Welcome to Grid Brief! Today we’re looking at power generation and power prices in America’s power markets, with news items where relevant.

What’s Keeping the Lights On?

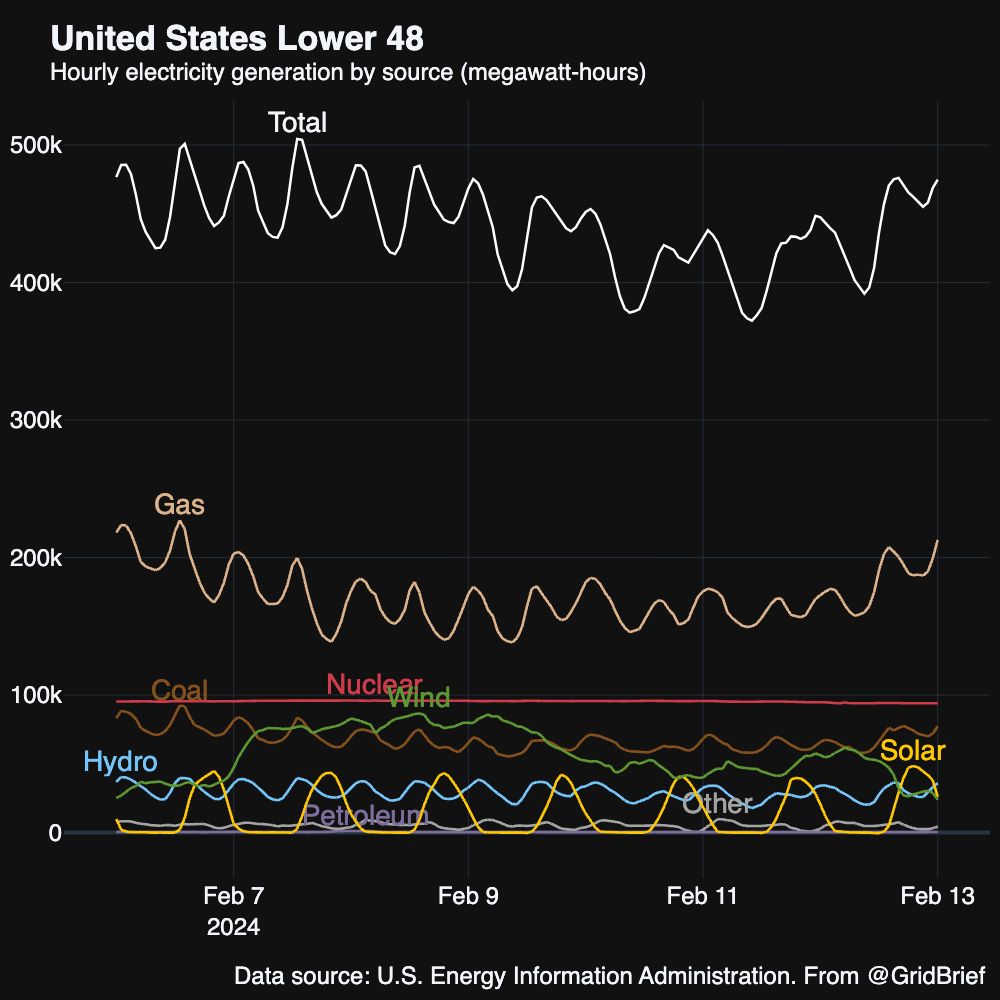

Let’s start with a snapshot of generation nation-wide:

And here’s a map to orient you as we move through the market areas:

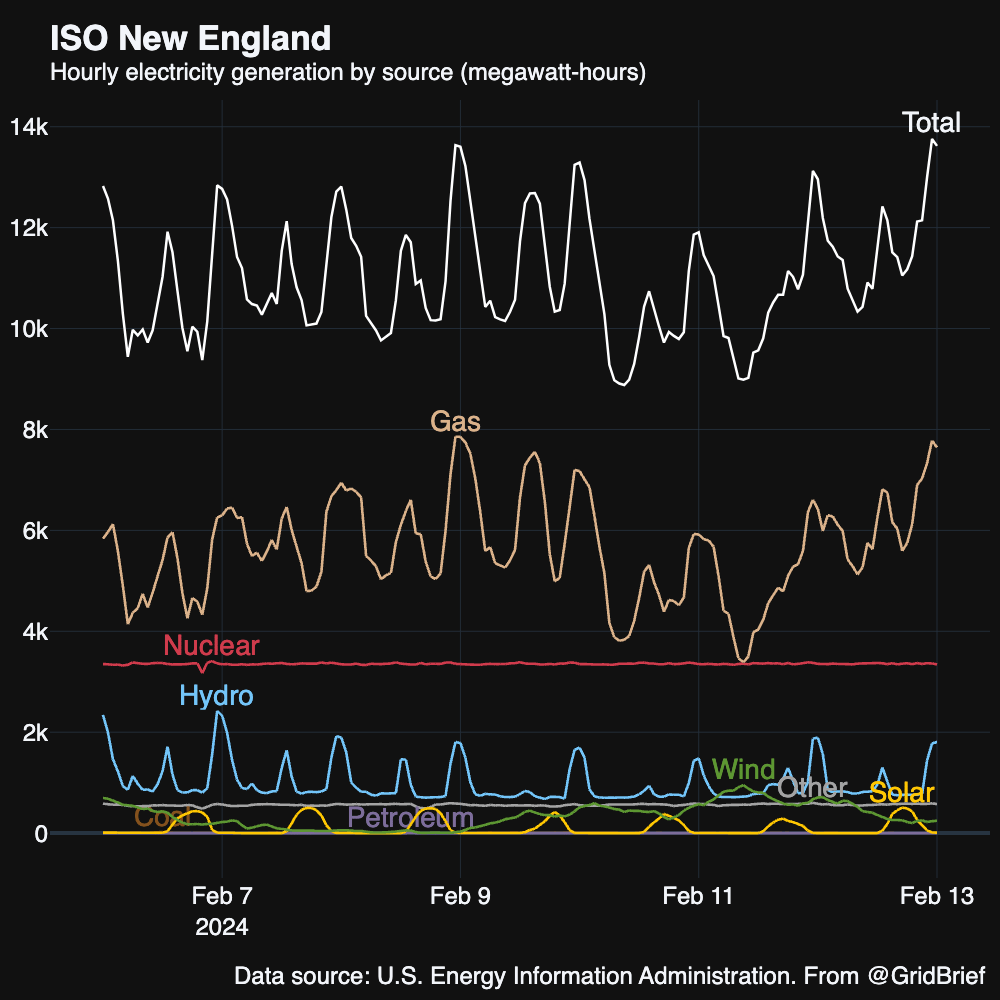

ISO-NE

Natural gas, nuclear, and hydro were the workhorses of New England. Generation rose as a nor’easter swept over parts of the Northeast and Mid-Atlantic.

For most of the week, prices fell in New England, with real-time prices routinely below day-ahead.

New Hampshire is losing a bio-mass facility. “A biomass power plant in Berlin has filed for Chapter 11 bankruptcy and terminated its contract to sell power to Eversource, after a years-long controversy over the cost of its electricity. Eversource, New Hampshire’s largest utility company, is rejecting the company’s termination of their contract, and the company says it will pursue mediation,” reports New Hampshire Public Radio. “Burgess BioPower, which owns the plant, has been selling electricity to Eversource since 2011. The biomass plant generates power by burning low-grade wood. Much of that power has been more expensive than the market rate, and that cost has been borne by ratepayers.”

ISO-NE wants to move away from its three-year-ahead capacity auction to something more seasonal, triggering a two-year delay for its upcoming capacity auction.

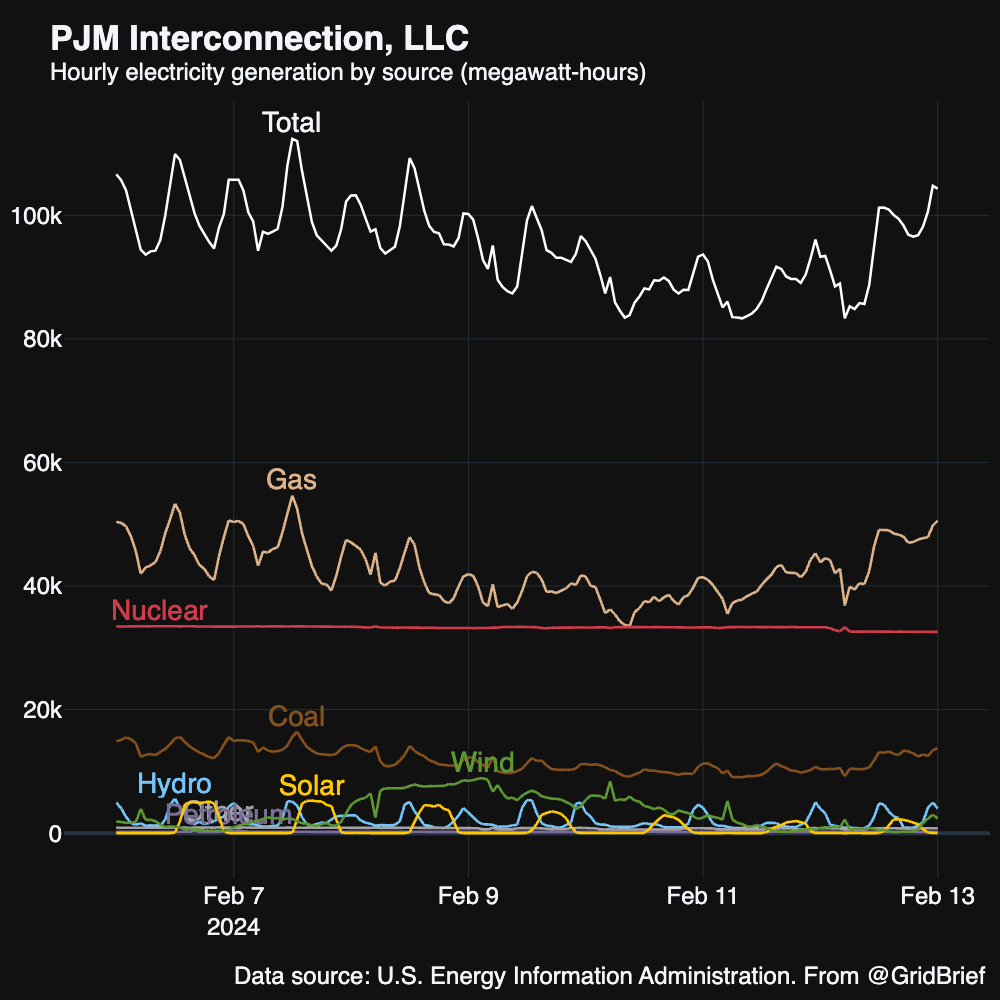

PJM

Natural gas, nuclear, and coal kept America’s largest power market running.

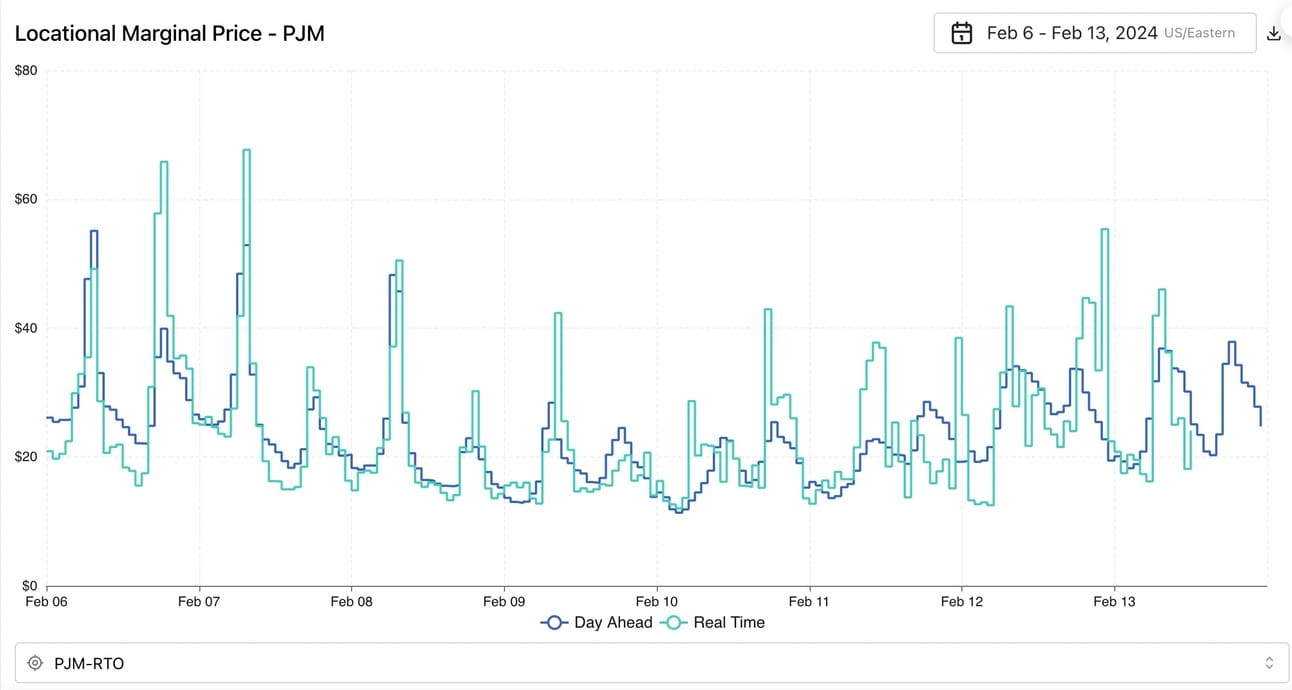

Real-time prices outpaced day-ahead prices over the week.

This summer, PJM plans to hold its long-delayed capacity auction. “After receiving two key Federal Energy Regulatory Commission decisions, the PJM Interconnection plans to hold its next capacity auction in June,” reports Utility Dive. “The announcement follows FERC’s Feb. 6 decision to reject a PJM proposal to revamp its offer cap and capacity performance rules and an earlier decision to approve a companion ‘modeling enhancement’ plan that revises its resource adequacy risk modeling and capacity accreditation processes and bolsters its testing requirements for capacity resources.”

Maryland ratepayers have asked FERC to reject PJM’s $5.1 billion transmission cost allocation.