US Heating Oil Prices Already High

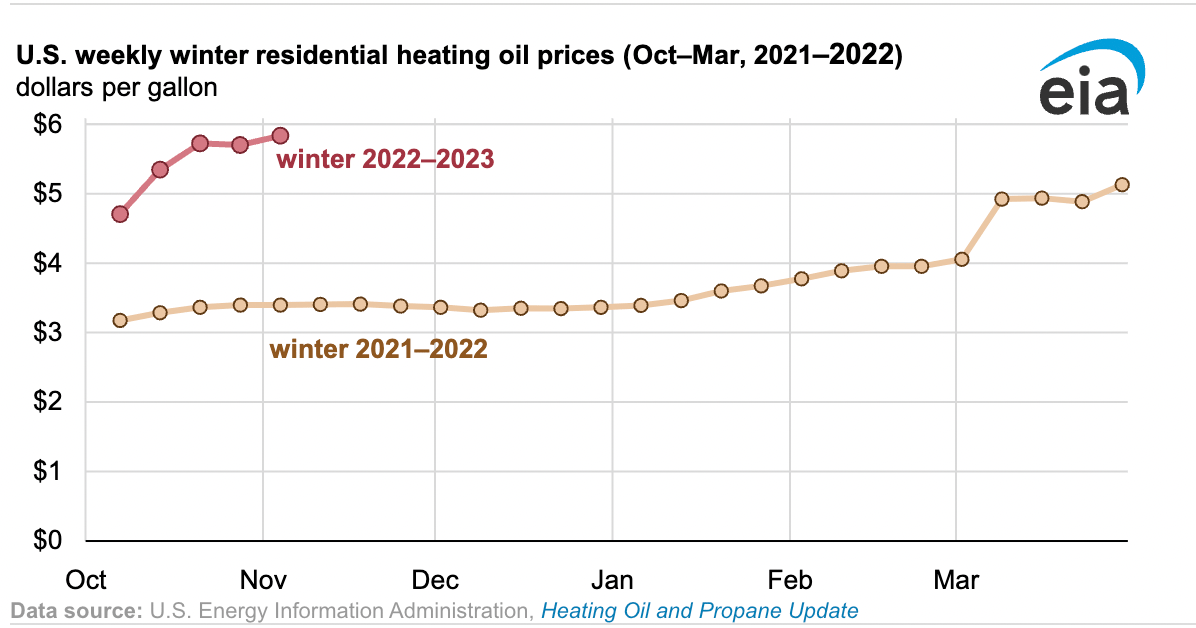

Heating oil prices in October of this year are already 65% higher than they were last year. October is the first month of what the Energy Information Administration calls the "winter heating period." It lasts until March.

Residential heating oil prices continued to rise to an annual high of $5.90 per gallon on November 7 due to tight inventories, low imports, and limited production capacity. Prices then fell to $5.79/gal a week later.

"[A]s of November 11, Northeast distillate fuel inventories totaled 15.2 million barrels, 44% less than for the same week last year. From January through August 2022, East Coast distillate imports were 38% lower compared with the same period in 2021," reports the EIA.

Even though refineries on the East Coast have been running close to full capacity, the region's refining capacity has dropped over the last several years. The largest refinery on the East Coast, owned Philadelphia Energy Solutions, shut down in 2019 due to a fire.

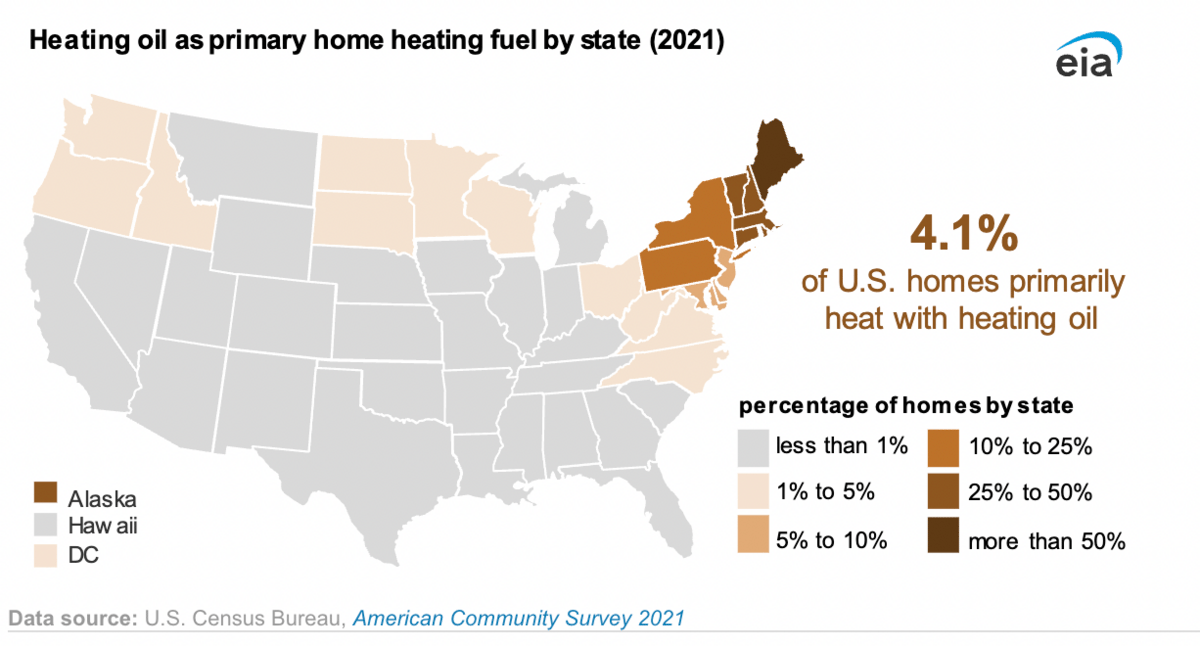

All of this will make things harder on New England where 33% of households use heating oil as their primary heating fuel. The EIA expects these households to pay 45% more on average for heating compared to last winter "because of higher retail heating oil prices and higher expected consumption."

US Sanctions Companies Selling Iranian Oil

Yesterday, the Treasury Department announced that it has sanctioned 13 companies that have sold Iranian petroleum to East Asian customers. This is the fifth round of sanctions targeting Iran's petrochemical industry since June.

"The 13 companies facilitated the sale of Iranian crude oil on behalf of sanctioned PGPICC, Trilance, NIOC, and NICO," reports Oilprice.com. "PGPIC was sanctioned in 2019 for providing financial support to Khatam al-Anbiya Construction Headquarters—the engineering arm of Iran’s Islamic Revolutionary Guard Corps. Trilance was sanctioned back in 2018 for materially assisting, sponsoring, or providing support for goods or services in support of NIOC."

These new sanctions target several companies based in Hong Kong, China, and the United Arab Emirates. "Under the new sanctions, all property and interests in property of these entities that are in the United States or under the control of U.S. persons will be blocked," reports Oilprice.com.

“Today’s action further demonstrates the complex sanctions evasion methods Iran employs to illicitly sell petroleum and petrochemical products,” the Under Secretary of the Treasury for Terrorism and Financial Intelligence, Brian Nelson, said. America will “continue to implement sanctions against those actors facilitating these sales," he added.

Iran is a large member of OPEC+. Its oil output has been restricted due to Western Sanctions.

Solar Farms Sued for Environmental Violations

The Environmental Protection Agency and the Department of Justice have moved to resolve alleged violations of the Clean Water Act with four different large-scale solar farms. All four solar farm owners used the same construction contractor, who leveled the land without providing adequate provisions to handle stormwater run-off. The run-off can increase the sediment in other waterways.

“Increased sediment in waterways can injure, suffocate, or kill aquatic life; damage aquatic ecosystems; and cause significant harm to drinking water treatment systems. To avoid these harms to the environment and public health, parties responsible for construction of solar farms are required to get construction stormwater permits under the Clean Water Act and comply with the terms of those permits,” the agencies said.

The fines for the four solar farms--located in Illinois, Alabama, and Idaho--total $1.34 million. This action from the DOJ and EPA results from increasing community backlash against the environmental footprint of utility-scale renewables installations.

“The development of solar energy is a key component of this Administration’s efforts to combat climate change,” Acting Assistant Administrator Larry Starfield of the EPA’s Office of Enforcement and Compliance Assurance told Power Magazine. “These settlements send an important message to the site owners of solar farm projects that these facilities must be planned and built in compliance with all environmental laws, including those that prevent the discharge of sediment into local waters during construction.”

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Two sites have been added to Rolls Royce SMR's factory shortlist. "In July the company announced six potential locations for the factory, saying the shortlist was selected against a clear set of criteria, picked from more than 100 submissions from local enterprise partnerships and development agencies," reports World Nuclear News. "They were: Sunderland in Tyne and Wear, Richmond in North Yorkshire, Deeside in Wales, Ferrybridge in Yorkshire, Stallingborough in Lincolnshire and Carlisle in Cumbria. Two more locations - Shotton, Deeside, in North Wales and Teesworks, Redcar, in north east England - have now been added after the sites met the shortlist criteria for the first of three expected factories in the UK, which will produce the vessels for the 470 MWe pressurised water reactor."

The White House has asked congress for $500 million to modernize the Strategic Petroleum Reserve. "The emergency crude stockpile played a key role in President Joe Biden's efforts to mitigate global supply disruptions caused by Russia's invasion of Ukraine and help lower fuel costs. The Department of Energy earlier in the month completed the largest-ever drawdown from the SPR, satisfying Biden's historic commitment to release 180 million barrels, or roughly 1 million b/d beginning in April," reports S&P Global.

Oil tumbled over fears of rate hikes. "Oil prices fell more than 3% on Thursday, with demand squeezed by mounting COVID-19 cases in China and fears of more aggressive hikes in U.S. interest rates. Brent crude fell $3.08 to settle at $89.78 a barrel, down 3.3%. U.S. West Texas Intermediate (WTI) crude slid $3.95, or 4.6%, to settle at $81.64 per barrel," reports Reuters. "It's kind of a triple whammy. We've got COVID-19 cases rising in China, interest rates are continuing to rise here in the U.S. and now we've got technical weakness in the market," Dennis Kissler, senior vice president of trading at BOK Financial told Reuters.

Crom's Blessing