Welcome to Grid Brief! Today we’re looking at power generation in America’s power markets with some relevant news bites.

What’s Keeping the Lights On?

Here’s a look at nation-wide generation before we get going.

As we saw on Monday, natural gas, nuclear, and coal were the major players.

And here’s a map to orient yourself as we move through the power markets.

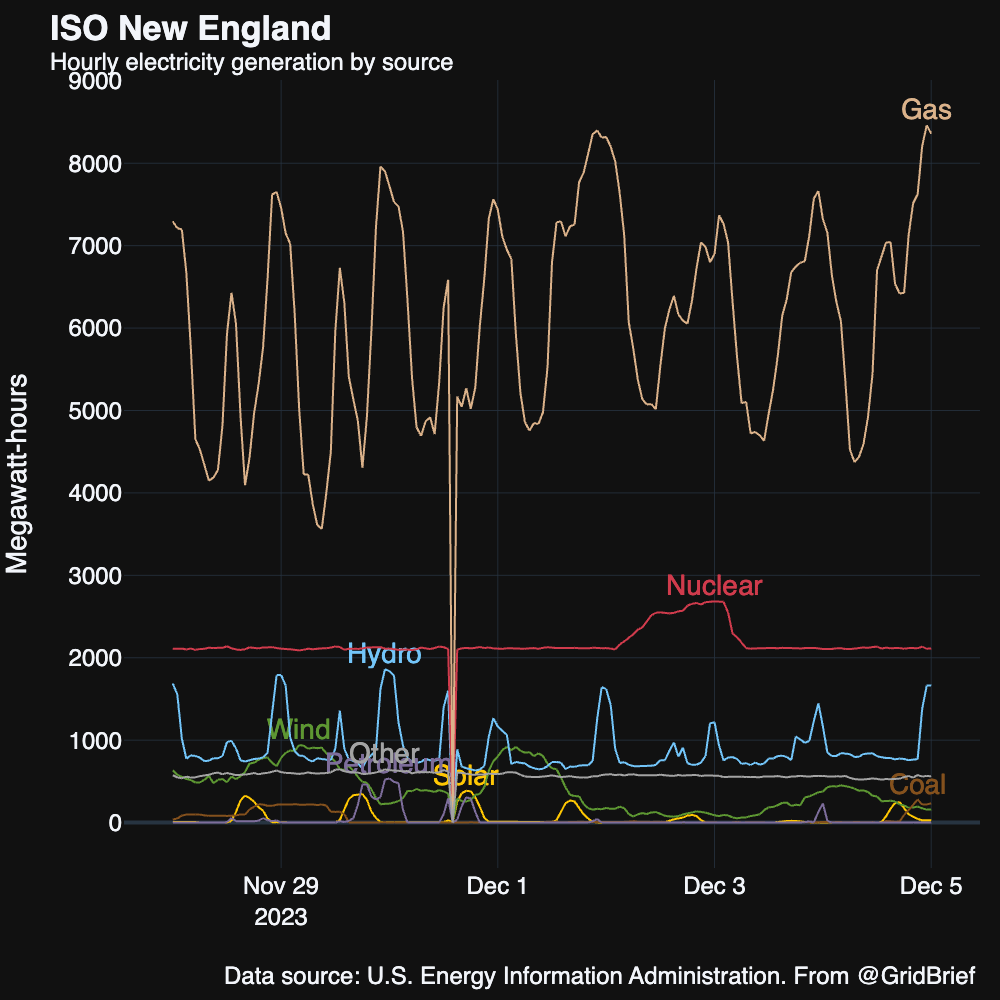

ISO-New England

New England saw a typical week: natural gas, nuclear, and hydro. It looks like there was a data glitch on Nov. 30.

Recently, ISO-New England has successfully moved utility scale solar markets into the wholesale market and slated it as a dispatchable resource. “Also, although [solar power generators] are paid the prevailing market rate when they inject electricity into the grid, non-dispatchable resources don’t submit priced offers to produce electricity in New England’s energy markets,” the grid operator explained in a press release. “As a result, their true costs aren’t reflected in wholesale electricity prices, even when they represent the cheapest source of electricity available to the grid.”

PJM

Natural gas, nuclear, and coal were the standouts in America’s largest power market. Notice that coal and gas ramp when wind lulls.

The Organization of PJM States (OPSI) is urging PJM to move from a “reactive” planning model to a “proactive” one. OPSI’s letter comes before PJM decides on a $5 billion transmission infrastructure package on December 11th.

“The size and scope of those projects merely amplifies the concerns many OPSI members have had for years about the negative impact of siloed, reactive planning,” reads OPSI’s letter to PJM. “These concerns range from transmission projects designated as ‘Immediate Need,’ even though many of them have remained uncompleted past their required in-service dates, to multi-year Reliability Must Run (‘RMR’) agreements that can cost customers hundreds of millions of dollars per year, all while the region waits for even costlier transmission upgrades. What’s more, the costs of these RMR agreements are not factored in selecting the most overall cost-effective reliability solutions.”

ERCOT

A raucous week in Texas: natural gas and wind switched off as the top generator several times.

Batteries are booming in the Lone Star state. But the Texas PUC recently postponed a vote on battery rules for the Texas power market, citing concerns that the new rules would be “discriminatory” and gum up the development of more battery resources. Some complained that ERCOT was trying to shoehorn batteries into rules more applicable to traditional power plants, according to a piece carried in Utility Dive.

MISO

Natural gas, coal, wind, and nuclear were the major power sources in the Midcontinent Independent System Operator.

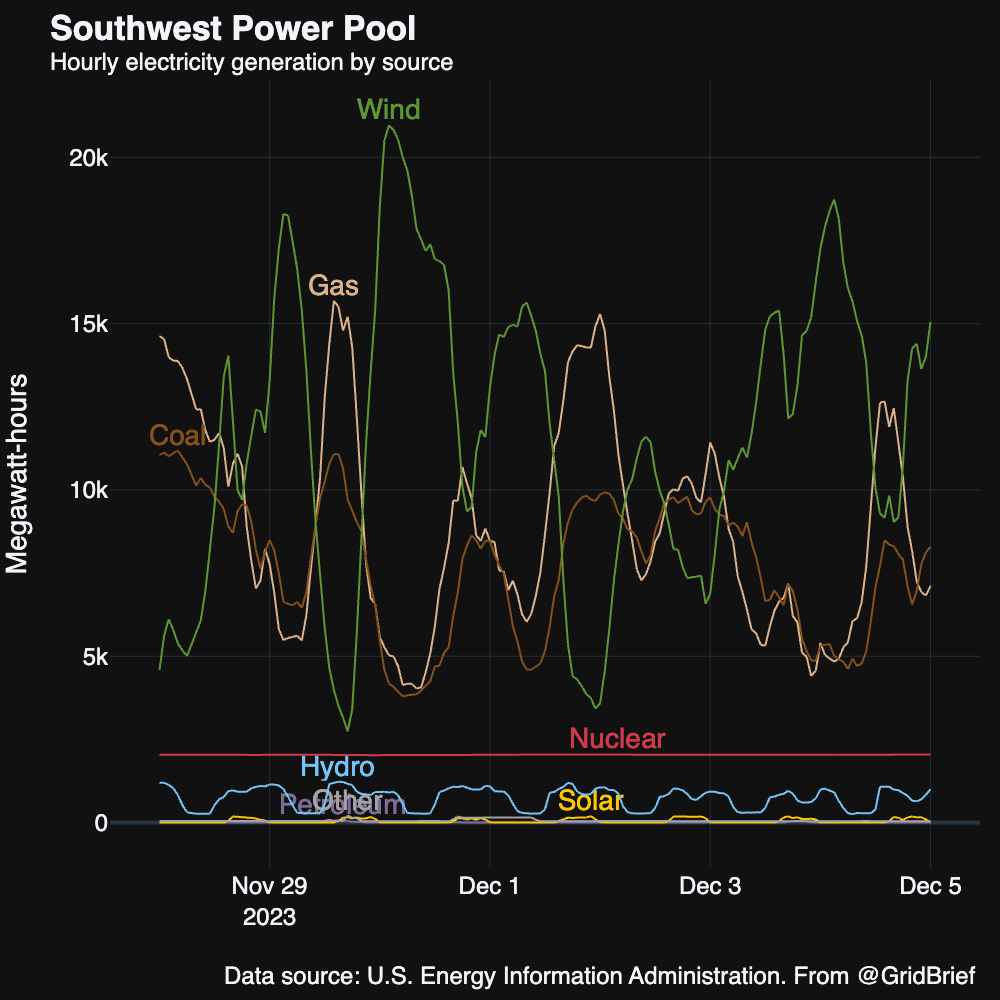

Southwest Power Pool

A volatile week in the Southwest. Natural gas, wind, and coal frequently swapped places in the top three with each other.

FERC recently rejected SPP’s winter resource adequacy proposal because it didn’t require wintertime “load responsible entities” to be available when necessary.

New York-ISO

Natural gas, hydro, and nuclear kept the lights on in the Empire State. Wind had a somewhat productive week as well.

Speaking of wind, New York opened its fourth offshore wind solicitation. “Developers Ørsted and Eversource are “working toward” the goal of having their 130-MW South Fork Wind farm start to generate power in December and deliver power to New York by early 2024, said Karl-Erik Stromsta, a communications advisor at Ørsted,” reports Utility Dive.

Bids are due on Jan. 25.

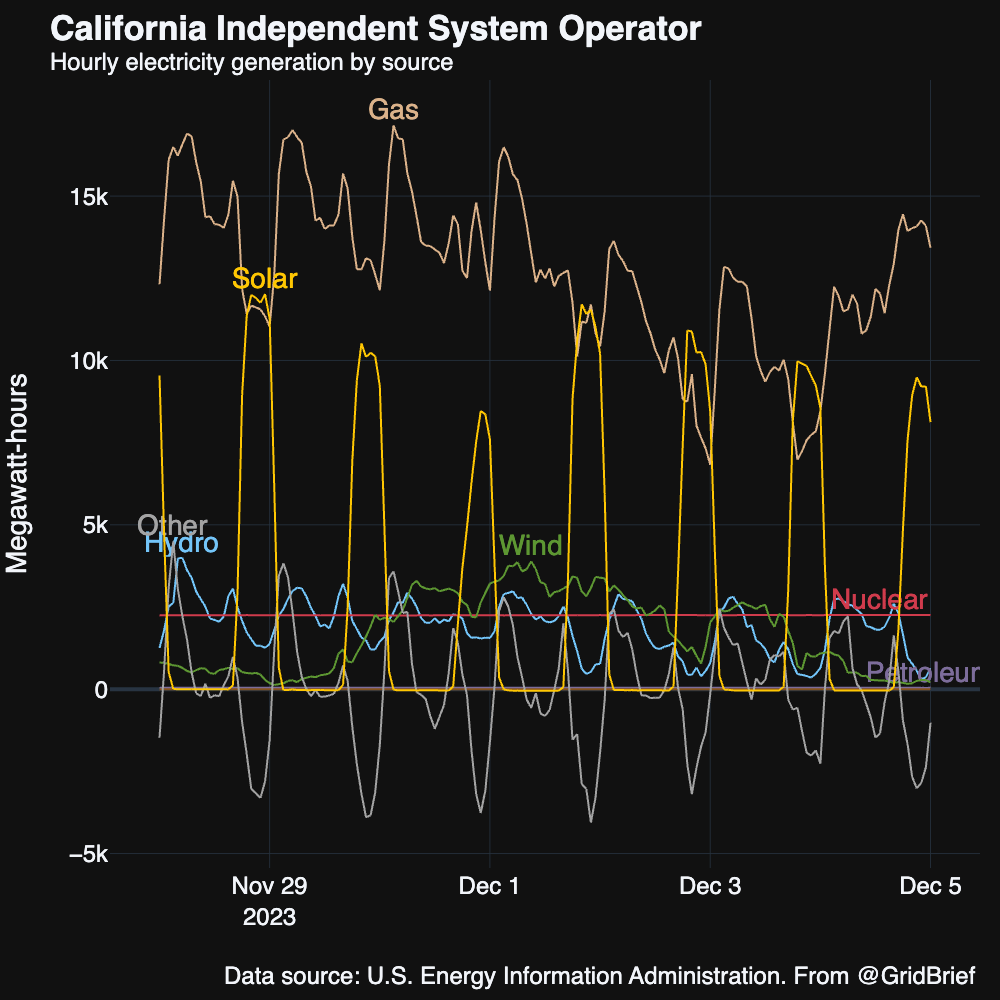

CAISO

Natural gas and solar had a typically productive week in California. Solar went negative likely via exports and battery charging. Hydro, wind, and nuclear all vied for third.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Wind power’s outlook takes a hit worldwide. “The global wind power sector will add less capacity in the next decade than previously expected due to financial trouble in the U.S. offshore wind industry and sluggish approval and project execution in China, consultancy Wood Mackenzie said on Tuesday. Orsted, the world's largest offshore windfarm developer, energy giants BP and Norway's Equinor have booked hundreds of millions of dollars worth of impairments on their U.S. offshore wind power portfolios, citing spiralling financing costs and supply delays,” reports Reuters. “Wood Mackenzie cut by 29 gigawatts (GW) its forecast for global wind power capacity by end-2032, downgrading cumulative installed capacity to 2.35 terawatts.

The downgrade makes up less than a 2% change in expected capacity, with more than 80% of the cut stemming from headwinds including in key markets like the United States and China.”

The United Arab Emirates’ renewable energy to beef up UK commitments. “UAE renewable energy firm Masdar is beefing up its British operations in a bid to scoop up offshore wind and other green energy projects in a sector struggling with supply-chain snarls and soaring costs,” reports Bloomberg. “‘We are currently ramping up our organization in the UK,’ Husain Al Meer, Masdar’s director for global offshore wind and UK operations, said in a call from the sidelines of COP28 in Dubai. ‘We are doubling down on building the team to be in the position where we take a lead on some of those investments going forward.’”

MENA countries supply a third of global LNG exports. “Exporting countries in the Middle East and North Africa region (MENA) supplied nearly one-third (29%) of global liquefied natural gas (LNG) exports in 2022,” reports the Energy Information Administration. “The share of global LNG exports coming from the region’s exporters—Qatar, Oman, the United Arab Emirates (UAE), Algeria, and Egypt—declined from 47% in 2013 to about 30% by 2020 because of growing LNG exports from Australia and the United States.”

Crom’s Blessing

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!