Welcome to Grid Brief! Today we’re looking at power generation in America’s monopoly utility areas.

Monopoly Area Monday

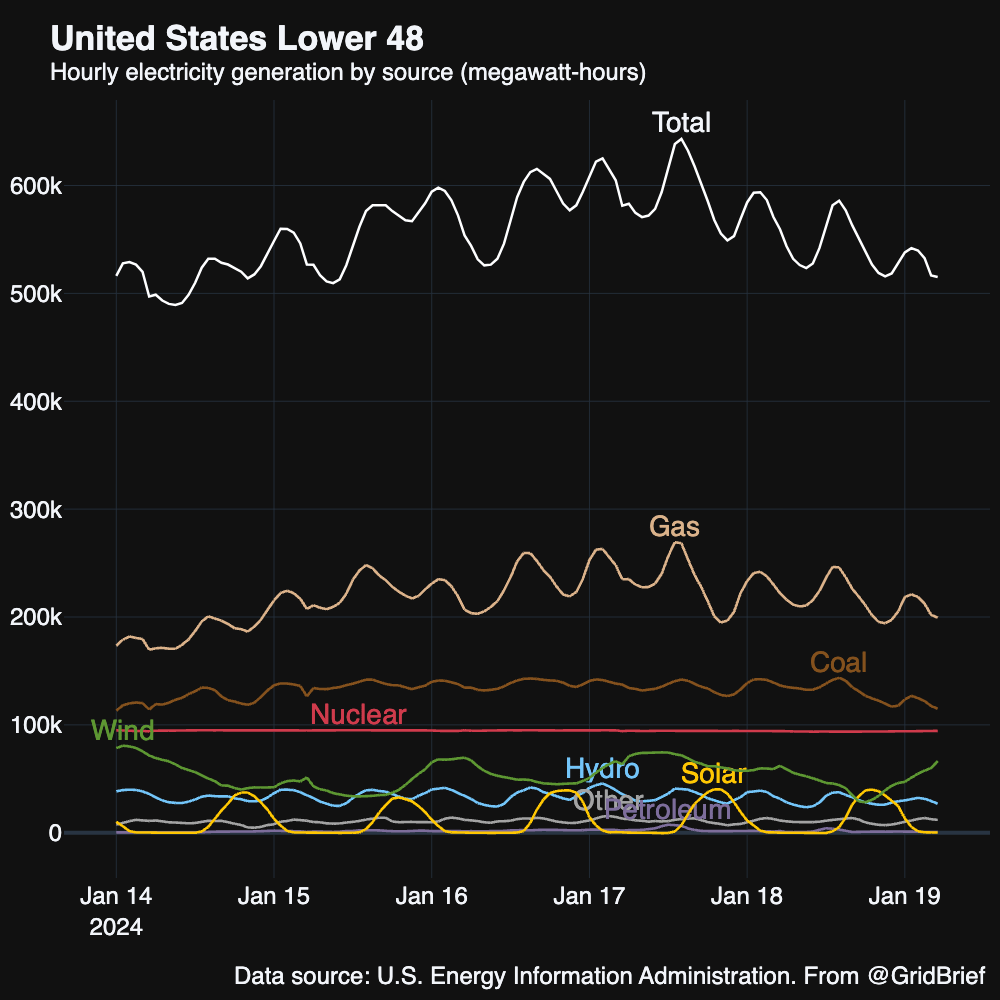

Let’s take a look at generation nation-wide:

Here’s a map to orient you as we move through the areas:

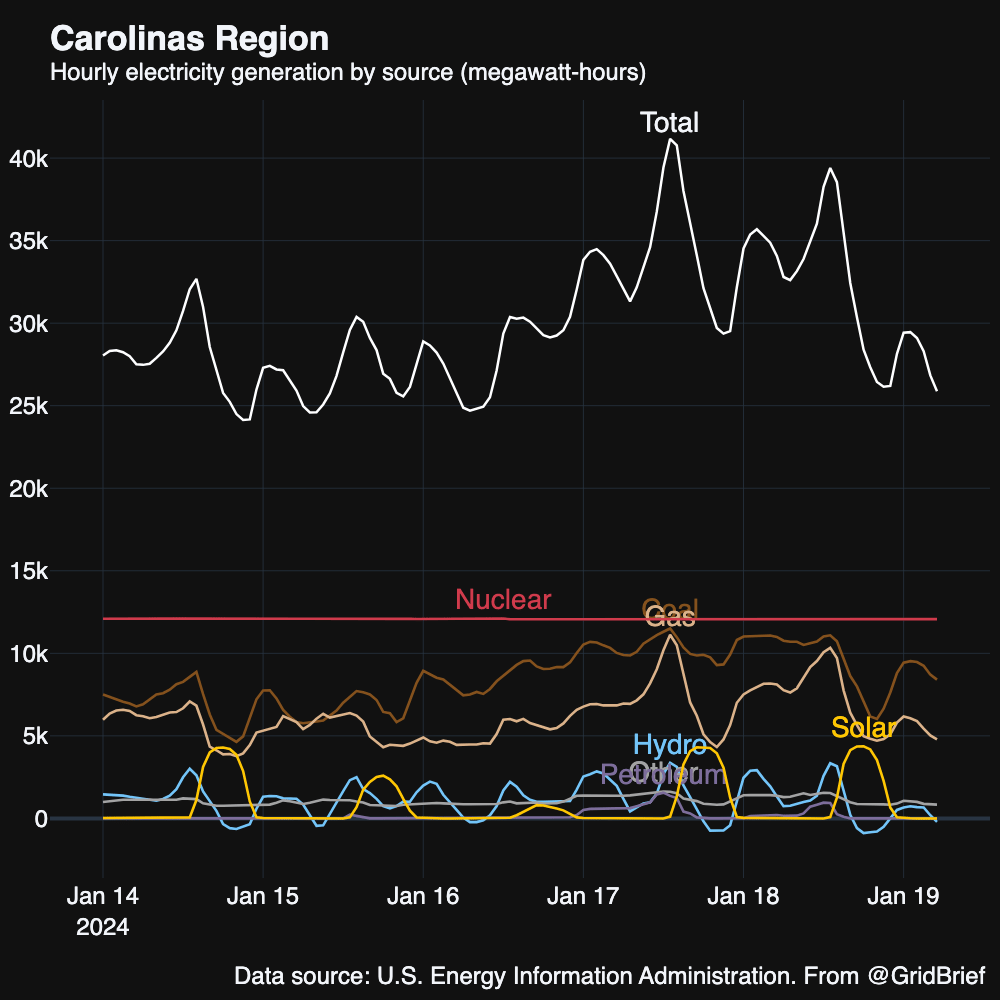

Carolinas

Nuclear, coal, and natural gas kept the Carolinas running.

North Carolina just increased legal penalties for damaging power infrastructure. “The measure would make it a high-grade felony to purposefully damage or attempt to damage an energy facility, including those that transmit or distribute electricity or fuel, and any associated hardware, software or digital infrastructure,” reports US News. The bill comes after a substation was attacked in Moore County in 2022, leaving tens of thousands without power.

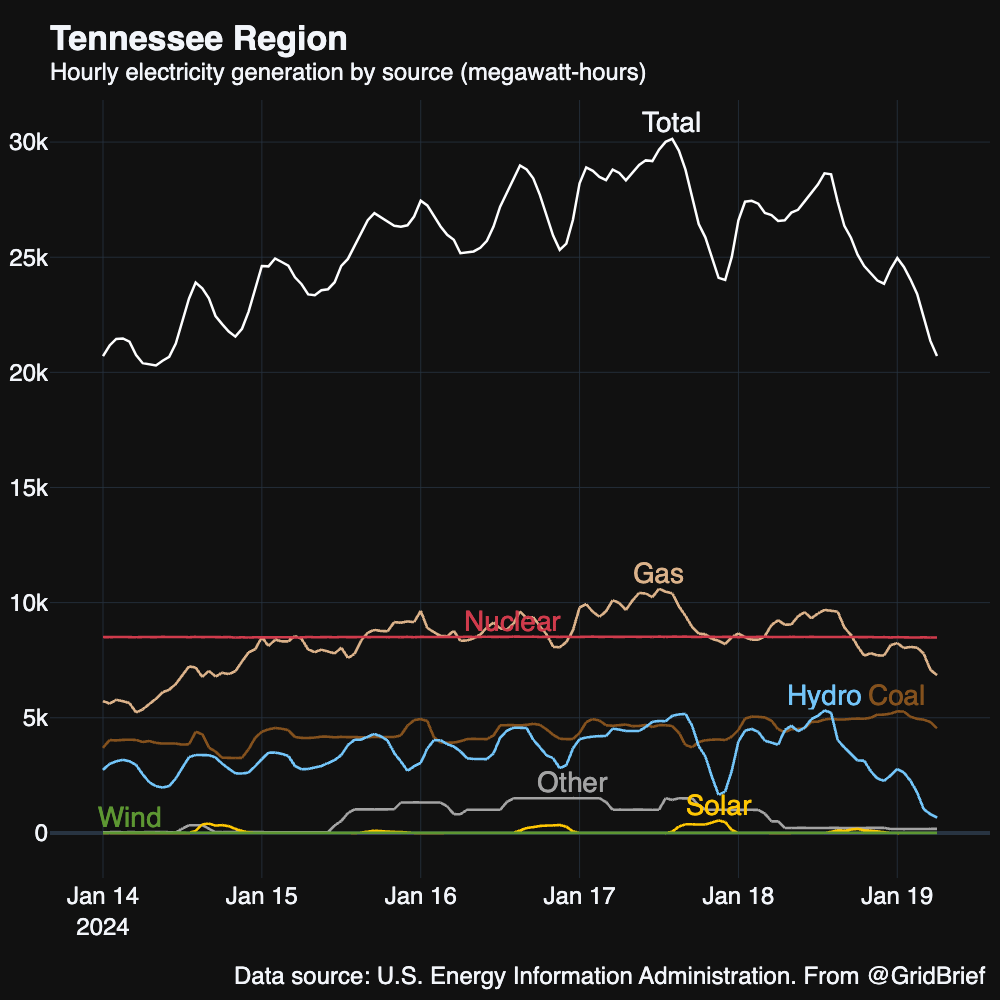

TVA

Nuclear and natural gas traded first and second place, while hydro and coal swapped third and fourth in America’s largest public power entity.

The Federal Energy Regulatory Commission approved a 32-mile pipeline to be built by the TVA. The pipeline is meant to serve a 1450 MW combined cycled gas plant to replace the TVA’s Cumberland coal plant. FERC’s decision comes after the TVA warned that it may have had to keep Cumberland online without approval for the pipeline. As covered by E&E News, the approval signaled a divide among FERC commissioners. Commissioner Mark Christie (R) and Chairman Willie Phillips (D) both approved the pipeline, while Commissioner Allison Clements (D) dissented.

Southeast

Natural gas, coal, and nuclear were the top three generators in the Southeast.

Georgia Power has requested to expand its generating capacity: “Georgia Power's proposed plan — which it says is necessary because of an unexpected growth in the number of new industrial customers expected to move into Georgia in the coming years — involves building 1,400 megawatts of natural gas generation in Georgia as well as buying 750 megawatts of power from Mississippi Power, enabling that company to delay the scheduled shutdown of a coal plant there,” reports the Macon Telegraph.

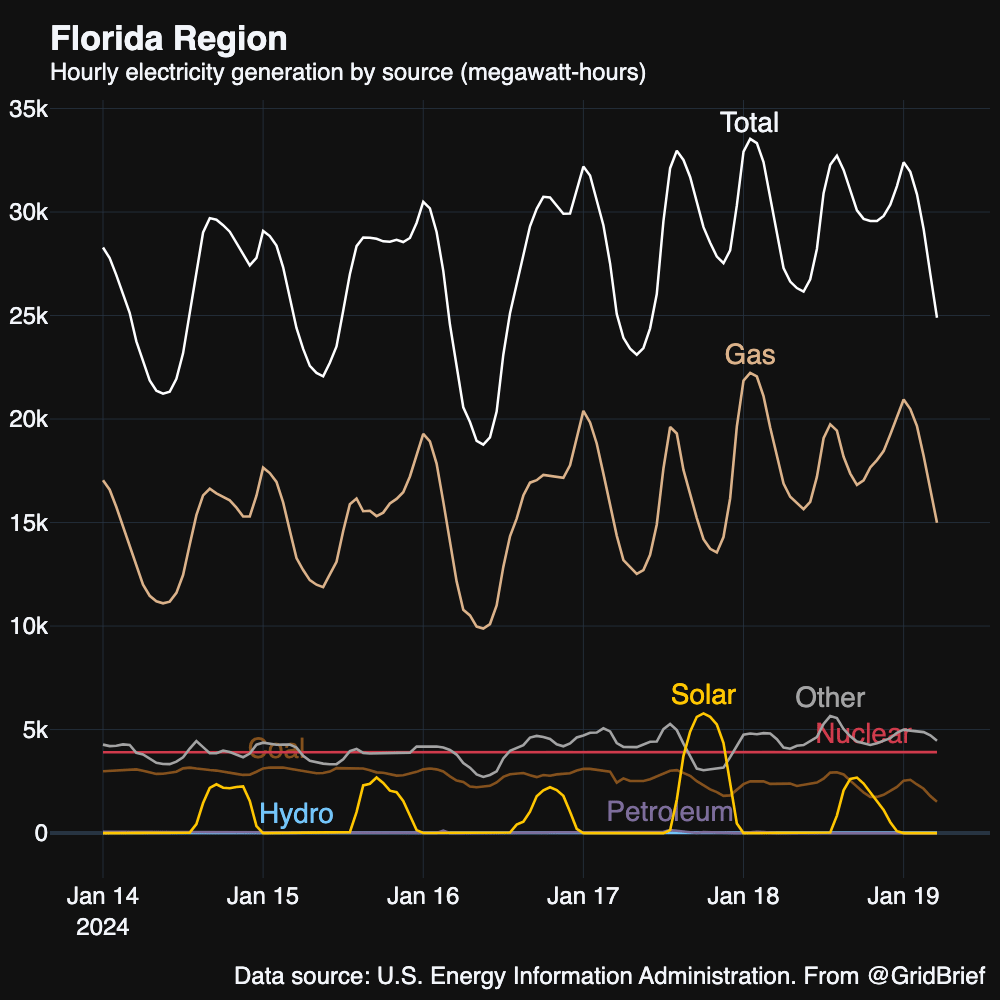

Florida

Natural gas, nuclear, and “other” were the big three in the Sunshine State, though solar did have a big day on the 18th.

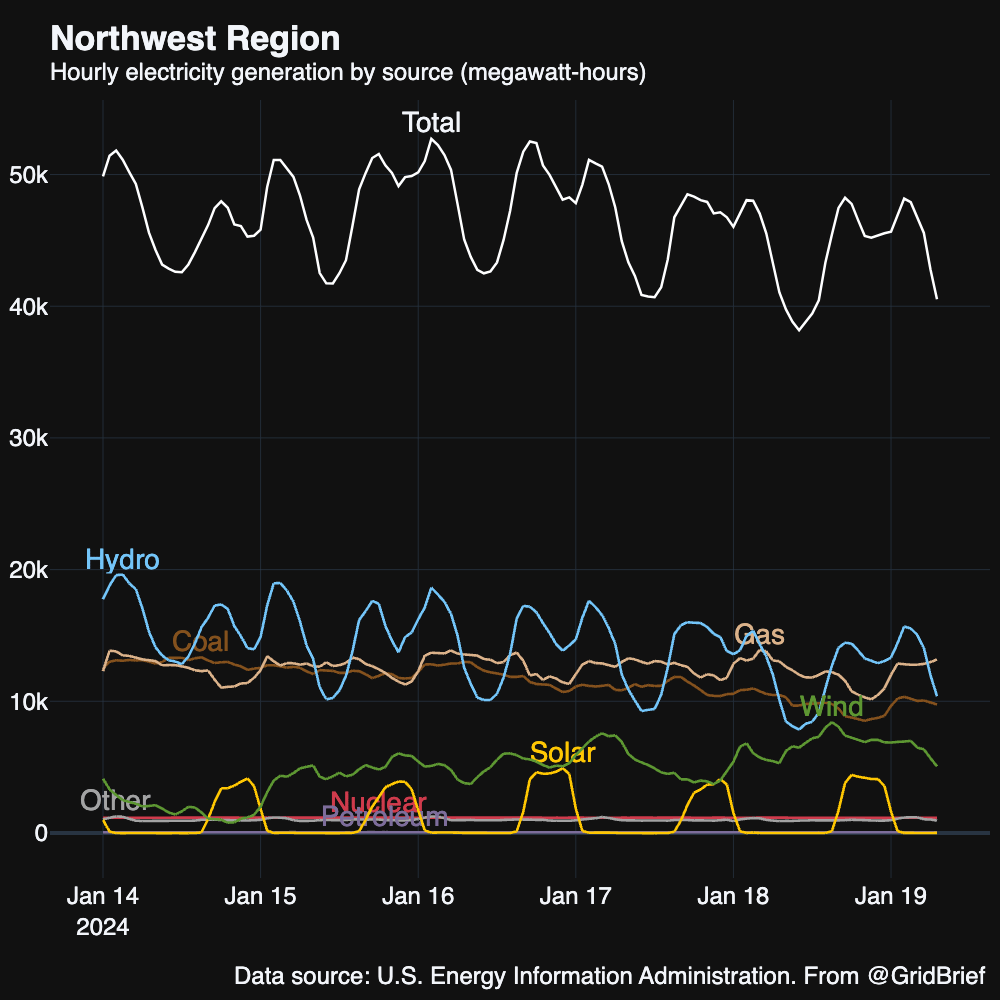

Northwest

Hydro, natural gas, and coal kept the lights on in the Northwest.

Utilities in the Northwest have been restoring power to those who lost it in last week’s arctic blast.

Pueblo, Colorado, which is zoned in the Northwest by the Energy Information Administration, is debating getting an SMR to replace its slated-to-retire Comanche coal plant. For a deep dive into that dispute, check out our premium coverage.

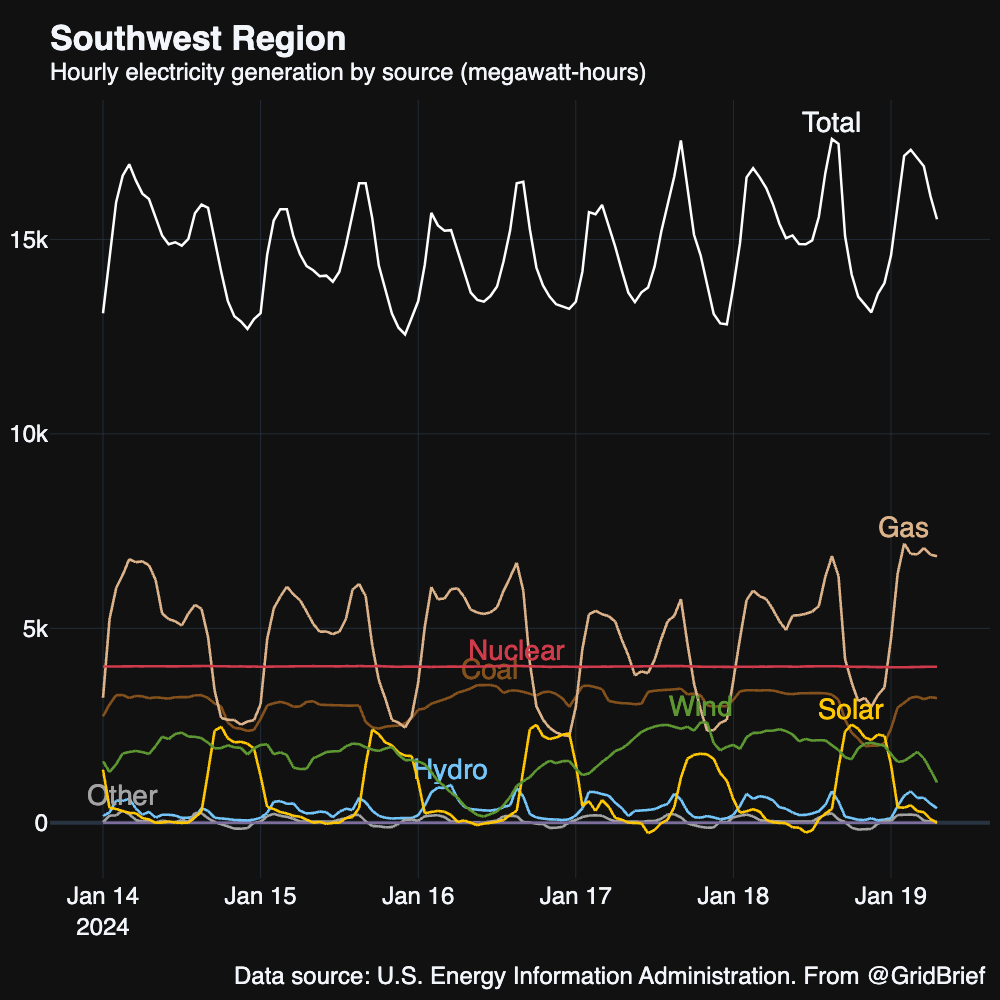

Southwest

Natural gas, nuclear, and coal kept the Southwest humming.

More solar projects are likely to come to the region. “The U.S. Bureau of Land Management on Wednesday unveiled an updated solar roadmap that proposes opening 22 million acres for developing utility-scale solar on public land in 11 Western states,” reports Utility Dive. “The proposal refines the BLM’s existing maps of land open to solar development in Arizona, California, Colorado, Nevada, New Mexico and Utah, and adds new maps of potential development areas in Idaho, Montana, Oregon, Washington and Wyoming, according to a press release from the U.S. Department of the Interior.”

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Ford slashes F-150 Lightning production as demand weakens. “About 1,400 employees will be impacted as the Rouge Electric Vehicle Center transitions to one shift beginning April 1, the Dearborn, Michigan-based automaker said Friday in a statement,” reports Bloomberg. “The company said it expects continued growth in global EV sales in 2024, though it will be less than anticipated. Last month Bloomberg reported that Ford would cut production goals for the F-150 EV in half this year.”

Russia became China’s biggest oil supplier in 2023. “Russia shipped a record 107.02 million metric tons of crude oil to China last year, equivalent to 2.14 million barrels per day (bpd), the Chinese customs data showed, far more than other major oil exporters such as Saudi Arabia and Iraq,” reports Reuters. “Imports from Saudi Arabia, previously China's largest supplier, fell 1.8% to 85.96 million tons, as the Middle East oil giant lost market share to cheaper Russian crude.”

Qatar and India eye a long-term LNG contract. “Qatar Energy within weeks could sign a long-term deal to provide liquefied natural gas (LNG) to Indian buyers on cheaper and more flexible terms than existing contracts, trade sources said, as India seeks to meet a goal to increase the fuel's use,” reports Reuters. “The Indian companies and Qatar Energy have agreed on terms and a contract could be signed by the end of this month or early in February, one of the sources said, adding the contract offering destination-flexible cargoes and lower pricing, would run until at least 2050, possibly longer. It would extend contracts set to expire in 2028 for the supply of 8.5 million metric tons per year (tpy) LNG to Indian buyers and play a part in meeting Prime Minister Narendra Modi's aim to raise the share of natural gas in the country's energy mix to 15% by 2030 from 6.3% now.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!