UK Opens New Coal Mine

Michael Grove, the British Secretary of State for Leveling Up, Housing, and Communities approved the first new coal mine int he UK in several decades.

"The proposed mine in Cumbria would dig up coking coal for steel production in the UK and across the world," reports BBC.

Some say this move undermines the UK's climate goals, others that it will keep Britain from importing coal and create jobs.

Grove's department released a letter explaining its decision. The BBC reports, "The secretary of state agrees with the assessment that the effects of the development on carbon emissions 'would be relatively neutral and not significant,' the letter says."

Grove's department said that its decision was in line with its vision for cutting carbon emissions.

MISO Tries to Mind the Gap

Last week, the Midcontinent Independent System Operator met to discuss the energy transition. Its members agreed that the energy transition is arriving faster than they expected, especially with the Inflation Reduction Act's renewable energy incentives in the mix.

"The grid operator is particularly concerned about reliably navigating the resource transition’s next five years in what it has termed 'mind the gap.' It foresees the potential for capacity deficits through 2027," reports RTO Insider.

Michelle Bloodworth, CEO of America’s Power, requested that MISO staff quicken their work laying groundwork for generation attributions during the transition. "They have already identified six reliability attributes as necessary: availability, the ability to deliver long-duration energy at a high output, rapid start-up times, providing voltage stability, ramp-up capability, and fuel assurance," reports RTO Insider.

But Bloodworth believes that plant retirements--mainly coal--are taking the scythe to those attributes and accredited capacity.

MISO's energy transition agita derives from problems inherent to deregulated electricity markets, which are now coming under scrutiny. Recently, groups have asked for the Senate to conduct an independent, first-of-its-kind cost analysis of Regional Transmission Organizations.

“It’s still [Federal Energy Regulatory Commission] policy to encourage RTO formation,” Travis Fisher, president and CEO of ELCON told Utility Dive. “And what FERC has said in its orders is basically that RTOs benefit consumers. And I don’t challenge that premise; I actually think they do. I just think it’s unfortunate that nobody has backed it up with data.”

Around 80% of America's renewables fleet lives in RTO areas. For a history of how and why America deregulated major portions of its electricity grid, you can read my piece on it for American Affairs.

Are America's Best Shales Days Behind It?

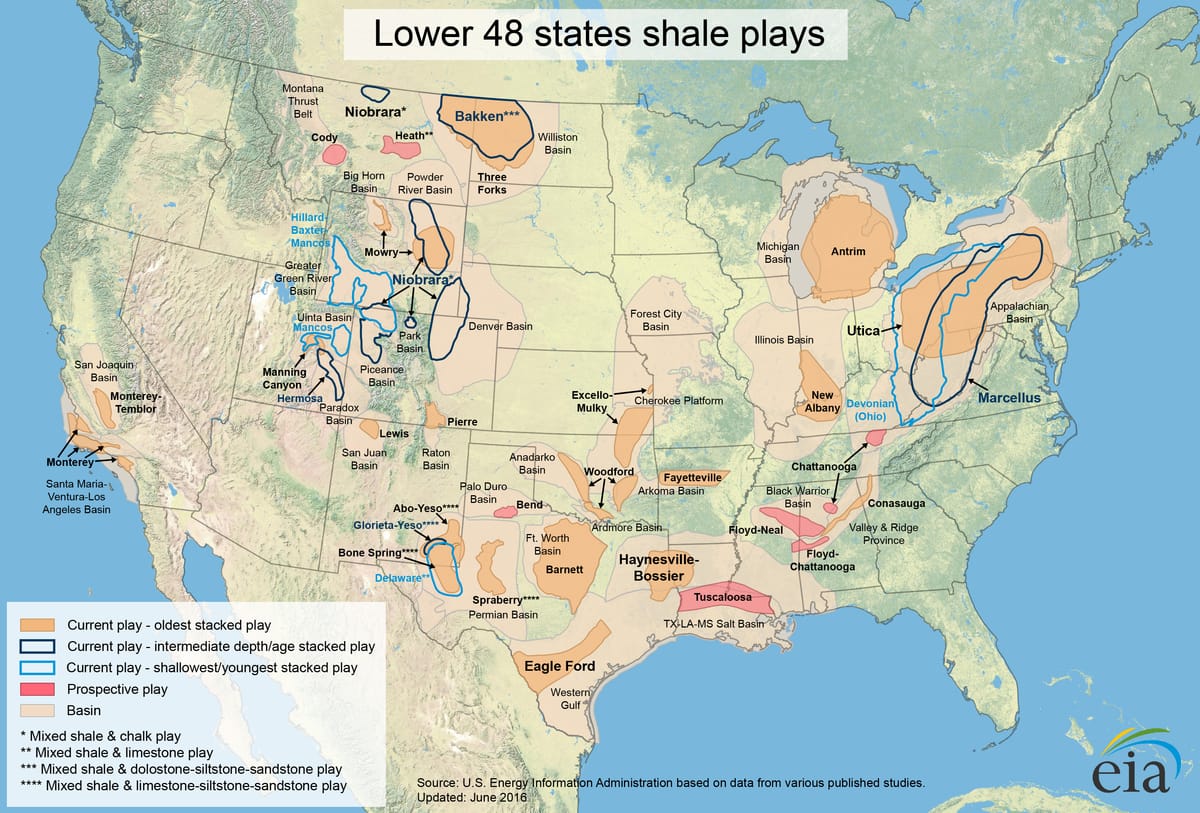

Oil wells in Texas are creeping closer and closer to city limits. This trend suggests that the once prolific Permian region is no spring chicken. And just yesterday, we covered that Bakken and Eagle Ford might be past their prime. This is no "peak oil" conspiracy theory, according to a new piece from Bloomberg. Shale's best days might be behind it.

"After years of honing their craft to boost output, producers in the Permian’s two main zones are pumping less oil per foot drilled in each new well, not more," reports Bloomberg. "Output guidance from Exxon Mobil Corp., Chevron Corp. and Devon Energy Corp. has shown that US shale growth is coming in at the low end of expectations. Analysts say the Permian could reach a production plateau within five years."

The consequences of American shale's ebb are global--it provided 90% of output growth in the last decade. During the boom, from 2012 to 2020, American shale outperformed Iran and Iraq. After production and prices fell from the Covid cliff, America's output is still 1 million barrels per day below 2020's 13 million bpd. Politics, supply chain problems, labor costs, and undervaluation aside, the rock surrenders less oil than it used to.

"Wells drilled this year produced between 8% and 13% less oil per lateral foot than a year earlier, according to BloombergNEF, the first major reversal after a decade of productivity gains," reports Bloomberg. "Pioneer Natural Resources Co., one of the biggest Permian operators, recently overhauled its drilling plan after executives were “not satisfied” with its well performance this year. Laredo Petroleum Inc. said some of its production was hurt by interference from other wells nearby."

Waning output makes a cozy world for OPEC as it reclaims the roost for itself. “The Saudis and OPEC have waited this out,” John Hess, CEO at Hess Corp., which drills in the Bakken, told Bloomberg. “Now, really OPEC is back in the driver seat.”

Like what you're reading? click the button below to get Grid Brief right in your inbox!

Conversation Starters

Zelensky has asked for aid to repair Ukraine's energy infrastructure. "Ukrainian and Russian forces fought pitched battles in the east as Moscow continued its offensive in several directions while President Volodymyr Zelenskiy pleaded with allies for more aid to help repair Ukraine's power infrastructure, which has been badly damaged by multiple waves of missile strikes," Oilprice.com reports. "The United Nations, meanwhile, said that at least 6,755 civilians have been killed and more than 10,600 were injured since the start of Russia's unprovoked invasion of Ukraine in February."

China has issued its first LNG tender since Russia invaded Ukraine. "State-owned China National Offshore Oil Corporation has issued a limited participation tender to buy LNG cargoes, meant for delivery over February-December 2023, company sources told S&P Global Commodity Insights," reports S&P Global. "CNOOC is the largest LNG importer in China. This is the first LNG buy tender from China since Russia invaded Ukraine, and is an important landmark as it indicates a revival of buying interest from China after demand stayed subdued for most of 2022, reflecting heightened pandemic-related curbs. However, the cargoes sought could also be resold overseas, contingent on local demand."

A South Korean nuclear power plant came back online after five years of maintenance. "Korea Hydro and Nuclear Power (KHNP) confirmed that Hanbit unit 4 resumed power generation at 3:40 am on 11 December, ending an outage that began in May 2017," reports World Nuclear News. "The unit was taken offline for a 'planned preventive maintenance; outage but remained offline after the discovery of 'voids' in its containment building. Those voids have been repaired, KHNP said. The five-year maintenance outage has also included maintenance of 'major devices and facilities' including replacement of steam generators, it added."

Crom's Blessing