The energy conversation is starting to fracture along a familiar fault line: advanced technology driving growth on one side, and political reflexes trying to contain it on the other. Fusion suddenly has political patrons. Portable nuclear is edging toward real deployment. Meanwhile, data centers are being recast as villains in an electricity story they didn’t create. History suggests this is the dangerous moment, when misunderstanding demand leads policymakers to throttle the very systems that keep economies competitive.

Major Stories

POLICY FRONTIER

Trump Media Tangles with Fusion Startup in Strange New Energy Crossover

Trump Media & Technology Group, the parent company of Truth Social, disclosed a preliminary agreement tied to a fusion energy venture connected to Devin Nunes, its CEO and former congressman. According to reporting, the arrangement involves a planned merger or strategic partnership with a fusion startup that claims to be developing compact, commercially viable fusion systems. The deal is early-stage and light on technical specifics, but notable for pulling fusion energy into a publicly traded, politically adjacent corporate ecosystem for the first time.

The fusion company at the center of the deal has not yet demonstrated net-energy gain, and no commercial fusion reactor exists anywhere in the world. Still, the move reflects growing interest among political and financial actors in positioning fusion as a future baseload solution, particularly as grid demand forecasts accelerate and conventional generation faces permitting bottlenecks.

Why It Matters - Fusion has long lived in the realm of promises. The moment political actors start circling it, expectations rise and timelines compress.

Grid Take - This is weird, yes. But it’s also revealing. Fusion is no longer viewed as a science project, but as a potential strategic asset. That shift alone changes capital flows, regulatory posture, and public expectations. The risk is hype. The upside is acceleration.

MARKETS & POLICY

Washington Flirts with Regulating Data Centers on Consumer Price Grounds

A growing chorus of policymakers and advocates is pressuring U.S. regulators to intervene in data-center electricity consumption, arguing that hyperscale facilities could raise power prices for residential customers. Reporting highlights discussions around rate design changes, special tariffs, and even usage restrictions aimed at slowing data-center expansion in regions facing grid congestion. The debate echoes similar regulatory efforts in parts of Europe, where governments have begun to cap or ration power for large digital infrastructure.

The concern rests on a simple narrative: AI-driven data centers consume enormous amounts of electricity and could crowd out household demand. What’s often missing from the discussion is how these facilities are actually financed and interconnected, and how their long-term contracts frequently underwrite new generation and transmission investment that would not otherwise be built.

Why It Matters - This is how grids get broken. Data centers are being treated as discretionary luxury loads rather than the backbone of modern industrial growth.

Grid Take - Data centers do not raise electricity prices by existing. They finance new generation, stabilize long-term demand forecasts, and underwrite infrastructure that benefits everyone. Price controls or blunt regulations would not protect consumers. They would delay supply, worsen congestion, and quietly push AI investment overseas. This is not a pricing problem. It is a permitting problem.

TECH FRONTIER

Portable Nuclear Takes a Step Toward Reality

Radiant Nuclear has raised new funding to advance development of its Kaleidos reactor, a 1-megawatt portable nuclear system designed to be factory-built, shipped in a standard container, and deployed in remote or high-risk environments. The reactor targets use cases like military bases, disaster response, mining operations, and isolated communities that currently rely on diesel generators for primary power. Radiant says the system is designed to operate for several years without refueling and to be removed intact at end of life.

Unlike grid-scale nuclear projects, which can take a decade or more to permit and build, Radiant’s approach focuses on speed, mobility, and replacement of fossil backup power. The company is positioning its reactor less as a utility asset and more as hardened infrastructure, similar to generators or fuel depots, but with dramatically higher energy density and lower logistics costs.

Why It Matters - This is not grid-scale power. That’s the point.

Grid Take - Portable reactors will not replace large plants, but they will replace diesel, reshape resilience planning, and give critical infrastructure a new option. This is how nuclear quietly expands: not through megaprojects alone, but through modular, boring, highly useful machines.

GRID RELIABILITY

DOE Issues Emergency Order for TransAlta’s Centralia Plant

The Department of Energy issued an emergency order requiring TransAlta to keep its Centralia coal plant, a roughly 670-megawatt facility, online amid reliability concerns in the Pacific Northwest. The plant was scheduled for retirement, but regional grid operators warned that losing the capacity during peak winter conditions could risk shortages and instability, particularly given constrained hydro output and limited replacement capacity coming online.

Why It Matters - Emergency orders are no longer rare. They are becoming a tool of routine grid management.

Grid Take - When emergency powers become normal, it’s a sign the system is running out of slack. This is not a coal story. It’s a capacity story.

MARKETS

MISO Capacity Auction Draws Legal Fire

A complaint filed at FERC challenges how MISO’s capacity auction prices reliability across its footprint, arguing the rules suppress signals needed to attract new firm generation. MISO’s auction requires load-serving entities to secure capacity three years in advance, with prices capped and zonal constraints often blunted by administrative interventions. Critics argue this design favors short-term affordability over long-term adequacy, leaving the market unable to reward new investment even as demand rises.

Why It Matters - Capacity markets are increasingly being asked to do policy work they were never designed to do.

Grid Take - Markets work when they are allowed to clear. When they are bent to achieve political outcomes, they produce scarcity signals too late to fix the problem.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

The Conversation

Quick Signals

Data centers are becoming the preferred scapegoat for policy failures upstream.

Emergency grid orders are filling the gap left by delayed capacity investment.

Nuclear innovation is shifting toward smaller, faster, and deployable systems.

AI competitiveness is now visibly linked to energy availability, not just chips.

Things to Read

WSJ: The people who physically build the grid still matter. Hitachi’s quiet dominance is earned, not accidental.

Cowboy State Daily: Wind development collides with wildlife realities, and transparency is becoming unavoidable.

RealClear Energy (AGA): Permitting reform remains the single biggest lever for affordability.

Mother Jones: Appalachia’s energy politics reframed, though still missing the economic freedom angle.

Chart of the Day

AI Performance Is Power Policy

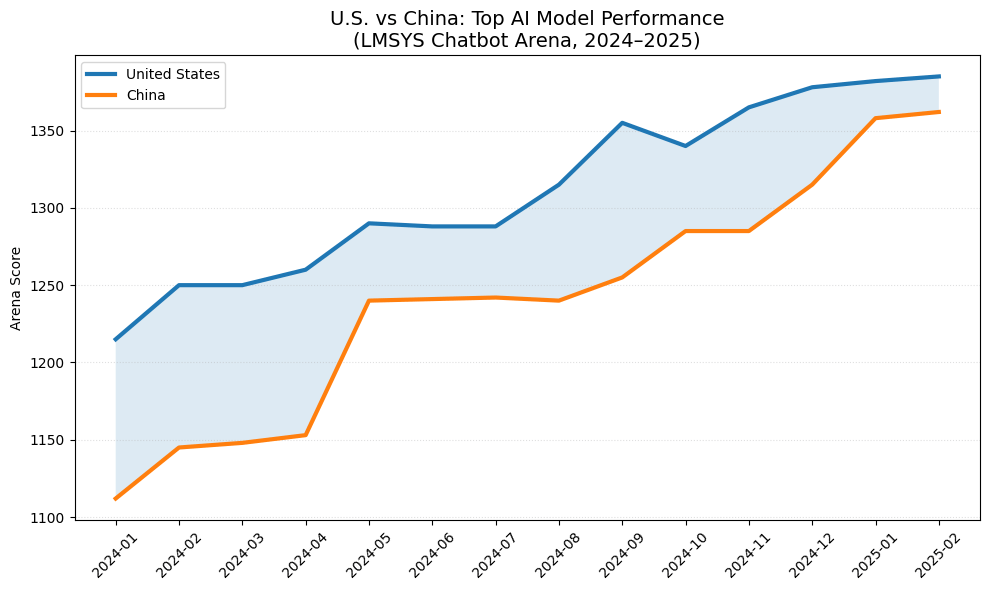

U.S. vs. China: Top AI Model Performance (LMSYS Chatbot Arena, 2024–2025)

The chart shows U.S. models maintaining a lead over Chinese counterparts, but with the gap narrowing sharply following China’s release of DeepSeek R1 in early 2025.

Why This Matters for Energy - AI dominance is not an abstract tech race. It is a power-intensive industrial competition. Every constraint placed on data centers is a constraint placed on national capability.

Grid Take - If energy policy treats data centers as a nuisance instead of strategic infrastructure, the result is simple: slower deployment, higher costs, and lost ground to countries willing to build. AI leadership runs through the grid. Always has.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!