TVA CEO Bullish On Nuclear

The Tennessee Valley Authority, America's largest public power entity, is betting big on nuclear energy.

"The Knoxville-headquartered utility is anticipating that advanced nuclear technologies will play a key role in its goal of net zero by 2050," reports the Washington Examiner. "TVA, which operates the youngest nuclear reactor in the country at Tennessee’s Watts Bar and manages three legacy plants, expects to stand up potentially dozens of small modular reactors to work alongside and ultimately replace the existing fleet."

“I use the number 20 — could be more, could be less, but that's a good number sort of to visualize,” Jeff Lyash, TVA's president and CEO, told the Examiner.

Nuclear already makes up for the largest portion of the TVA's energy mix at 41% as of last year. But the public power juggernaut wants to phase out its coal plants to hit its clean power goals. The TVA hopes to be 100% clean by 2035.

"TVA is currently designing a small modular reactor plant to be built on the Clinch River in Oak Ridge, Tennessee, which is the only site in the country with a Nuclear Regulatory Commission-approved early site permit for a small modular reactor," reports the Examiner. "The site could ultimately take up to four reactors, and the plan is for its first unit to be online in the early 2030s."

Lyash believes this is just the beginning and that the utility can permit and build more nuclear plants.

FERC Approves Missouri Coal Extension

The Federal Energy Regulatory Commission has granted Ameren's Rush Island coal plant an extension until 2025 for grid reliability purposes.

"Shuttering the plant near Festus, Missouri, could cause severe voltage stability problems, leading to cascading power outages, the Midcontinent Independent System Operator said in an August application for a 12-month ['system support resource'] agreement that can be renewed annually. The contract will be paid for by load-serving entities that benefit from keeping the plant running," reports Utility Dive.

While FERC approved the operating license, it did not approve Ameren's request for a 0.5% increase on its returns for keeping the plant running for longer than anticipated. “Our preliminary analysis indicates that Ameren Missouri’s filing has not been shown to be just and reasonable,” FERC said.

FERC also said that MISO conducted an adequate search for alternatives before requesting the coal plant be kept online. MISO has plans to continue looking for other options to maintain grid reliability besides letting Rush Island burn coal.

"The SSR agreement can be terminated if the power plant is no longer needed to keep the grid running smoothly," Utility Dive reports.

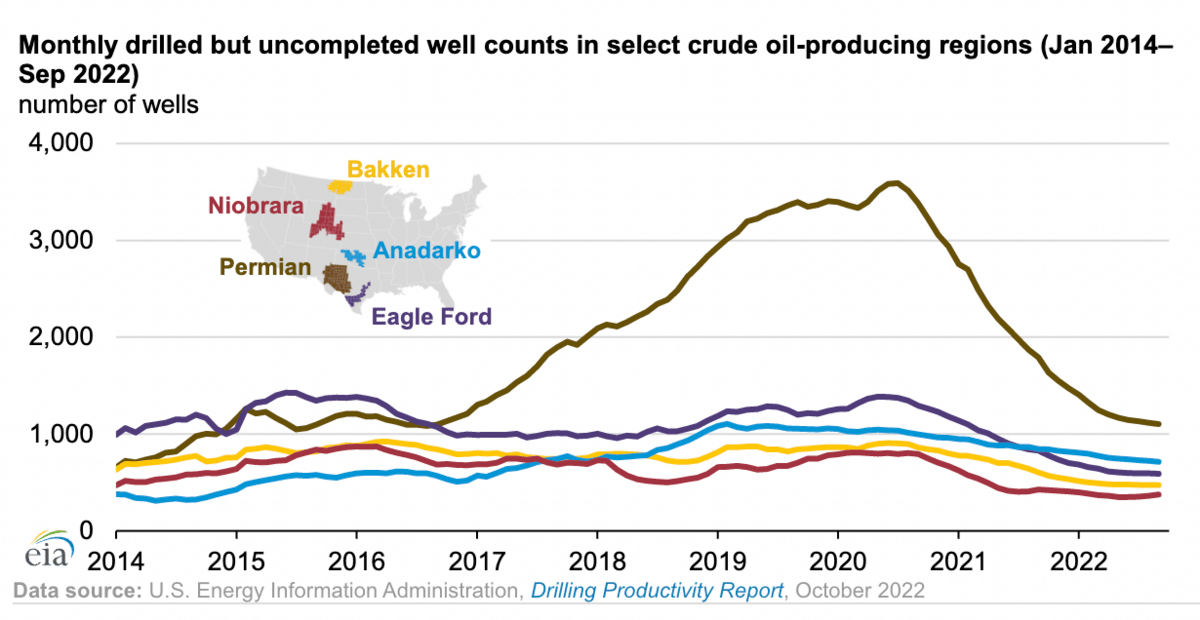

EIA: "Decline in drilled but uncompleted wells may limit future crude oil production growth."

America's got a DUC--drilled but uncompleted wells-- problem according to the Energy Information Administration.

"[M]ore wells were completed than were drilled in the United States from July 2020 through September 2022," the EIA reports. "As a result, the number of [DUCs] in the United States fell to 4,333 as of September 2022, the fewest since at least December 2013, when we started estimating the number of DUCs."

Pair fewer DUCs with natural gas pipeline constraints and we might see yet more limitations on increasing American crude oil production.

Of the seven major O&G production regions in America that the EIA looked at, the Permian Basin made for an eye-popping 60% of total crude oil production. Natural gas is produced as a byproduct of crude in the Permian, which means that pipeline constraints on moving gas out of the region (known as "takeaway capacity") could wound future oil production growth.

As we saw yesterday, when pipelines switch off for maintenance in the Permian region, prices can drop below zero or simply result in flaring gas as awarded by the Texas Railroad Commission.

Like what you're reading? Click the button below to get Grid Brief right in your inbox.

Conversation Starters

Gazprom has begun testing on a gas field to help Russia export gas to China. "The tests announced Tuesday are part of the measures to put the Kovykta gas field into service, which is expected in December, and will allow Russia to increase exports to China," reports Insider Paper. “Putting the Kovykta into service is an important step in the implementation of the ‘Power of Siberia’ project and the creation of new centers of gas production in the east of the country,” Gazprom chief executive Alexei Miller said in a statement.

Exxon has just made two new offshore oil discoveries in Guyana at the Sailfin-1 and Yarrow-1 wells in the Stabroek block. "Exxon did not disclose how much crude oil or gas it estimates the new discoveries to contain. Guyana amounts for one third of the crude discovered in the world since Exxon first hit oil in the country in 2015," reports Reuters. "The about 11 billion barrels of recoverable oil discovered prior to Wednesday's finds, should make the country a global oil power in the coming years."

While BlackRock hasn't backed out of fossil fuels investments, it is going big on green. "BlackRock said it had raised $4.5bn (£3.97bn) for a new climate infrastructure fund today as it looks to ramp up investment in the net zero transition amid criticism of its decision to continue backing oil and gas firms," reports Oilprice.com. "The investor is set to target five sectors with the new capital – energy, low carbon power, transport and logistics, regulated utilities, and digital infrastructure – as it looks to cash in on the global push towards decarbonisation. It is aiming for a total $7.5bn raise with the new cash, after its previous infrastructure fund bagged $5.1bn in 2020."

Crom's Blessing