WV Lawmakers Make Way for Berkshire Hathaway Solar

Berkshire Hathaway Energy is building a $500 million solar-powered microgrid in West Virginia. The project will be sited on the former Century Aluminum smelting plant’s location in Ravenswood. “The project will deliver solar energy to all of the customers within a special business development district, which will be overseen by the state Department of Economic Development,” reports the Mountain State Spotlight.

Yet in order to approve the project, West Virginia’s lawmakers and its Justice administration had to undercut its Public Service Commission’s ability to oversee it.

“But eliminating the PSC from the process means that even though Berkshire Hathaway Energy will act as a utility by powering businesses within its own industrial park, the company will negotiate rates with its customers, with little to no rate regulation from anyone,” reports the MSS. “Its only current customer is Precision Castparts Corp., a titanium parts manufacturing company that Berkshire Hathaway owns, but the company plans to attract other industrial customers to the park.”

Part of Berkshire Hathaway’s business model is soaking up tax credits for renewables projects. Warren Buffett himself is on record saying building renewables doesn’t make sense unless you get the tax credits. West Virginia’s PSC has been generally hostile to renewable energy developments, so undercutting it is a shrewd move to ease their tax burden.

Price Cap on Russian Crude Could Cause Tanker Shortage

The EU’s embargo of Russian oil takes effect in December. The only way EU or G7 countries will be able to buy Russian oil is if It is sold at or below whatever price cap the buyers plan to set. Where will Russia’s 2.4 million barrels per day go?

“Even if the price cap mechanism fails to work for the West, as many analysts expect, and even if Russia manages to divert all its previously EU-bound oil exports eastwards to Asia, this would create a shortage in the oil tanker market, sending shipping rates surging further,” reports Oilprice.com. “This would mean elevated oil prices, even for discounted Russian oil because of the high freight rates.”

As we covered earlier, the trade routes will also be longer—from the Baltic and Black Sea all the way to Asia, rather than right to Europe. The Asia route takes an average of 21 days, or three times the normal European route.

This reroute would be a historic change in the oil trade that catches the tanker industry when times are already tight. Buyers will have to eat higher prices due to rising shipping rates and low tank availability.

The European tanker and oil transportation giant, Frontline, recently said that oil’s transit volume continues to grow to “unseasonably high volumes.” “The tanker market is now a ‘ton-mile story’ as the Russian invasion of Ukraine is displacing crude and products trade flows, with ‘highly inefficient trading patterns developing,’” according to Oilprice.com’s reporting on the Frontline’s conference presentation.

Bottlenecks appear imminent as the incentives to build more tankers has yet to arrive. And even when it does, tankers aren’t printable on demand.

India's Coal Comfortable Autumn

Last year, coal shortages punished India’s grid sending blackouts across the country. This year, despite increases in electricity consumption, its coal stocks are more than twice the size of last year’s and its grid is more stable.

After the government prioritized maximizing domestic coal production and transporting solid fuels by rail, Reuters reports the following improvements:

"Domestic coal production increased by 27 million tonnes (17%) between June and August compared with the same period a year earlier."

"The number of loaded coal trains despatched from the mines to power plants averaged 253 per day, up from 214 per day in 2021."

"Coal deliveries to power producers totalled 177 million tonnes between June and August up from 150 million tonnes in 2021."

Last year, the average amount of coal onsite for India’s coal plants sat around 4 days’ worth. Today, it’s 9 days’ worth. While India has increased its solar capacity, which has helped the country meet demand during its summer heat and spared its coal reserves. Coal has backed up the grid after sunset when the panels drop off the grid. More generally, India’s grid has more consistently cleaved to the 50hz frequency range this year, which means load and demand have improved their harmonization.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Iranian oil workers are threatening to strike if the government doesn't halt its crackdown on protestors. "Iran has been roiled by unrest that has spread to more than 80 cities and towns, including in the northwest, where 22-year-old Mahsa Amini lived before eyewitnesses and family said she was beaten -- and later died -- after being seized by the morality police in Tehran on September 13," reports Oilprice.com. "Labor protests in Iran also have been on the rise in recent months in response to declining living standards and state support as crippling Western sanctions wrack the economy."

The prefabricated dome at the No. 2 unit of Taipingling Nuclear Power Plant in south China's Guangdong Province was installed on Sunday. "The project involves the building of six nuclear power units using Hualong One, a domestically designed third-generation reactor, at the plant. Construction of the first phase of the project – No. 1 and No.2 units – began in 2019 and 2020, respectively," reports CGTN.

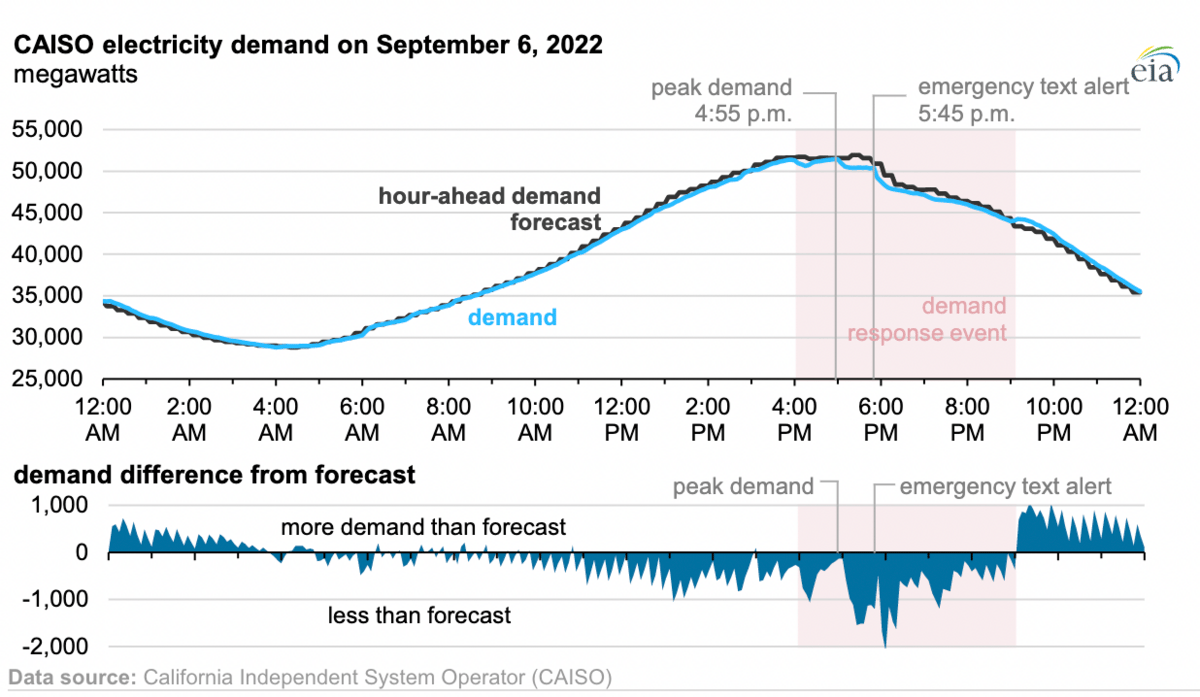

What did California's Flex Alert, which asked consumers to reduce consumption to save the grid from blackouts, look like? The Energy Information Administration just published a remarkable visual in a recent report. "About an hour after reaching peak load, California’s Office of Emergency Services (CAL-OES) issued the following emergency text alert through the Wireless Emergency Alert system, 'Conserve energy now to protect public health and safety. Extreme heat is straining the state energy grid. Power interruptions may occur unless you take action. Turn off or reduce nonessential power if health allows, now until 9pm.' This message was targeted to consumers in counties with high population density that were experiencing extreme heat," the agency reports. "Within five minutes of the text alert, electricity demand in CAISO declined by more than 2,100 MW from the hour-ahead forecast."

Crom's Blessing