UK to Cut Pipelines to EU If Russian Gas Crisis Gets Worse

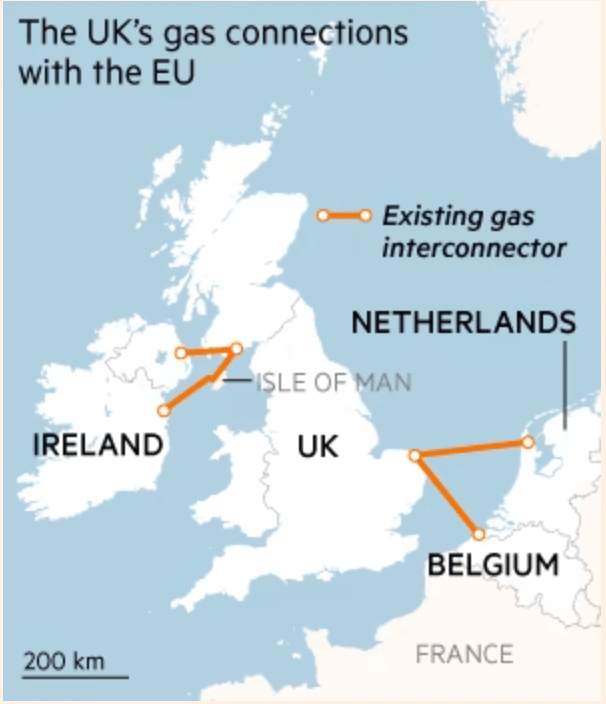

Self-preservation will become the rule this winter. "The UK will cut off gas supplies to mainland Europe if it is hit by severe shortages under an emergency plan that energy companies warn risks exacerbating a crisis on the continent," reports The Financial Times.

As it gets down the wire this winter, we might bare witness to energy rationing and countries cutting each other off from supplies to save their own skins.

The UK isn't the only country contemplating such a future. "Germany and the Netherlands this month triggered their own emergency plans, restarting coal plants and urging industry to cut gas usage after Russia cut gas exports," FT reports.

Irina Slav put it best: "There are no friends in a crisis."

Newsom's New Energy Plan for California

Governor Gavin Newsom just released a new energy plan. The bill will "reshape how business is done on the California power grid," reports the LA Times.

Here are the highlights:

The most radical and important part: the bill would "give the Department of Water Resources unprecedented authority to build or buy energy from any facility that can help keep the lights on during the next few summers."

The DWR's decisions would not be subject to "the normal public input process under the California Environmental Quality Act — and from approval by agencies such as the California Coastal Commission and local air quality management districts."

A separate provision would also allow those trying to build wind, solar, or batteries (along with their requisite transmission requirements) the ability to fast-track their approval processes and circumvent county governments. "State officials would be required to conduct environmental reviews and approve or deny those projects within nine months. Legal challenges to any project approvals would need to be resolved by state courts within another nine months."

The plan might also save a few gas plants and the Diablo Canyon nuclear power plant.

Local government officials and green groups aren't enthusiastic about the plan.

"In a letter opposing the bill, the California State Assn. of Counties, Urban Counties of California, Rural County Representatives of California and the League of California Cities said renewable energy facilities 'can have enormous impacts on local communities,'" reports the LA Times.

They described the Energy Commission approval process as “overly broad, usurps local control, excludes local governments from meaningful involvement in major development projects within their jurisdictions, and could result in even more litigation.”

Alexis Sutterman, energy equity manager at the California Environmental Justice Alliance, claims the bill is “incredibly dangerous.”

“It’s putting billions of dollars into keeping fossil fuel infrastructure online at a time when we should be doing everything we can to move away from fossil fuels, both for equity and the sake of our climate,” Sutterman told the LA Times.

Two-dozen groups, in an opposition letter, complained that Newsom's plan hasn't gotten enough public review.

This shows how hard it is to make everyone happy. Local communities want to exert control over what environmentalists want--meanwhile, green aspirations fragilize the grid. But localism and environmentalism possess powerful constituencies in the state. I don't envy Newsom's position.

US Q1 Battery Storage by the Numbers

S&P Global just released its brief Q1 battery storage report for the US. Here's the rundown:

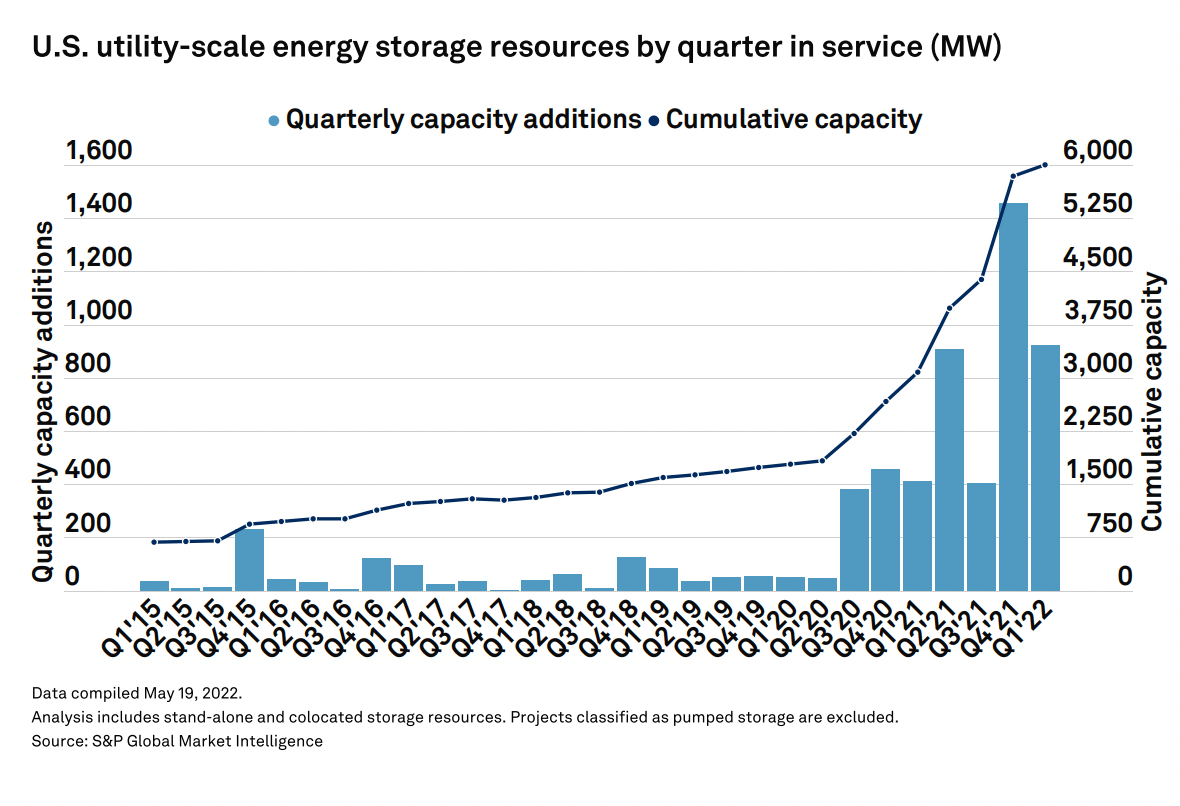

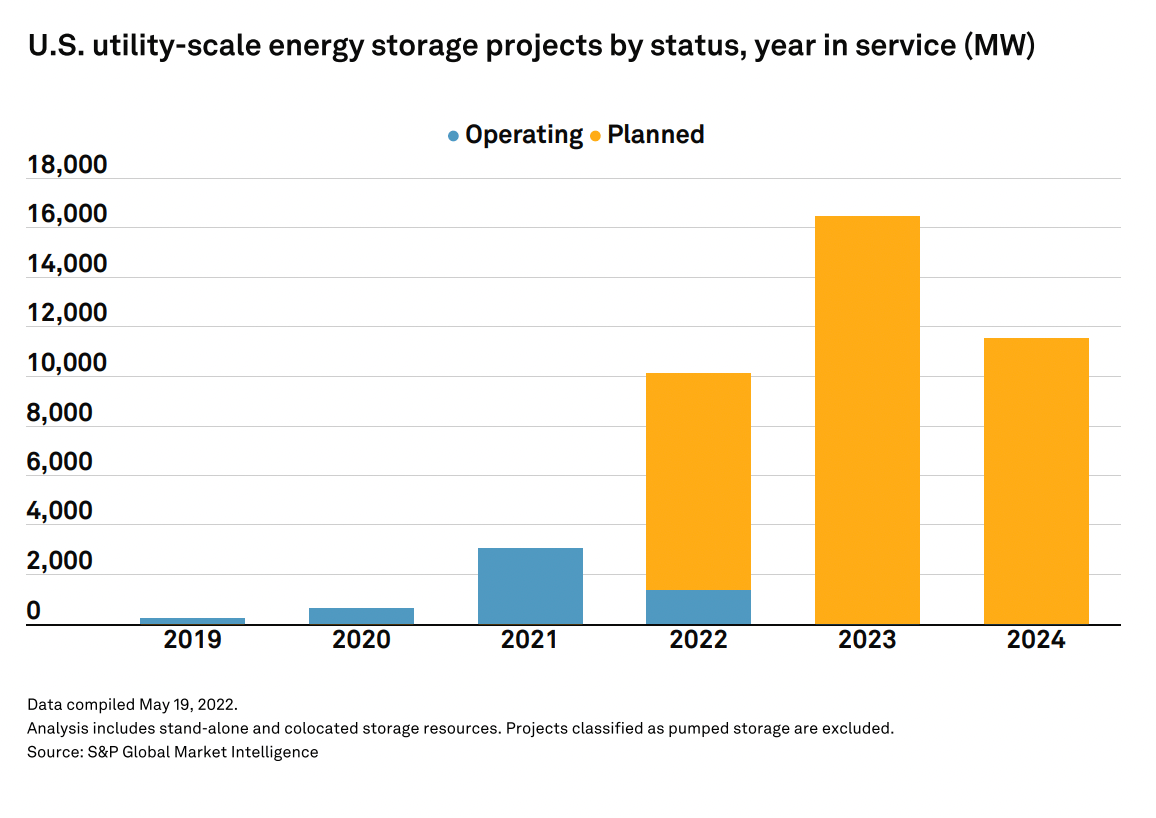

Q1 of 2022 marks the second-best quarter for battery capacity additions. Though the 37% drop-off from last year's Q4 peak is noticeable.

Batteries seem to be booming. "The first-quarter performance pushed total operating nonhydroelectric power storage capacity in the U.S. to nearly 6,800 MW, with the Southwest and Texas together accounting for about 75% of that."

But the volatile metal markets might stymy some of these plans.

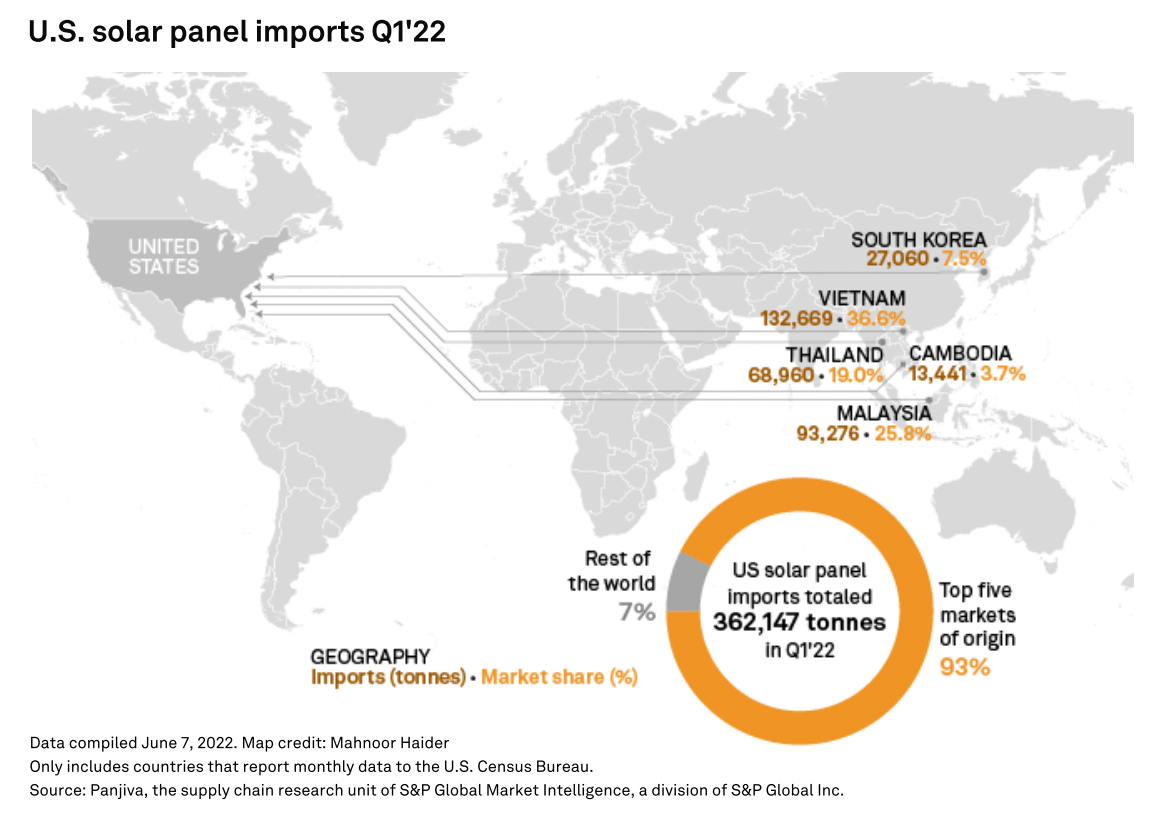

At the end of the report, sits this graphic. I have to say, I find it staggering. Earlier in the month, Biden invoked the Defense Production Act to circumvent the Commerce Department's investigation into Asian solar firms. It was trying to see if any of these companies were skirting duties that should be imposed on Chinese duties.

Biden's move demonstrated the length's the administration will go to make sure the solar industry can buy solar panels made from Chinese slave labor. This visual represents the fruits of Biden's decision.

Looking at this makes the administration's concern for the domestic solar industry look like a sick joke.

Like what you're reading? Click the button below to get Grid Brief right in your inbox.

Conversation Starters

Nuclear might make a comeback in Sweden. "State-owned utility Vattenfall AB said Tuesday it will start an 18-month study on whether it’s plausible to have at least two so-called small modular reactors adjacent to the Ringhals plant on the nation’s west coast," reports Bloomberg. The energy crisis is the impetus for the study.

The US might release more from its Strategic Petroleum Reserve.

Shell’s CEO Ben van Beurden says that the company's spare oil capacity is running "very, very low." Van Beurden told reporters, “I think it will be impossible to cover the entire pipeline gas capacity out of Russia with LNG. If we are not going to take significant measures, like for instance energy savings, maybe a certain degree of rationing, it will be problematic."