward locking in power prices earlier, rather than passing real-time fuel, weather, and capacity shocks directly through to consumers.

Forward contracting is not new. Versions of it already exist through default service procurement, long-term PPAs, and hedging programs in the U.S. and abroad. What’s changed is the motivation. These tools are now being pitched explicitly as consumer-protection measures following price spikes driven by tight capacity, high gas prices, and extreme weather.

The tradeoff is timing. Contracts signed during periods of scarcity tend to embed higher prices for years. Forward contracts also don’t add new generation or transmission — they only redistribute price risk once supply is already constrained.

Why It Matters - Volatility is being addressed financially after scarcity has already formed, not alongside reforms that would shorten build timelines or expand supply.

Grid Take - Forward contracts can smooth bills, but they don’t solve shortages. Without faster permitting, interconnection, and construction, they become a way to manage high prices — not prevent them.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

The Conversation

Quick Signals

The grid bent, but did not break — with help.

Emergency authority is now a standing reliability tool.

Dispatchable capacity remains the backbone in stress events.

Nuclear investment is moving upstream into manufacturing.

Large loads are being treated as grid actors, not just customers.

Things to Read

RMI – Power outages cost more than we account for

A reminder that reliability failures impose real economic damage long after power comes back.WSJ – Nuclear power is making a comeback

Less cheerleading, more acknowledgment that firm power is returning because alternatives keep failing stress tests.OilPrice – LNG enters a year of political risk

Global gas markets are becoming policy instruments — with consequences for price stability.NYT Opinion – Nuclear in blue states

A window into how ideology bends when reliability math becomes unavoidable.

Chart of the Day

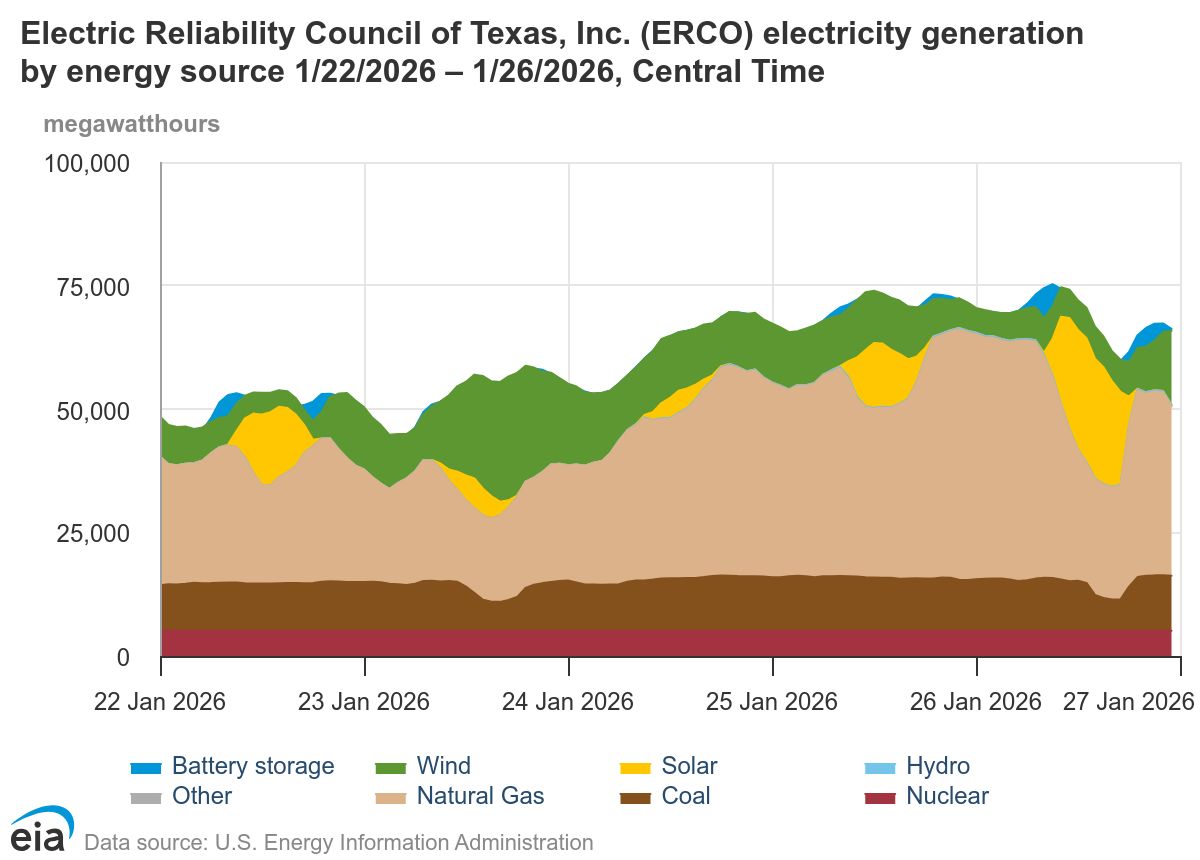

ERCOT Generation During Winter Storm Fern (Jan 22–26, 2026)

This chart shows how ERCOT met load during Winter Storm Fern as demand rose and weather conditions tightened across Texas. Total generation increased materially over the period, with natural gas carrying the marginal load and providing most of the system’s flexibility. Coal and nuclear output remained stable, contributing steady baseload throughout the event.

Wind output was episodic, rising and falling sharply across days and hours, while solar contributed briefly during peak daylight windows before disappearing during evening load ramps. Battery storage provided short bursts of support but remained small relative to system needs.

The system held together not because capacity existed on paper, but because enough dispatchable generation was available in real time to respond as conditions worsened.

Grid Take - This isn’t about ideology or averages. It’s about performance under stress. When demand surged and conditions tightened, the grid leaned on resources that could show up, stay online, and respond. Planning around installed capacity without accounting for availability is how scarcity hides until it matters most.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!