Welcome to Grid Brief! Today we’re looking at power generation in America’s power markets with some news items for each area.

What’s Keeping the Lights On?

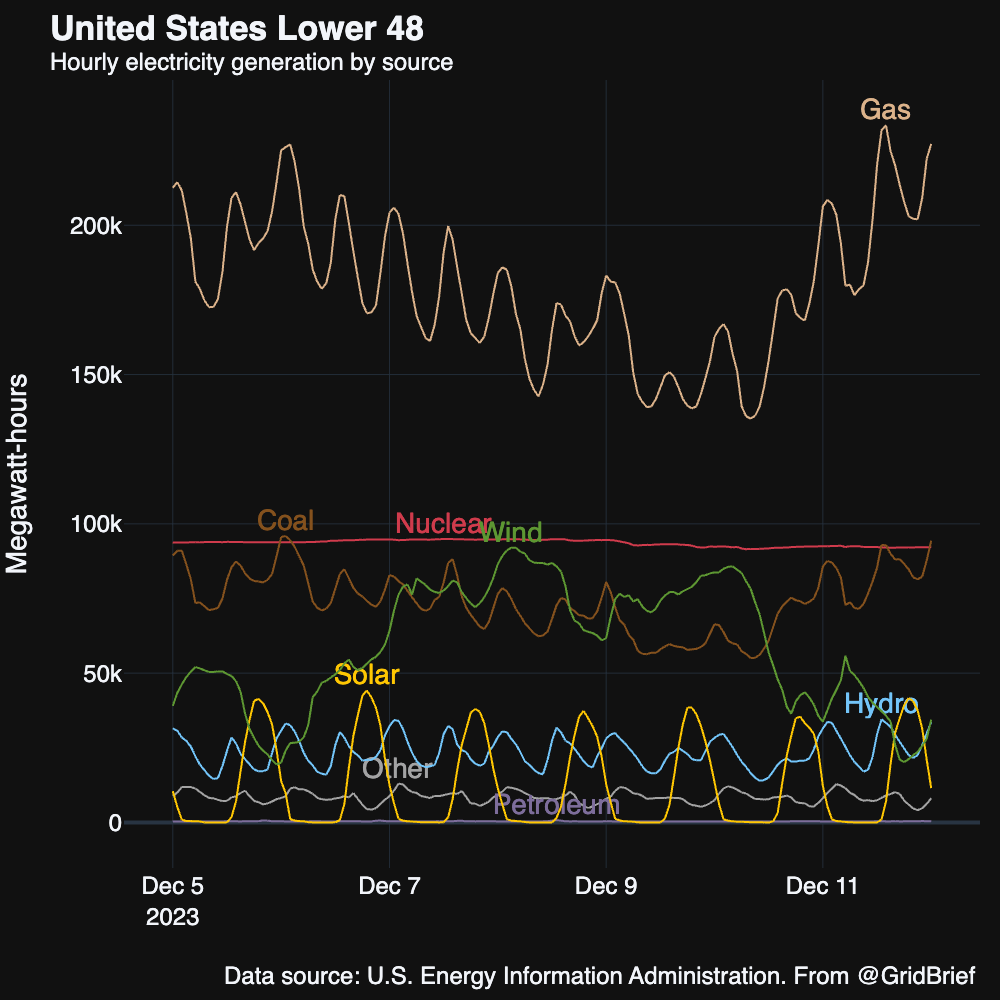

Here’s a snapshot of power generation nation-wide.

The major thing to note is the relationship natural gas and coal have to wind—when it lulls, they ramp.

And here’s a map to orient you as we move through the power markets.

ISO-NE

Natural gas, nuclear, and hydro were the star players in New England this week.

ISO-New England recently released its report on shortfall risks. The grid operator’s main takeaway is that future summers should pose no challenge for the region and they can manage shortfalls over 21-day period in the oncoming winter seasons. But the grid operator also pointed out that the “region’s energy shortfall risk is dynamic, and will be a function of the evolution of the supply and demand profiles. Risk could increase if expected renewable resources don’t materialize, needed transmission isn’t built, or fuel supply chains are disrupted.”

PJM

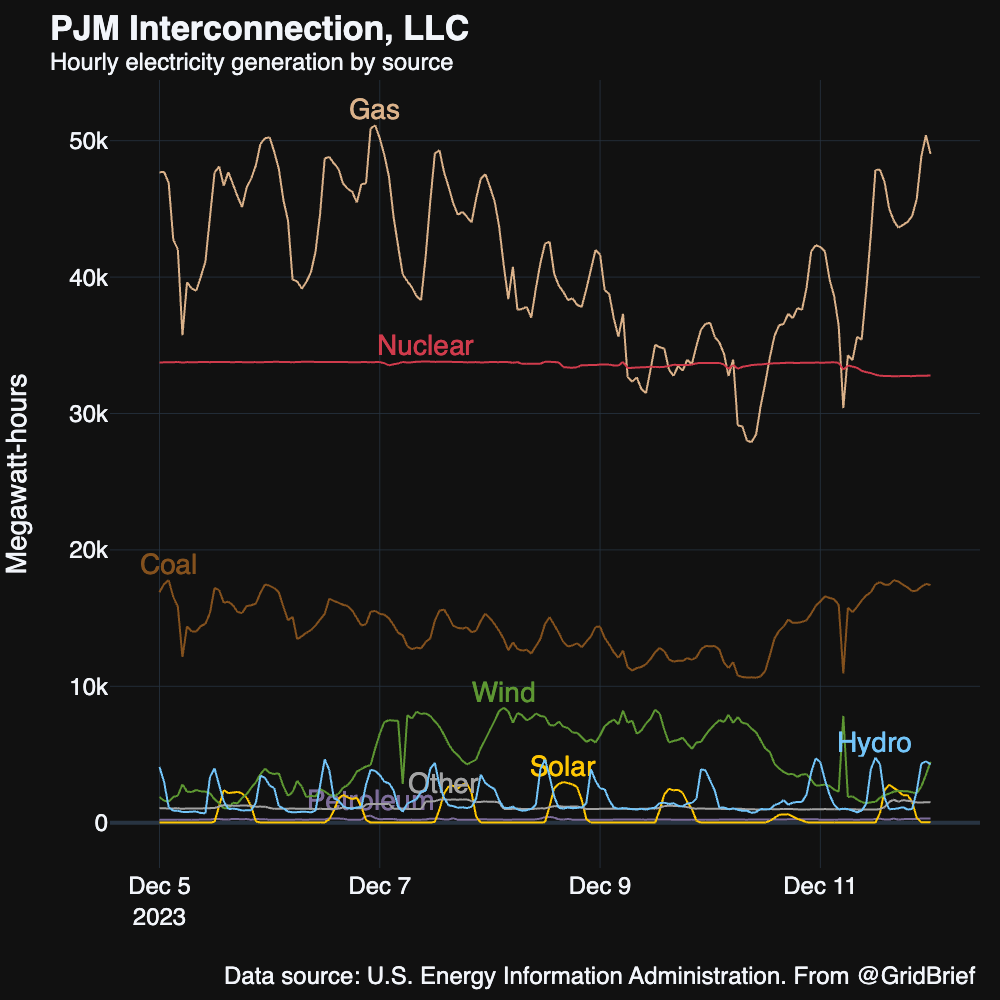

Natural gas, nuclear, and coal kept America’s largest power market running. We also have some fascinating looking relationships between fossil ramping and wind intermittency.

Speaking of coal, PJM railed against a 2025 Baltimore coal plant closure deal between the plant’s owner and the Sierra Club. The grid operator’s President and CEO, Manu Asthana, wrote a letter to the Sierra Club about the closure of the plant owned by Talen, saying, "This situation requires immediate attention. Failure to come to resolution on this issue could result in degraded grid reliability for over 1,000,000 Maryland consumers during peak hours, including the entirety of the city of Baltimore, for the years between the stated deactivation of Brandon Shores and the date whereby needed transmission can be constructed."

PJM has also approved $5 billion in transmission projects.

ERCOT

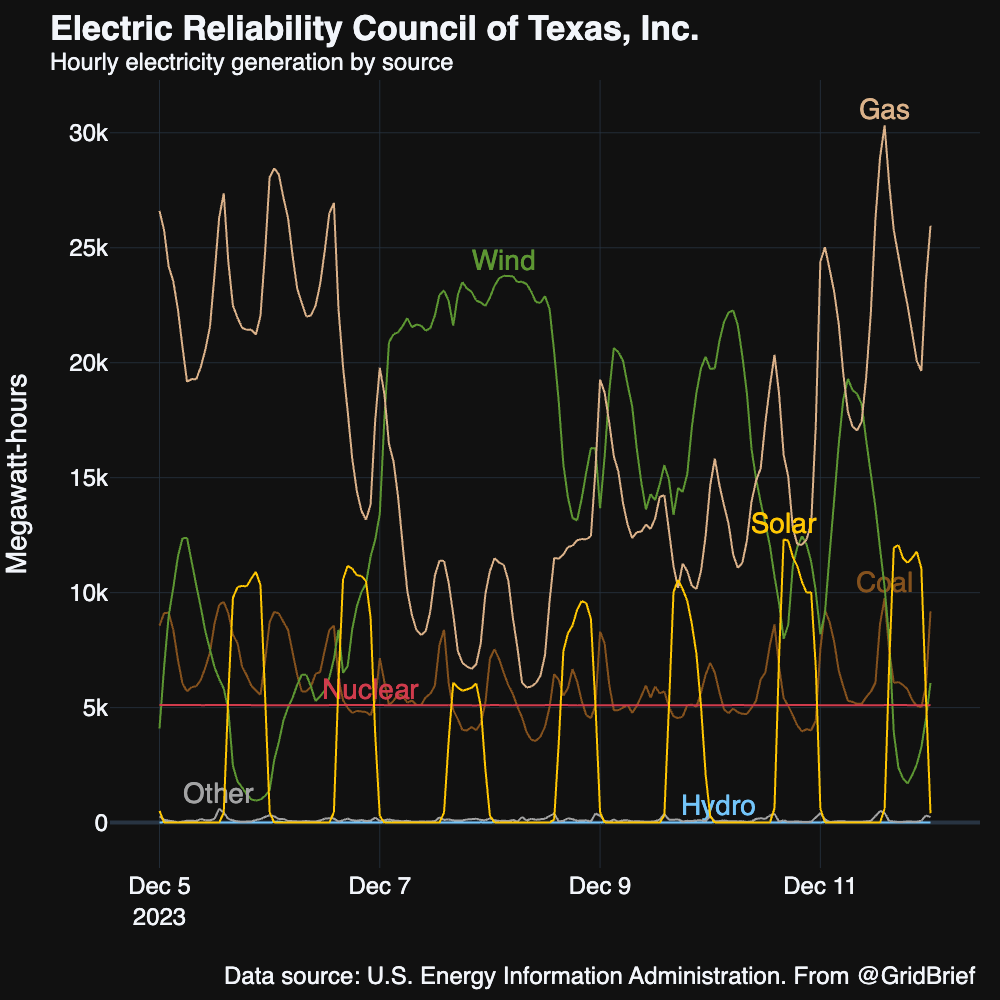

Wind had a huge week in the lone star state—well, for parts of it, anyway. Natural gas, coal, solar, and nuclear all took their turns in the top three.

MISO

‘

The Midcontinent Independent System Operator offered up its own object lesson in wind-fossil ramping, too. Natural gas, coal, wind, and nuclear all rotated between the top three spots.

SPP

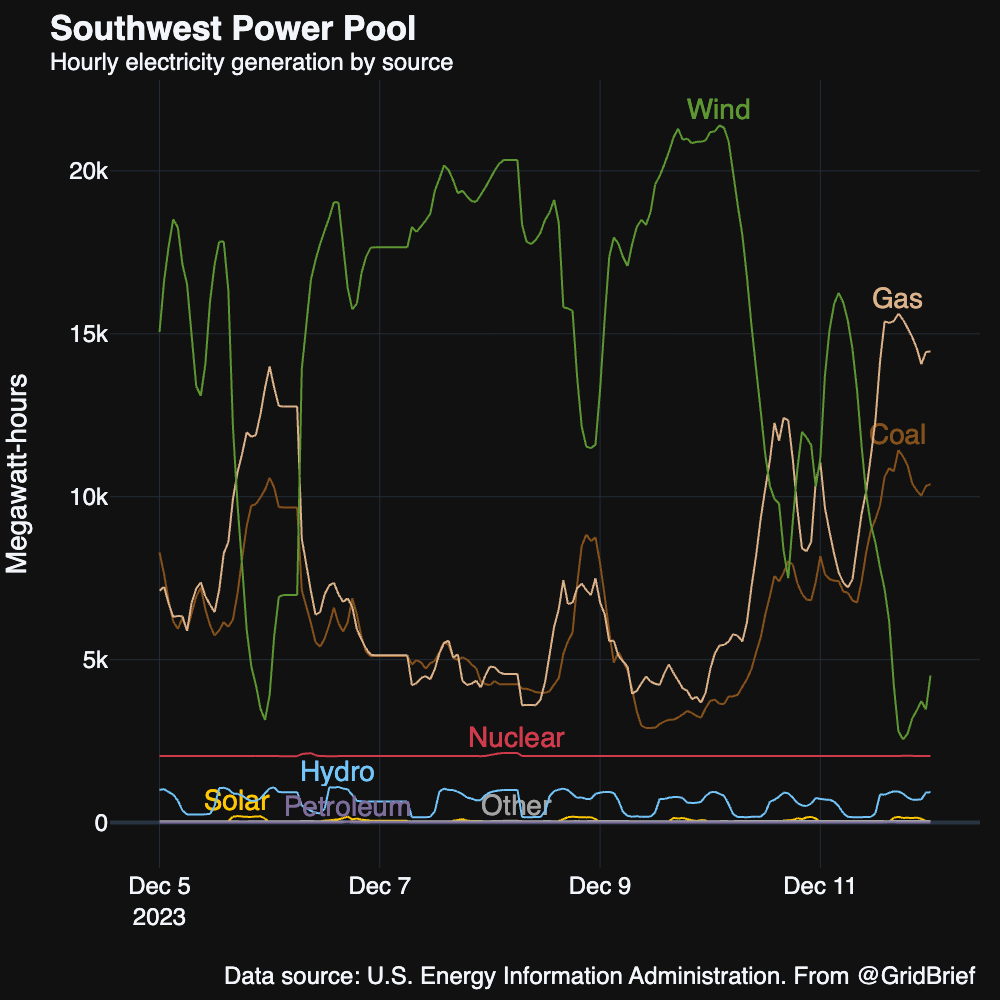

Southwest Power Pool had a roaring week for wind. But, as in California when solar performs really well, fossil burning never stops.

NY-ISO

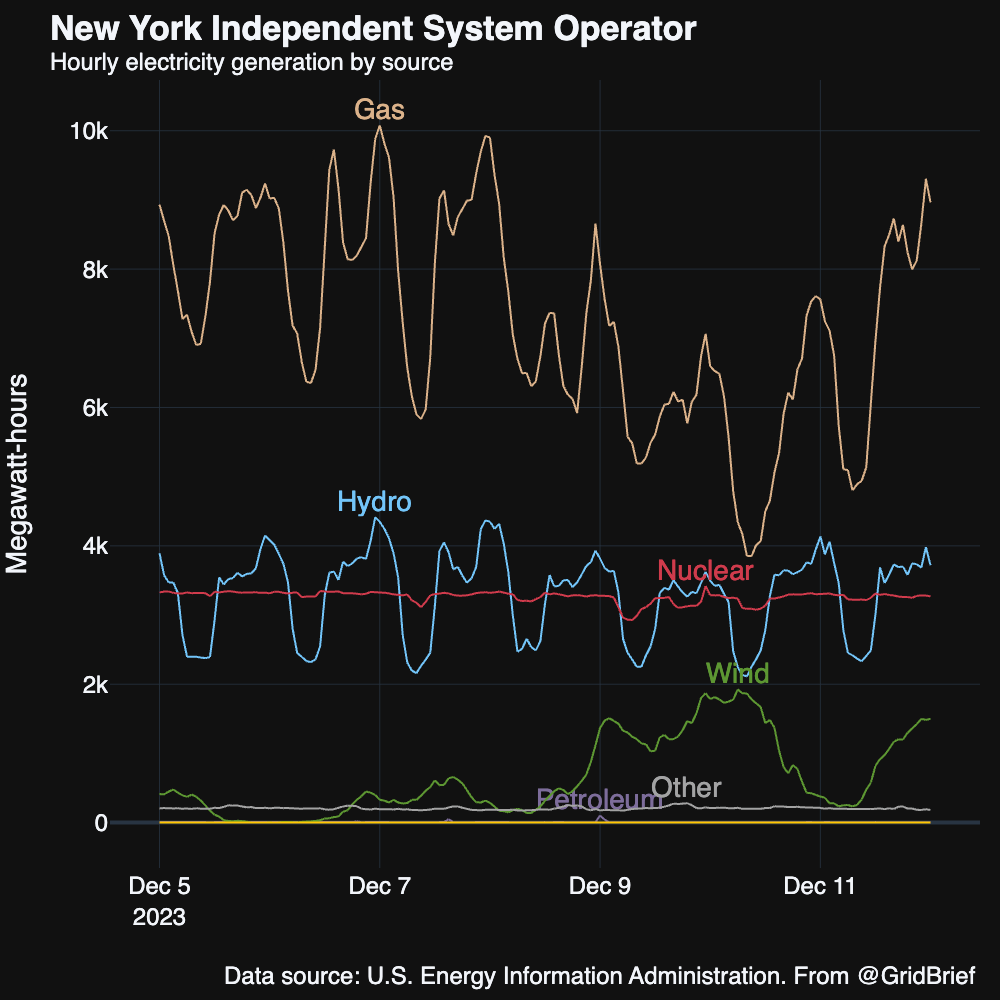

Natural gas, nuclear, and hydro were the kingpins of the Empire State this week.

New York City just removed zoning obstacles for rooftop solar, batteries, and electrification gear.

CAISO

Natural gas and solar were the top two generators in the Golden State. A slew of other generators swapped third place.

Renewable energy advocates say California’s transmission permitting process isn’t moving fast enough, according to reporting by Utility Dive.

“Without the needed transmission, it’s going to be a big setback on the [clean energy transition],” said one consultant. “We need to build 7,000 MW to 8,000 MW of clean energy to meet the SB 100 zero-carbon goal.”

SB 100 requires California to source all of its electricity sales from zero-carbon generators by 2045.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Wind industry sees a bleak quarter in America. “The third quarter of 2023 saw U.S. wind installations ‘crater,’ adding only 288 MW of capacity – the slowest quarter for new wind energy in the country in the past five years,” reports Utility Dive. “In terms of capacity additions, it was the lowest quarter for the wind energy sector since the second quarter of 2018, when 152 MW were added. The first and second quarters of this year saw capacity additions of 1,772 and 1,099 MW, respectively.”

Brazil re-okays power imports from Venezuela. “Brazil will resume electricity imports from its neighbor Venezuela after more than four years of hiatus, Brazil's energy and mines ministry and energy firm Ambar said on Monday. The move is expected to reduce energy costs for consumers in the Brazilian state of Roraima, which is the country's only state not connected to the national grid,” reports Reuters. “The Brazilian government late last month authorized Ambar, an energy trading company controlled by the J&F group, to import electricity generated by the Guri hydroelectric plant in Venezuela in a process that should begin soon, according to Ambar. The authorization is valid until January of next year.”

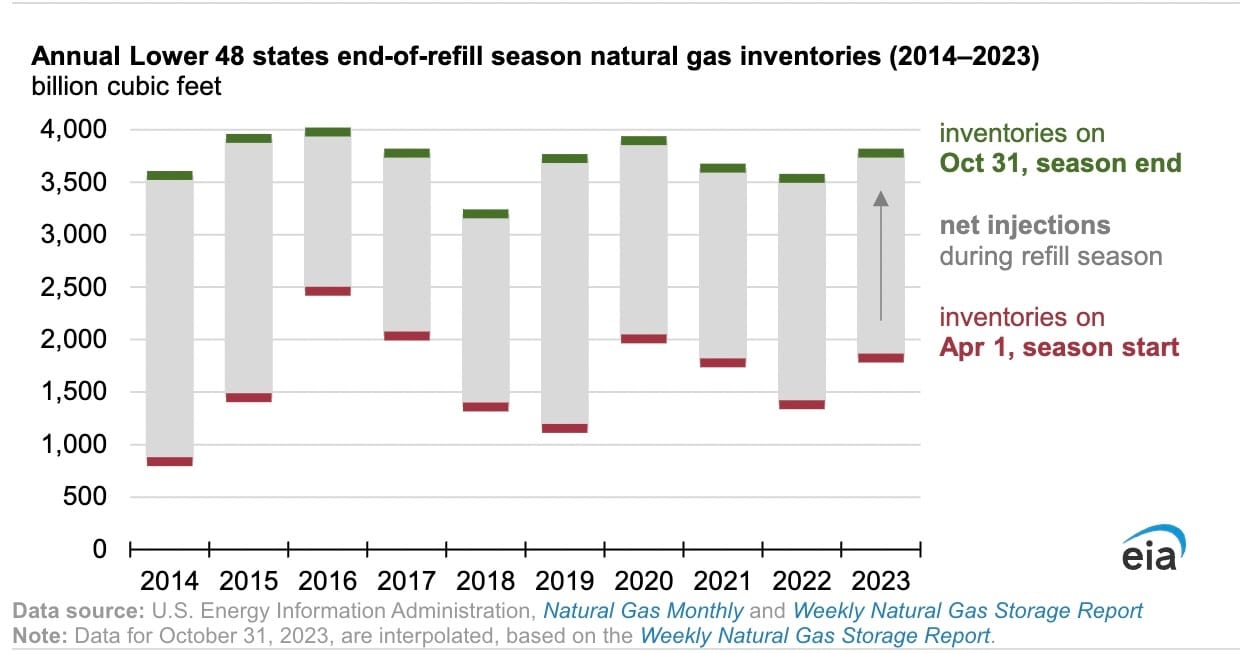

The US enters winter with robust natural gas storage. “Working natural gas in storage in the Lower 48 United States ended the natural gas injection season at 3,776 billion cubic feet (Bcf),” reports the Energy Information Administration. “The Lower 48 states will enter the winter heating season, which runs from November 1–March 30, with the most natural gas in storage since 2020. In addition, we now have 5% more natural gas in U.S. inventories entering the winter heating season than the previous five-year (2018–22) average, and 7% more than last October 31. The large volume of gas in storage today is partially the result of a mild 2022–23 heating season.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!