Black Summer for MISO

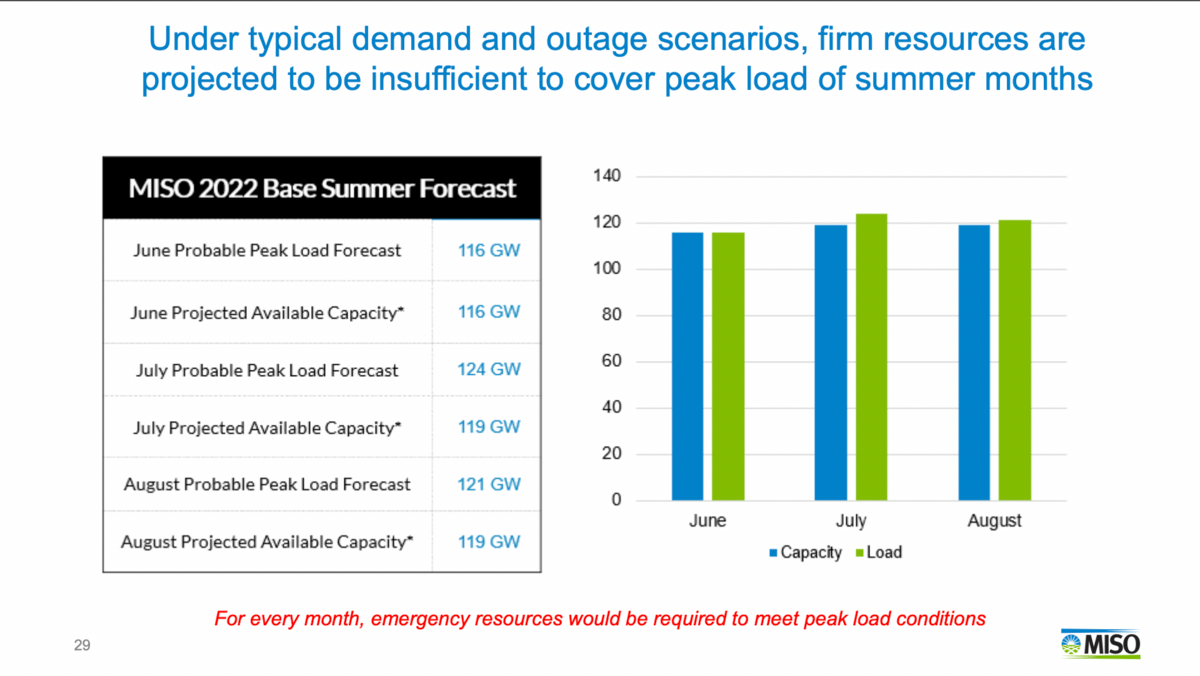

The Midcontinent Independent System Operator expects a 5 GW shortfall in firm generation to meet projected load this summer. This dire information was presented to stakeholders during its Summer Readiness Workshop last Wednesday.

“The seasonal assessment aligns with the cleared resources identified in the 2022-2023 Planning Resource Auction, which indicated capacity shortfalls in both the north and central regions of MISO and leaving those areas at increased risk of temporary, controlled outages to preserve the integrity of the bulk electric system,” said JT Smith, executive director – market operations at MISO.

To put that in plain English: This shouldn't surprise anyone. We won't have enough juice on the grid to keep the lights on without imports. Many places may experience rolling blackouts to avoid a Big Blackout.

As we covered last month, prices are skyrocketing in the northern part of MISO. The price of electricity in MISO's capacity auctions leaped from $5/MW-day a year ago to $236.66/MW-day across its central and northern regions due to an increase in projected electricity use coupled with a drop in power supply.

High prices mean limited juice. Limited juice potentially means blackouts. And going into the summer that limited juice amounts to a 5 GW shortfall. And that's because reliable generators--like coal and nuclear--have been retired and replaced with renewables and natural gas.

Utility Dive reports that this summer MISO "is anticipating a warmer-than-normal summer and an active hurricane season, and it is also monitoring for drought conditions. According to MISO’s forecast, probable load in July will peak at 124 GW, with only 118.5 GW of probable generation. Smaller shortfalls are projected in June and August as well."

So the question is whether or not MISO can rely on imports to shore up the gaps. The answer is ambiguous.

When Isaac Orr from the Center of the American Experiment asked MISO about the firmness of the needed imports, it became clear that MISO knows some of the wind capacity they're hanging their hat on might not show up--it's intermittent and non-dispatchable after all.

When asked for comment after the meeting, Orr said that "MISO says emergency resources and non-firm energy imports are projected to be needed to maintain system reliability." MISO will need to invoke emergency services, e.g. asking large industrial consumers to voluntarily reduce electricity consumption to help keep the lights on.

"This voluntary reduction," Orr explained, "is called a load modifying resource, or LMR."

The problem is that MISO could find itself in a position where the non-firm imports don't show up. MISO tends to import from its eastern neighbor, PJM. But the painful lesson (as Californians learned in 2020) is that your neighbors don't always have electricity to spare.

"Emergency 'max gen' events are also becoming more frequent as the amount of dispatchable capacity on the system declines," Orr continued.

The date that popped up throughout the meeting , when MISO declared a "max gen" event. At noon on that day, "wind was producing just 7.7 percent of its potential output, according to Energy Information Administration data. This total is about half of the capacity accreditation of 15 percent given to wind turbines," Orr said.

"Any resource can underperform its capacity accreditation based on the circumstances, but underperformance for wind and solar is a feature, not a bug. This is why I call capacity accreditations for wind and solar 'phantom firm' resources. Maybe they will produce at this level, but maybe they won't."

To prepare for the situation, MISO says that it's "training and conducting exercises with member companies to prepare for the worst-case scenarios and to implement lessons learned and best practices. During Real-Time operations, unplanned outages and other variables may require additional actions to maintain grid reliability."

They're preparing the best they can under the conditions they're in, which is all anyone can ask of them. ISOs are policy takers, not policy makers. That being said, some living in MISO could be in for a black summer.

Biden Appoints NRDC Alumnus to Nuclear Regulatory Commission

Biden has appointed two people to fill out the Nuclear Regulatory Commission's roster. One of them has relevant experience and the other is an alumnus of the Natural Resources Defense Council, an anti-nuclear environmental organization.

The first, Annie Caputo, has worked with the commission before and has "held positions involving nuclear fuel and government affairs at Exelon Corporation." You can read more about her here.

The other, Bradley R. Crowell, spells bad news for American nuclear. He "served in the Obama administration and in 2013 was confirmed by the Senate as assistant secretary of energy for congressional and intergovernmental affairs." From 2004 to 2007, Crowell worked as a legislative advocate for the NRDC.

The NRDC, once helmed by Biden's climate advisor Gina McCarthy, played a huge role in shutting down the Indian Point nuclear power plant last year. It is currently working to close the Diablo Canyon plant in California. The organization's anti-nuclear victories go back decades. In the 1980s, one of its lawyers, Ralph Cavanagh, took California's nuclear moratorium to the Supreme Court and won.

The NRDC, along with the Environmental Defense Fund, made for a more sophisticated wave of the patently Malthusi postwar environmental movement. Rather than rely on democratic politics, they took the fight to the courts.

We can only hope the Senate sees the wisdom in blocking a man who cut his teeth in such a poisonous and ideological organization from securing a seat at the NRC. Our clean air depends on it.

Conversation Starters

Putin has put together a retaliatory set of sanctions against the West. The Cabinet of Ministers will have ten days to decide who makes the list.

China's new lockdowns are bruising the global steel supply chain. China produces over half of the world's steel. The price of steel will likely remain high until other producers can fill in the gap, which is unlikely to happen soon.

Last month, US oil shipments to Europe have hit their highest mark sine 2016.

Word of the Day

estimated ultimate recovery

n.

The amount of oil and gas expected to be economically recovered from a reservoir or field by the end of its producing life. Estimated ultimate recovery can be referenced to a well, a field, or a basin. (source)

Crom's Blessing