Welcome to Grid Brief! Here’s what we’re looking at today: UK nuclear investors have to clear new security hurdles, MISO sees project delays despite interconnection approvals, oil and diesel prices climb, and more.

UK’s Sizewell C Investors Face Security Scrutiny

The UK plans to build a new 3.2 GW nuclear power plant, Sizewell C. But the UK government is creating new security criteria for the plant’s investors.

“Ministers will be looking for private investors who can add value to the project and will only accept private investment if it provides value for money, while bolstering energy security,” the government said in a statement.

Last year, the UK government bought out a Chinese company's share in the project due to security concerns.

“The UK has set a target of building 24 gigawatts of nuclear capacity by 2050, a huge ambition that has been met with skepticism,” reports Bloomberg. “The two reactors at Hinkley Point C, costing as much as £32 billion ($40 billion) combined, are due to start operating in 2027 and 2028. Sizewell C is likely to need similar spending, although EDF says it can cut costs by repeating some construction processes.”

Companies interested in investing in Sizewell C have until October 9th to prove their bona fides.

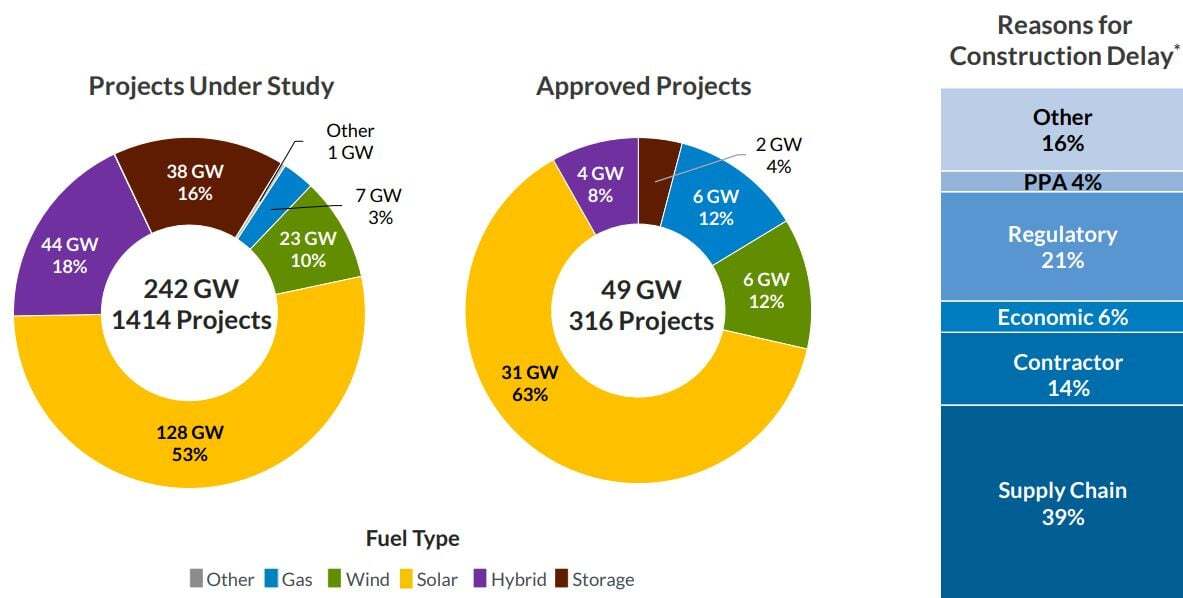

MISO Sees Project Delays Despite Approvals

The Mid-continent Independent System Operator is witnessing 49 GW of delayed projects with interconnection approval.

“Projects that have completed the interconnection process and are awaiting construction as of July include 31 GW of solar, 6 GW of gas, 6 GW of wind, 4 GW of generation combined with storage and 2 GW of stand-alone storage,” reports Utility Dive.

Supply chain and permitting problems are stalling the projects. These bottlenecks come as MISO faces a 2.1 GW capacity shortfall starting in 2025/2026.

MISO’s neighbor, PJM, is in the same boat. PJM has 44 GW of approved-but-stalled projects. PJM also expects capacity shortfalls in the coming years.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Chevron CEO Sees $100 Oil Possible

When asked if the world will see oil at $100 per barrel, Chevron CEO Mike Wirth said, “We’re certainly on our way. We’re getting close.”

Wirth added: “We’re going to see record oil demand, all-time record demand.”

The CEO’s statements come as OPEC+ has cut its output and countries are drawing from inventories. Brent hovers near $95 per barrel—a ten month high.

But the real eyeopener is diesel. “US [diesel] prices jumped above $140 to the highest ever for this time of year on Thursday,” reports Bloomberg. “Europe’s equivalent soared 60% since summer.”

Conversation Starters

China triples its diesel exports. “China's diesel exports in August surged from a year earlier and have nearly tripled so far in 2023 compared to the same time a year ago, data showed on Monday, as refiners take advantage of strong regional refining margins to ship fuel overseas,” reports Reuters. “Exports of diesel, the biggest fuel by share of refinery output, last month totalled 1.26 million metric tons, up 51.5% from last year's 830,000 tons, data from the General Administration of Customs showed. Total diesel exports for the first eight months of the year are up 197.2% versus the same period in 2022.”

US considers putting military personnel on tankers. “Washington is taking steps to expand the U.S.-flagged commercial tanker fleet, which transports oil for the U.S. military and could start placing Navy and Marine personnel on tankers traversing the Strait of Hormuz,” reports Reuters. “For 2023, Washington’s goal is to charter 10 vessels for up to $6 million per year each, while nine vessels have so far been added to the roster, with agreements running up to 2035. Next year, the Department of Defense plans to add an additional 10 vessels to the program. The expansion of the U.S.-flagged tanker fleet comes a month after the deployment of Navy and Marine forces in the Middle East to support efforts to secure the Strait of Hormuz in the wake of hijackings by Iran.”

Chevron’s Australian LNG plant returns to full production. “Chevron’s Wheatstone LNG export facility in Australia has returned to full production after a fault at the plant cut output by around 25% last week, the U.S. supermajor said on Monday as strikes at its two Australian facilities escalate amid labor disagreements,” reports Oilprice.com. “Last Thursday, LNG production at Wheatstone was reduced by 25% after a fault, the day on which trade unions escalated their strikes at the plant and the other Chevron LNG facility, Gorgon. The fault at the Australian plant coincided with the escalation of the strikes at the Chevron facilities which collectively account for 5% of global LNG supply.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.