US Nat Gas Generation Declined in 2021

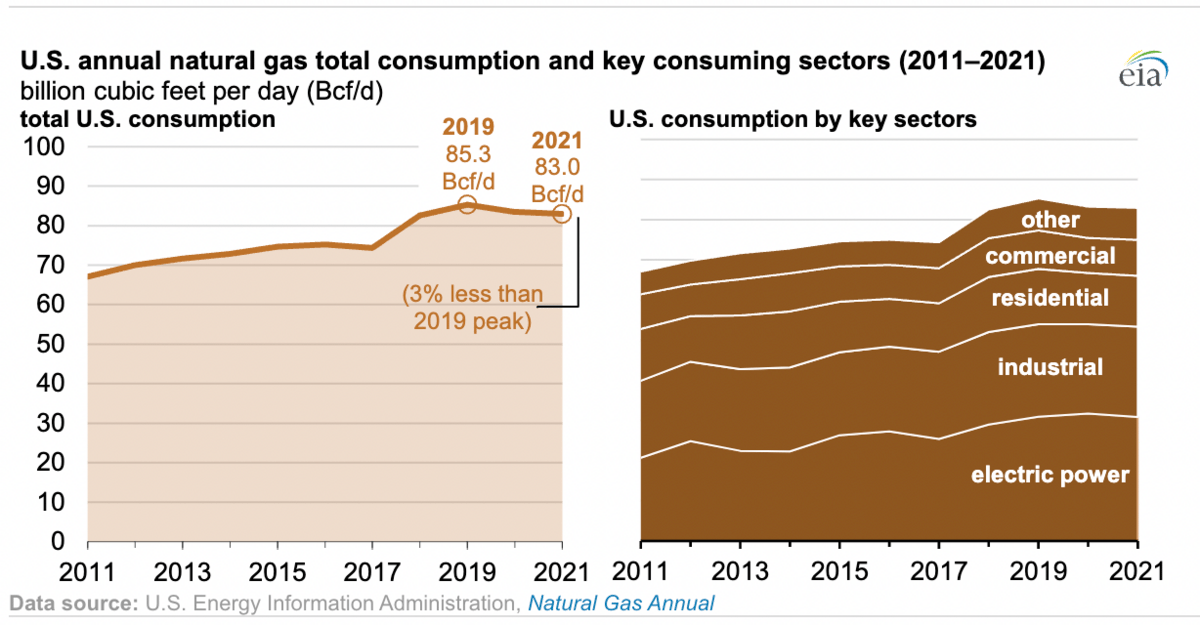

Gas consumption in all sectors "was effectively flat between 2020 and 2021, down by only 0.5 billion cubic feet per day (Bcf/d). U.S. natural gas consumption reached a record 85.3 Bcf/d in 2019 and has declined annually since then," reports the Energy Information Administration.

Gas consumption fell during the COVID lockdowns. "The decline in natural gas used in the electric power sector, the largest U.S. natural gas-consuming sector, drove the total decline, falling by 3% in 2021 and reversing four years of annual growth in the sector," the EIA reports.

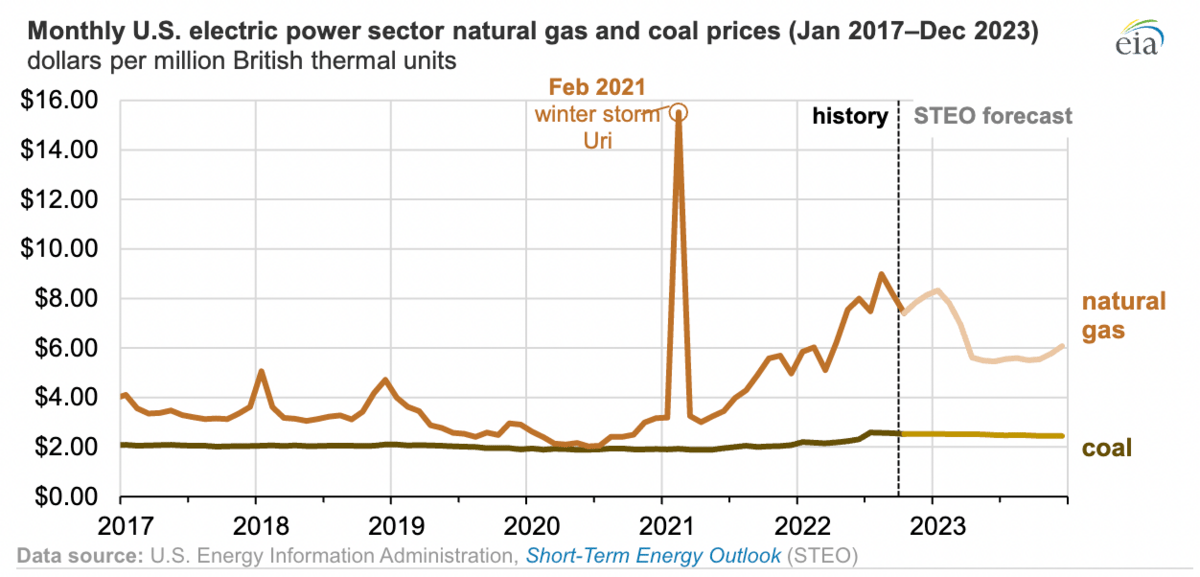

In 2021, high natural gas prices made it less competitive when compared to coal, the price of which held stable for electricity generators throughout the year. "The wholesale spot price for natural gas at the Henry Hub benchmark in Louisiana nearly doubled from 2020 to 2021, rising to average $3.89 per million British thermal units," the EIA reports.

American natural gas prices rose throughout 2021 for a variety of reasons: low inventories, tight supply and demand balances, consumption limitations due to weather, and production outages. Higher prices abroad also encouraged exports. America exported 30% more natural gas in 2021 compared to 2020.

Yet the EIA expects natural gas generation and consumption to increase.

"Natural gas-fired generation capacity has continued to increase with the ongoing retirement of coal-fired generation capacity," the administration reports. "Despite relatively high natural gas prices, natural gas accounted for 37% of all power generation in 2021, nearly equal to the combined shares of coal and nuclear (the next two largest sources). Historically low coal inventories at power plants limited coal-fired electricity generation in summer and early fall, which, in turn, could have also pushed natural gas prices higher."

And that's why the EIA expects to find a 5% increase in natural gas consumption and generation when it looks back on 2022.

Biden Threatens Windfall Tax

President Joe Biden saber rattled about a windfall tax for big oil yesterday.

Oil companies have been posting record profits ever since Europe decided to sanction Russian energy. Biden equated their windfall to "wartime profiteering" and said that the the profits weren't "earned" as when a company performs better due to innovation.

A White House official told the Associated Press, “The president will again call on oil and gas companies to invest their record profits in lowering costs for American families and increasing production. And if they don’t, he will call on Congress to consider requiring oil companies to pay tax penalties and face other restrictions."

"Major oil companies enjoyed soaring profits for Q3 2022, with Exxon reporting record-setting earnings on Friday at $19.7 billion, beating analysts' estimates by some $4 billion. Shell came in $9.5 billion–its second-highest earnings to date, and Chevron also saw its second-highest earnings at $11.2 billion, double what it brought in for the same quarter of 2021," reports Oilprice.com.

It's unclear how removing the incentive of profits while threatening to "end" the fossil fuel industry is supposed to encourage investment.

Constellation Seeks Nuclear Life-Extensions

On Halloween, America's largest producer of clean energy, Constellation, said that it will ask the Nuclear Regulatory Commission for 20-year life extensions on two of its nuclear power plant in Illinois: Clinton and Byron.

"The extension means the two plants will contribute billions of additional dollars to Illinois’ economy and continue providing enough carbon-free energy to power the equivalent of more than 2 million homes, helping the state meet its goal to get 100 percent of its energy from clean sources by 2050," the company said in a press release. "If approved by the NRC, Clinton could operate until 2047 and Dresden could operate until 2049 (Unit 2) and 2051 (Unit 3)."

Dresden Generating Station, which sits in Morris, IL, produces about 1800 MW of electricity. Units 2 and 3 are General Electric boiling water reactors built in the 1970s. Unit 1 was retired. Clinton, named after its hometown, has a single GE reactor of the same kind. It switched on in 1987 and produces about 1080 MW.

Nuclear reactors are proving to be some of the most durable and reliable sources of energy. "There's a lot of nonsense tossed out around 'Levelized Cost of Energy,' but it's nearly indisputable that lifetime extensions of existing nuclear facilities is the most outstanding value in all of energy," Mark Nelson, President of the Radiant Energy Fund, told Grid Brief in a message. "Unlike lots of other things, nuclear power plants with proper maintenance get more reliable as they age, not less reliable."

Constellation's decision marks a quick about-face for the industry, which was moving towards and early retirement of Clinton, Dresden, and three other nuclear plants in Illinois. In July 2021, Illinois passed a bill to retain the state's nuclear fleet as part of its net zero emissions goal for 2050.

"Dresden was saved by a single vote after 13 months of uncertainty. Now, it's powering our state through a generational energy crisis while saving ratepayers money each month," Madison Hilly, founder of the Campaign for a Green Nuclear Deal, told Grid Brief. "With a 20-year life extension, Illinois will continue benefiting from reliable, affordable electricity well into the century. Thank God we didn't give up our key competitive advantage in a carbon-constrained future when conditions were good and we took nuclear for granted."

Plus, the federal government passed its Inflation Reduction Act which included a production tax credit for continued nuclear plant operation for the next ten years.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Europe will need to rely on US oil to make up for what they'll lose from Russia, according to Eni's CEO Claudio Descalzi. "The European Union is set to ban seaborne imports of Russian crude from Dec. 5 and refined products in February, as it seeks to punish Moscow for the invasion of Ukraine. Flows to the bloc will probably decrease by 2 million barrels a day," Descalzi told Bloomberg. “That will be a big hit,” he said. “Anything that we can recover is going to be coming from the US.”

Westinghouse isn't the only game in town. Poland just signed a deal with Korea for another nuclear reactor. "Korea Hydro & Nuclear Power Co., a state-run nuclear plant operator, signed a letter of intent with Polish utilities PGE SA and ZE PAK SA on Monday, South Korea’s energy ministry said in a statement. The consortium will build several APR-1400 reactors near ZE PAK’s coal plants in Patnow," reports Bloomberg.

OPEC+ has increased its demand outlook for the near- and medium-term. "OPEC said in the report that global oil demand will increase to 103 million barrels per day next year—an increase of 2.7 million bpd from 2022 and an increase of 1.4 million bpd from what the group predicted for 2023 last year," reports Oilprice.com. "OPEC raised its oil demand outlook for the medium term as well, through 2027, increasing the outlook by 2 million bpd by the end of that period, compared to what the group forecasted last year."

Crom's Blessing