Xcel to Exit Coal by 2030

Xcel, a Minneapolis-based utility, wants to cut 80% of its emissions by 2030. To do that, it plans on rapidly exiting coal. The first casuality of its plan is Polk, a 1067 MW coal plant in Texas. Xcel is shuttering it four years early, speeding up its overall coal exit by three years.

"With planned power plant retirements in other states, Xcel will shutter its entire coal-fired generating fleet in its eight-state service territory before 2031, the Minneapolis-based company said Monday. Xcel previously aimed to be coal-free by 2034," reports Utility Dive. That's about 6500 MW of coal-fired generation.

Xcel plans on replacing coal with renewables, which they claim will save customers in Texas $70 million. Last month, Xcel officials said that the Inflation Reduction Act's production tax credits cut the levelized cost of energy for solar projects by 25% to 40% and wind projects by 50-60%.

The levelized cost of energy (LCOE) is a metric used to derive the cost of supplying MWs to the grid. Notoriously, it leaves out system costs and transmission connections for renewables, which makes them appear "cheap" in comparison to reliable generators like coal and nuclear. For more on the origins of LCOE and its applications, Mark Nelson, president of the Radiant Energy Fund, dove into its history for the Decouple Podcast.

"Xcel Energy's plans to close the last of its coal plants by 2030 and to replace them with wind and solar is nothing more than a cash grab designed to boost its corporate profits at the expense of the families and businesses it is supposed to serve," Isaac Orr of the Center of the American Experiment told Grid Brief. "Utilities are allowed to charge enough for the electricity they sell to cover the cost of delivering the power, plus a 10% profit when the utility builds or buys something new, as long as this expenditure is approved by the state regulatory body. As a result, utilities have a powerful incentive to close depreciating assets like coal plants and build as much new stuff as possible. So long as the regulator rubber stamps it, they make more money."

Japan Retains Sakhalin-1 Stake

Japan will keep its stake in the Sakhalin-1 oil and gas project after the Russian government asked the Japanese companies to stay in the picture.

"Russia’s president signed a decree to change the ownership of Sakhalin-1 last month, with the state setting up a new entity to manage the project. Previous shareholders such as Japan’s SODECO consortium were offered the chance to retain their stakes," reports Oilprice.com. "SODECO, or Sakhalin Oil and Gas Development Co, comprises Itochu, the conglomerate, Marubeni, and Japan Petroleum Exploration Co. The Japanese government has a 50-percent stake in the consortium."

Earlier this year, Russia stripped Exxon from Sakhalin's operatorship when the company committed to its total pullout from Russian energy. For a while, India's ONGC considered taking a stake in the project as it was a large stakeholder in Sakhalin prior to Exxon's exit.

Yet it's not surprising Japan stepped in. Its trade minister has been vocal about its importance to his country despite western sanctions on Russian energy.

"The Sakhalin-1 is extremely important for Japan's energy security as it is a valuable source outside of the Middle East," trade minister Yasutoshi Nishimura said.

Norway's Necessary Natural Gas

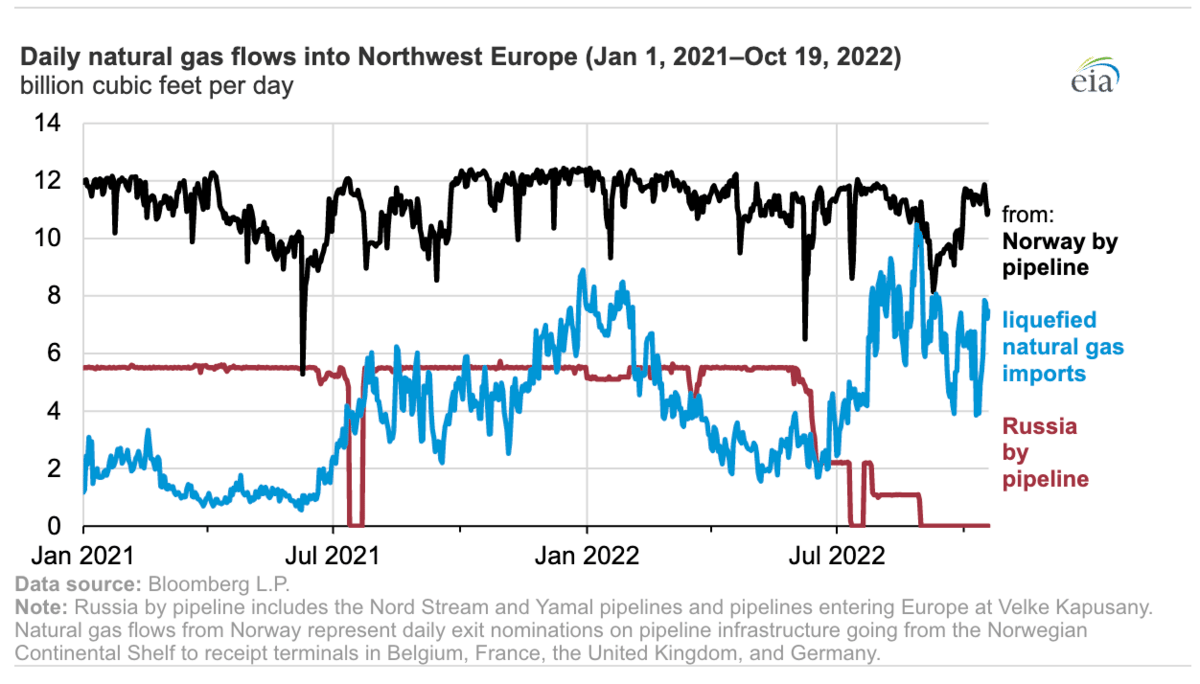

Norway's in the top ten oil-producing countries in the world; Europe has always relied on its hydrocarbons. Ever since Europe rolled out its sanctions against Russia in response to its invasion of Ukraine, Norway's exports have become even more important to the region.

"Norway is not a member of the EU, but it is an important trade partner and a member of the European Economic Area," reports the Energy Information Administration. "According to our updated Country Analysis Brief: Norway, in March 2022, the Norwegian government authorized an increase of approximately 0.14 billion cubic feet per day (Bcf/d) of natural gas production by the end of 2022, primarily from two existing fields. In 2021, Norway produced 11.1 Bcf/d of natural gas."

Norway has exported over 90% of its fossil fuels since 1990. Last year, Norway was the third-largest natural gas exporter in the world after Russia and America. The map below depicts Norway's pipeline network. As you can see, it's a vital lifeline to the UK and Northwestern Europe.

"Most of Norway’s natural gas exports are shipped via the country’s extensive export pipeline infrastructure, with smaller volumes exported as liquefied natural gas (LNG). In June 2022, Norway reopened its Hammerfest LNG facility, which could allow for an increase in natural gas exports by about 0.7 Bcf/d in 2022.," reports the EIA. "Hammerfest processes natural gas from the nearby Snøhvit field in the Barents Sea. In 2019, the last year the liquefaction facility was fully operational, 5% of Norway’s natural gas exports were shipped as LNG."

Last year, Norway invested 4% of its GDP (about $18 billion) into its oil and gas sector.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Libya plans to finalize an offshore gas field development deal with Eni. "Currently we are in the process of signing an investment with Eni to produce gas offshore, and this is something around $6 to $8 billion [in investments]," NOC Chairman Farhat Bengdara told reporters at the ADIPEC conference in Abu Dhabi. "There is also a program of drilling offshore and onshore that will start soon by Eni and BP. We are in talks with TotalEnergies to invest more in Libya and increase production, and other companies of course."

Power Magazine has just published a wonderful retrospective on Maryland's Calvert Cliffs Nuclear Power Plant, which has been online for half a century. "[T]he plant operates at a capacity factor of well over 90% and produces 15 TWh of carbon-free energy annually—'the equivalent of adding a bit more than 20% to Maryland’s [renewable portfolio standard] requirements.' And while Calvert Cliffs provides 2% of power output in PJM, that’s substantial compared to the 6% provided by PJM’s entire renewable output, the report notes. The plant continues to be integral for Maryland, which imports 40% of its power. It provides 20% of the state’s needs, and 81% of its in-state clean generation," reports Power Magazine.

Germany will place a price cap on electricity prices for households and industrial consumers this winter. "For industrial consumers, electricity will be limited to 13 euro cents per kilowatt-hour (kWh) applied for 70% of the previous year's consumption," reports Reuters. "For households, prices will be capped at 40 cents per kWh for 80% of basic consumption."

Crom's Blessing