Youngkin Goes Nuclear

Virginia Governor Glenn Youngkin has called for more nuclear energy in his state. He announced his hopes for nuclear during a press conference on his energy plan.

“The only way to confidently move towards a reliable, affordable and clean energy future is to go all in — all in — on innovation, and not abandon prematurely the reliable network that we currently have in place,” Youngkin said at the event unveiling his plan. “I mean, think through this: innovation in nuclear, in carbon capture, in hydrogen, along with building on our leadership in offshore wind and solar. They all should be part of the solution.”

Democrats and environmentalists called his "all of the above" approach obstructionist to climate goals. No doubt because Youngkin has been sharply critical of states that have pursued "100% renewables" paths to clean energy.

"[T]his plan advocates for the development of the first commercial SMR in the US in southwest Virginia and calls for developing spent nuclear fuel recycling technologies that offer the promise of a zero-carbon emission energy system with minimal waste and a closed-loop supply chain," said Youngkin. "We have to be all-in in nuclear energy in Virginia. When it comes to reliability, affordability. When it comes to clean power. When it comes to the abundant nature of growing power demand, absolutely nothing beats nuclear energy. It is the baseload of all baseloads.

Youngkin's desire for more nuclear found harmony with Republican House Representative Cathy McMorris Rogers in Washington state, who recently called for more natural gas and more nuclear in the energy transition. Joy Ditto, the CEO of the American Public Power Association, has also gone on record saying that her organization is "bullish" on nuclear.

US Eases Venezuelan Sanctions

The Biden administration is planning to ease sanctions against the Venezuelan government to allow Chevron, a Venezuelan oil company, to pump more product.

"In exchange for the significant sanctions relief, the government of Venezuelan President Nicolás Maduro would resume long-suspended talks with the country’s opposition to discuss conditions needed to hold free and fair presidential elections in 2024," reports the Wall Street Journal. "The U.S., Venezuela’s government and some Venezuelan opposition figures have also worked out a deal that would free up hundreds of millions of dollars in Venezuelan state funds frozen in American banks to pay for imports of food, medicine and equipment for the country’s battered electricity grid and municipal water systems."

The move comes after OPEC+ snubbed Biden and cut its oil production by a staggering 2 million barrels per day. Softening the relationship with Venezuela, which sits on some of the biggest fossil fuel reserves in the world, could help lower the cost of oil for Europe and America.

"Venezuela was once a major oil producer, pumping more than 3.2 million barrels a day during the 1990s, but the state-run industry has collapsed over the past decade because of underinvestment, corruption and mismanagement," reports the Wall Street Journal. "Sanctions leveled by the Trump administration further dented production and forced Western companies out of the country."

Whether or not the easing will happen, and whether or not Chevron will overcome its underinvestment and overcorruption problems, the move from Biden shows the Democrats' complete unwillingness to support its domestic fossil fuel industry.

Norway to Boost O&G Production

Norway expects its oil and liquids production to rise by 15% next year.

"Natural gas production in Norway, which supplies around 25% of the gas consumed in the EU and the UK, is expected to rise by 8 percent in 2022 compared to 2021, the government’s latest estimates showed," reports Oilprice.com.

Norway's stepping up the plate to provide Europe with the power that it needs. "The Norwegian continental shelf supplies significant amounts of energy to Europe, and Norwegian gas is now very important for Europe. Norwegian gas exports to Europe are set to increase by as much as 100 TWh of energy from last year," said Oil and Energy Minister Terje Aasland. "The most important thing Norway can contribute now to help our neighbors in Europe is to maintain high daily production and to invest in new production on the continental shelf."

And Norway's in it for the long haul. The country expects its production levels to stay high until the end of the decade. The draft budget anticipates great profits: "[r]evenues from petroleum activities are expected at $132 billion (1.4 trillion Norwegian crowns) – a record high – in 2023, compared to an expected $113 billion (1.2 trillion crowns) for 2022, and nearly five times higher than the 2021 revenues from oil and gas," reports Oilprice.com. "The high expected income from petroleum activities will mostly reflect expected high oil prices, and especially gas prices, as well as a weaker exchange rate for the Norwegian crown."

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

The Czech Finance Ministry has announced a staggering 60% tax on "excess profits" for its energy sector. "Finance minister Zbynek Stanjura said at a Thursday news conference that the proposed tax would be on excess profits from the energy sector starting in 2023 through 2025, bringing in $3.4 billion next year, and $6 billion across the three years," reports Oilprice.com. "The proposal requires parliamentary approval before it can be implemented."

GE just laid off more workers. "General Electric Co is laying off workers at its onshore wind unit as part of a plan to restructure and resize the business, which is grappling with weak demand, rising costs and supply-chain delays," reports Reuters. "The sources said the company on Wednesday notified employees in North America, Latin America, the Middle-East and Africa about the cuts. It also has plans to cut its onshore wind workforce at a later date in Europe and Asia Pacific." The American layoffs amount to 20% of its onshore wind division.

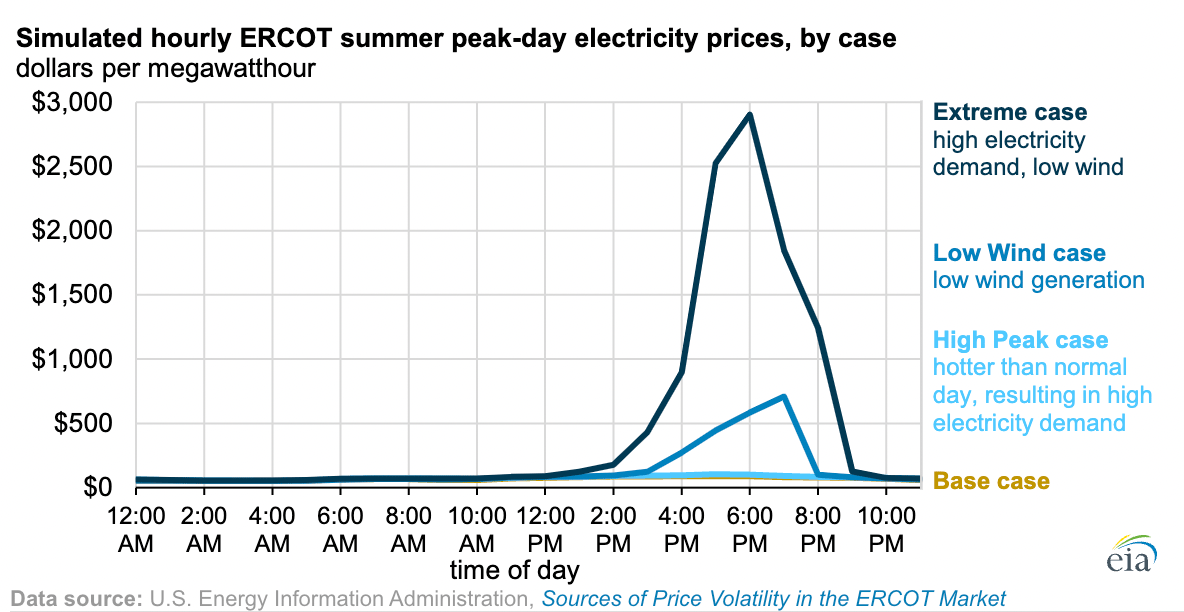

A recent report from the Energy Information Administration reveals that wind power in Texas often contributes to increases in the wholesale price of electricity. "[W]e analyzed how variability in electricity demand and wind generation affects hourly electricity prices in Texas’s wholesale power market under summer peak-day conditions, when summer electricity demand is highest," reports the agency. "We found that both high levels of electricity demand and low wind availability can significantly raise wholesale prices in ERCOT, supported by its market design. When combined, these factors can lead to especially sharp price spikes during summer peak-day conditions." In other words, when it's needed most, wind doesn't just fail to show up--it hurts Texas consumers. Wind now makes for nearly a quarter of Texas's electricity generation mix, with more on the way.

Crom's Blessing

Correction 10/7/22

A previous version of this digest read that Chevron is the Venezuelan state oil company. This is incorrect. Petróleos de Venezuela S.A. (PDVSA) is the state oil company. The text has been altered to reflect this correction.