UK to Sign LNG Deal With US

According to government sources, UK Prime Minister Rishi Sunak will sign a major LNG supply deal with the US.

Sunak is "set to announce the agreement with the U.S. after the COP27 climate summit in Egypt, which ends on November 18," reports Oilprice.com. "The two countries are in the final stages of a discussion on an "energy security partnership."

No hard numbers for LNG shipments or volumes provided to the UK energy system over the next year have been offered. The announcement comes as the UK's National Grid has announced that cold days this winter could see rolling blackouts during peak hours (4-7pm) if Europe doesn't have sufficient gas supplies for export.

Context: American Coal Mining

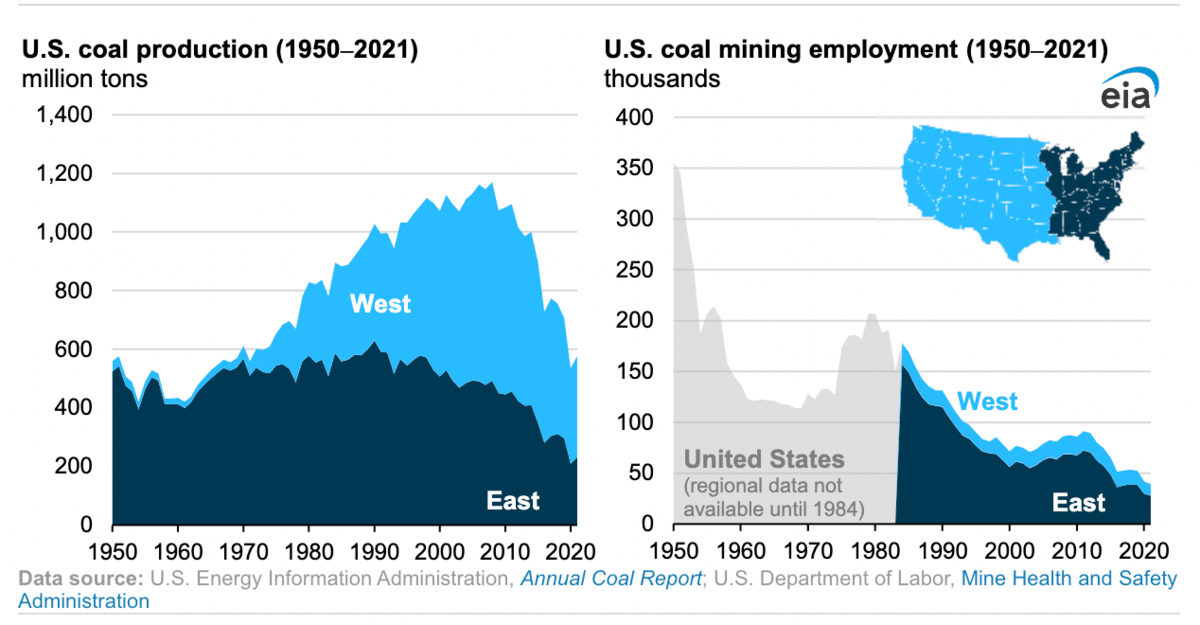

Last year, 60% of American coal was produced in the western part of the country. But just under a third of the coal mining industry works in that region. What accounts for this discrepancy?

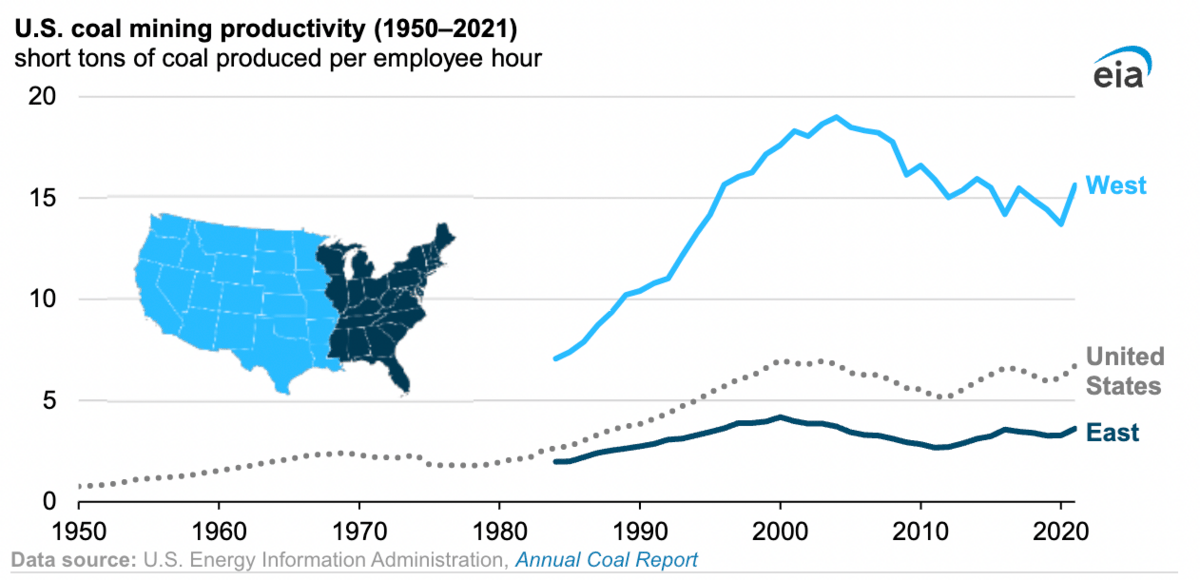

According to the Energy Information Administration, the difference between eastern and western coal mining is due to technology: coal mines in the American West are surface mines, which allows them to use larger equipment that reduces the number of workers.

"In 2021, on average, every coal worker in the West produced 16 tons of coal per hour. In the East, the average worker produced 4 tons of coal per hour," reports the EIA. "Mining productivity, or the amount of coal produced per employee hour, is greater in the West because most western coal mines are large, open-pit operations that tap thick coal seams that are close to the surface. This setup allows western mines to use super-sized draglines, shovels, and trucks, which allows them to extract more coal with fewer workers."

The EIA separates East and West by the Mississippi River. Before the 1970s, most of America's coal came from the East. Mining shifted westward for three reasons: emissions regulations, the debut of large-scale surface mines in Wyoming's Powder River Basin, and lower freight shipping costs.

The Clean Air Act of 1970 (along with its amendments in 1977 and 1990) sought to restrict emissions from coal power plants by limiting them to burning low-sulfur coal, which is found mostly in the West. This encouraged more production in the Powder River Basin.

Then a new business environment bloomed after railroads underwent deregulation. The new regulatory framework "encouraged railroads to innovate, introducing dedicated unit trains (long trains that usually carry a single commodity directly to its destination)," reports the EIA. "These unit trains allow coal from western mines to be shipped economically to power plants across the country. Previously, western coal could be mined more cheaply than eastern coal, but it had farther to travel to get to buyers and so the shipping cost made it less competitive."

But coal production has been falling since its peak in 2008. America has been rapidly shifting towards natural gas for electricity production since the turn of the century. "In 2021, 577.4 million tons of coal were produced in the country, less than half the amount produced in 2008," the EIA reports.

Unsurprisingly, the coal mining industry has been shedding employment--mostly in the East. Since 2008, eastern coal mining employment has dropped 59% since 2008 (from nearly 70k employees to just under 30k in 2021). The West, meanwhile, has seen a 39% drop since 2008 (from about 18k employees to about 11k workers in 2021).

The Real Cost of European Security

Europe has enough oil and gas to survive the winter--though bills will still be high. But focusing on Europe hides the true cost of its energy security: the developing world.

"Much deeper costs will be borne by the world’s poorest countries, which have been shut out of the natural gas market by Europe’s suddenly ravenous demand," reports Bloomberg. "It’s left emerging market countries unable to meet today’s needs or tomorrow’s, and the most likely consequences — factory shutdowns, more frequent and longer-lasting power shortages, the foment of social unrest — could stretch into the next decade."

Though cooler weather has swept over Pakistan, India, Bangladesh, and the Philippines, that's no guarantee of true relief. South Asia knows cold winters as well as Northern Europe. The likelihood of locking down long-term supplies has shrunk to a sliver. "The strong US dollar has only complicated the situation, forcing nations to choose between buying fuel and making debt payments. Under the circumstances, global fuel suppliers are increasingly wary of selling to countries that could be heading for default," reports Bloomberg.

“Energy security concerns in Europe are driving energy poverty in the emerging world,” Saul Kavonic, an energy analyst at Credit Suisse Group AG told Bloomberg. “Europe is sucking gas away from other countries whatever the cost.”

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Massachusetts has rejected Commonwealth Wind Project's plea to renegotiate their power purchase agreement, without which the developer says the project will fail. "In Friday's order, the Massachusetts Department of Public Utilities rejected pleas by Commonwealth Wind and Mayflower Wind projects to delay its review of power purchase agreements (PPAs) that the wind farms had reached with three of the state's utilities," reports S&P Global. "The decision came in response to requests in October by Commonwealth Wind developer Avangrid and Mayflower Wind, a joint venture between Shell New Energies and Ocean Winds North America, for a one-month delay in the proceedings to allow for renegotiation of their contracts with Eversource, National Grid and Unitil. Both project developers had said rising cost pressures had imperiled the PPAs' economics, and that the delay would help them find financial assistance in the recently passed Inflation Reduction Act."

Norway is doubling down on the green energy transition. "Norwegian energy giant Equinor is on track to almost double the share of its investment in renewable energy this year, despite walking away from expensive offshore wind deals," reports Reuters. "Around 20% of company's gross investments in 2022 will be in renewable energy, CEO Anders Opedal told Reuters on the sidelines of the U.N. climate summit COP27 in Egypt."

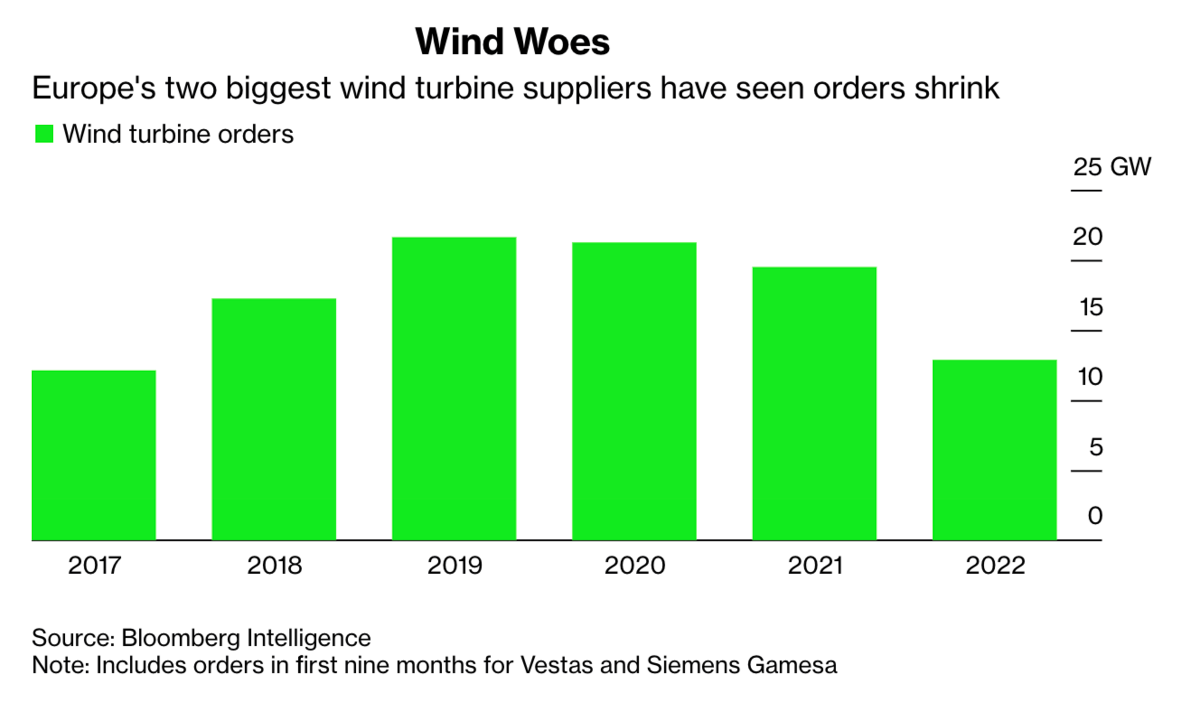

Wind energy has taken a beating this year. And according to the head of Vestas, one of the world's largest wind turbine suppliers, renewables advocates shouldn't have sold the world on renewables being cheap forever. “It made some people make the wrong assumption that energy and electricity should become free,” Vestas CEO Henrik Andersen said. “We created the perception to some extent. So we are to blame for it. That was a mistake.”

Crom's Blessing