Welcome to Grid Brief! Here’s what we’re looking at today: the UK is in talks with Hitachi about a nuclear power plant site in Wales, India Coal sees record profits, and more.

UK, Hitachi Talk Welsh Nuclear

The UK government is in talks with Hitachi about purchasing a site in Wales for nuclear power plant construction in an attempt to breathe life into Great Britain’s nuclear power industry.

This isn’t the first time the UK government opened discussions with Hitachi about Wales.

“Hitachi walked away from plans to build a new nuclear reactor at the Welsh site in January 2019 after failing to secure a financial agreement with the British government,” reports Bloomberg. “The move ended up costing the company £2.1 billion ($2.7 billion), according to the newspaper.”

The conversation with Hitachi has been renewed because the UK rekindled its commitment to nuclear power, aiming to add 24 GW of nuclear capacity by 2050. But the UK is struggling to make headway on its goal. Last week, the EDF said that its nuclear project construction at Hinkley Point will go $13 billion and several years over budget again, putting its price-tag at $46 billion.

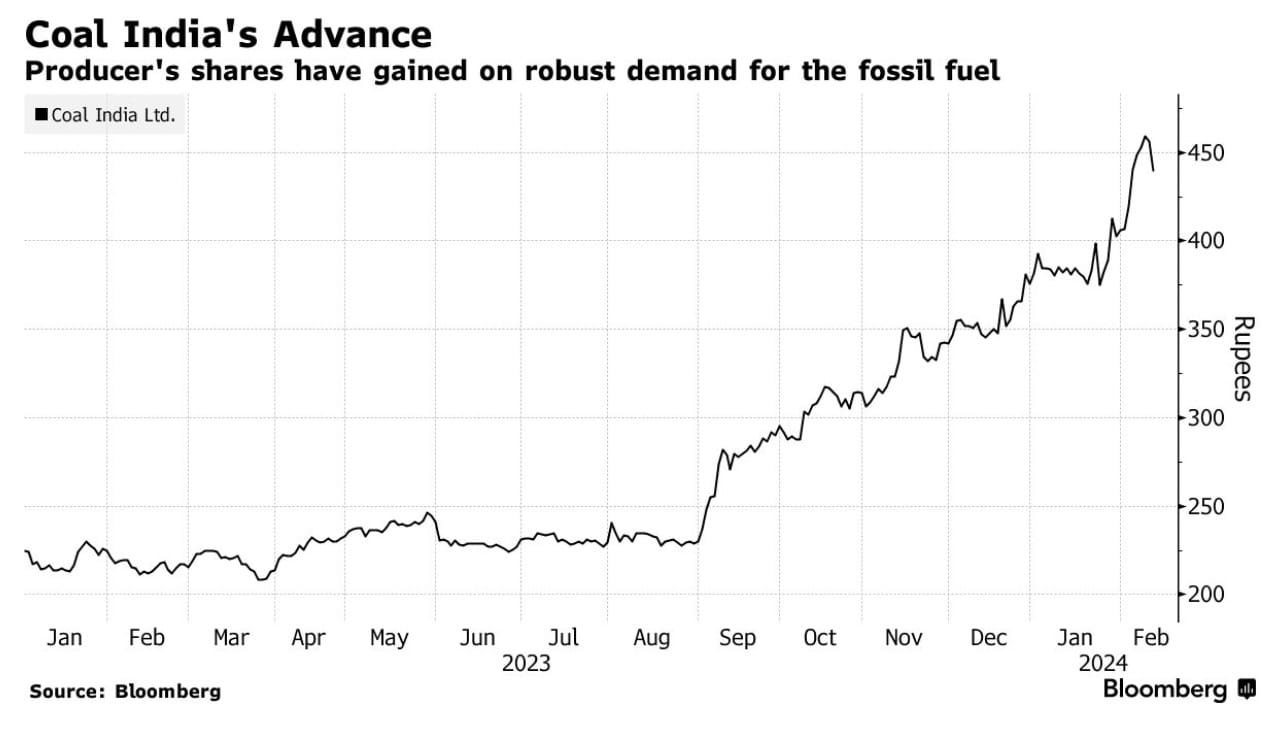

Coal India Makes Record Profits

Coal India shattered quarterly profit expectations; it has begun to stockpile for India’s brutal summer season, which has been known to strain the nation’s power supply and cause blackouts.

CI’s profits for Q4 2023 leapt 17% from last year’s final quarter to $1.1 billion.

“Coal India’s shares have more than doubled in the past year on bumper earnings, even as the producer increased spending to add mines and infrastructure,” reports Bloomberg. “Shipments during the quarter rose almost 9% from a year earlier, offsetting a 6% decline in average prices.”

Coal makes up for 70% of India’s power generation. The country plans to add nearly 90 GW of capacity to its grid by 2032, 30 GW of which will be coal.

Correction 2/13/24 (8:56 a.m. CST): This piece originally misstated India’s capacity goals and has been fixed.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Austria seeks end of Russian gas imports. “Faced with stubbornly high Russian gas imports as the war in Ukraine rages on, Austria is seeking to take more radical steps, including ending energy company OMV's long-term contract to buy gas from Gazprom, Austria's energy minister said on Monday,” reports Reuters. “Having long sought to maintain close ties with nearby Russia, Austria sought to end its decades-long dependency on affordable Russian gas soon after Russia invaded Ukraine in 2022, scrambling to find alternative providers.”

Tensions between Guyana and Venezuela heat up. “Venezuela has accused neighboring Guyana of issuing illegal exploration licenses to oil companies for the Essequibo region which is under dispute between the two countries,” reports Oilprice.com. “According to Caracas, Georgetown had been issuing ‘illegal oil concessions ... in a maritime area that is indisputably Venezuelan.’ At the end of last week, Caracas made news when it ordered troops to the border with Guyana, which sounded the alarm on the buildup. Venezuela did not deny it but said it had the right to shore up its borders in response to U.S. military exercises in Guyana toward the end of the year and the presence of a UK anti-narcotics vessel that is in Guyanese waters.”

Energy transitions halts Aramco. “The decision of Saudi Arabia to abandon plans to expand its crude oil production capacity is a result of the energy transition, Saudi Energy Minister, Prince Abdulaziz bin Salman, said on Monday. At the end of last month, Saudi Arabia surprised the oil market by announcing a shift in production capacity strategy,” reports Oilprice.com. “State oil giant Aramco said it was ordered by the Kingdom’s leadership to stop work on expanding its maximum sustainable capacity to 13 million barrels per day, instead keeping it at 12 million bpd. The world’s biggest oil firm said in a statement that it would update its capital spending plans for the year in March when it announces its 2023 financial results.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!