Welcome to Grid Brief! Here’s what we’re looking at today: offshore wind projects get rebid in New York, FERC and the NRC talk nuclear energy, and more.

Offshore Wind Developers Rebid in NY

On Thursday, the New York State Energy Research and Development Authority announced several bids for offshore wind projects in a solicitation geared toward allowing developers to rebid on projects that had become economically non-viable.

“Equinor rebid its 816-MW Empire Wind 1 project after announcing a split with previous co-developer BP that will see Equinor taking full ownership of the Empire Wind lease and projects, while BP takes ownership of the Beacon Wind lease and projects,” reports Utility Dive.

BP is set to take a pre-tax impairment charge of about $600 million, while Equinor anticipates losses of around $200 million total. Some BP analysts believe that the company overpaid for its stake in Beacon Wind when it bought its stakes in the project for $1.1 billion in 2020.

Ørsted also rebid its 924-MW Sunrise Wind project in the solicitation, acquiring a 50% share from Eversource.

“If Sunrise Wind is not successful in the solicitation, the existing [Offshore Wind Renewable Energy Certificate] contract for Sunrise Wind will be cancelled per the state’s requirements, and Ørsted’s and Eversource’s 50/50 joint venture for Sunrise Wind will remain in place. In that scenario, the joint venture will evaluate its next steps,” the company said in a statement. “If the project is provisionally awarded, a new contract will be negotiated with NYSERDA under the updated terms of the current solicitation.”

“RWE and National Grid submitted a bid for a second 1.3-GW Community Offshore Wind project, after the first was awarded a power supply contract in October,” Utility Dive added.

The rebids signal continued faith in offshore wind as a clean energy technology, but soaring costs have continued to swamp offshore wind in America. Last year, the offshore wind industry saw a wave of cancelations.

Onshore wind has begun to suffer challenges of its own. At the end of last year, European wind giant Enel lost to the Osage Tribe in Oklahoma over its illegal wind installation on tribal lands. The company was forced to remove 84 turbines on 8400 acres of land, a $300 million loss. It is the biggest legal defeat in the history of renewable energy. For more on that, you can read our premium coverage of the case.

FERC and NRC Talk Nukes

The Federal Energy Regulatory Commission and the Nuclear Regulatory Commission met last week to discuss nuclear power’s status in America.

Here are the three main takeaways:

America has 25 small modular reactor license applications on the way into 2029. The reactors are up to 200 MW in size.

Utilities are working with the NRC to keep their current plants running—both agencies lauded California’s decision to keep PG&E’s Diablo Canyon Nuclear Power Plant online.

FERC stressed the importance of nuclear for a low-carbon, reliable energy future. The North American Electric Reliability Corp. emphasized this point in a presentation at the meeting that showcased the uncertainties a renewables-heavy grid poses for reliability. According to NERC’s presentation, the agency expects 83 GW of fossil and nuclear capacity to retire by 2033, while its anticipates 62 GW of solar, 29 GW of gas, 21 GW of batteries and 5 GW of wind to come online—a gain of 34 GW of nameplate capacity, but much of it non-dispatchable and intermittent.

Will SMRs be able to inject reliability in time to catch the wave of retirements? Given that electricity demand also looks to rise simultaneously, as we recently covered in last week’s premium Deep Dive, it’s unlikely. SMRs are new technologies and first-of-a-kind builds are steep engineering challenges. While any successes would be a welcome addition to America’s power sector, NuScale, the company farthest along in the SMR space, just had one of its first projects fall apart before shovels met the earth.

However, it is heartening to see mutual appreciation for nuclear between the agencies, especially the NRC, which has been a historically hostile regulator.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Germany’s “wind harvest” wanes. “Years of network expansion on land in Germany has led to a drop in the proportion of offshore wind power contributed from the North Sea to the country's total wind energy output, Dutch grid operator TenneT said on Monday. In 2023, the share of offshore wind power from the North Sea fell for the first time to 13% in Germany, from 17% in 2022, TenneT said,” reports Reuters. “Netherlands-owned TenneT operates the Dutch high-voltage grid and part of the German grid, and is key in the energy transition away from fossil fuels. ‘The 'lost years' are now increasingly having an impact on the 'wind harvest' in the North Sea,’ TenneT Chief Operating Officer Tim Meyerjuergens said, referring to years of wind power capacity expansion on land.”

More delays for Trans Mountain. “Canadian heavy crude weakened as the Trans Mountain pipeline expansion faces yet another delay due to ‘technical issues’ that emerged during construction,” reports Bloomberg. “The state-controlled pipeline company is working to ‘determine the safest and most prudent actions for minimizing further delay,’ according to a statement. The company didn’t provide a new estimate for start-up of commercial operations, which had been planned for April, but said it’s still working ‘towards the anticipated in-service date in the second quarter of 2024.’”

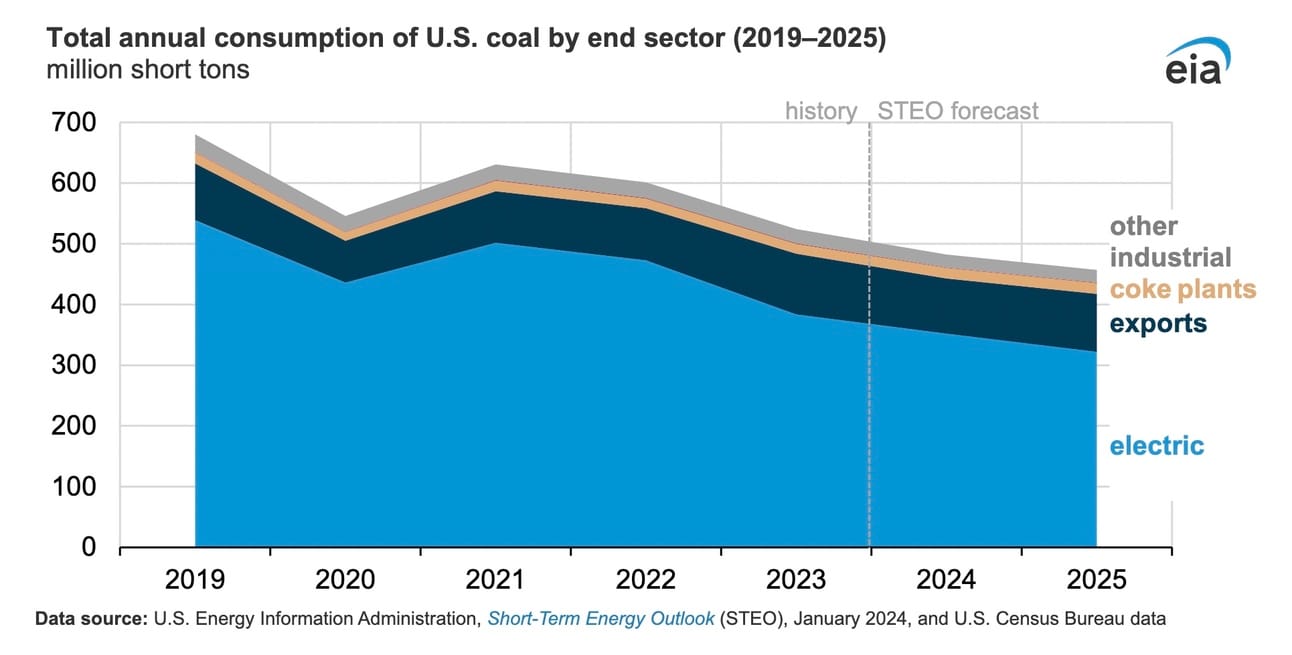

US coal exports gain share of shrinking market. “We expect U.S. coal consumption will total 482 million short tons (MMst) in 2024, 29% less than in 2019. We expect that exports will make up 19% of total demand in 2024 and 21% in 2025, up from a share of 14% in 2019 because of decreasing domestic consumption, especially from the electric power sector,” reports the Energy Information Administration. “We expect that the U.S. electric power sector will consume 73% of U.S. coal in 2024 and 70% in 2025, down from 79% in 2019. In 2019, the U.S. electric power sector consumed 539 MMst of coal, while exports totaled 94 MMst. Coal consumption declined substantially across all sectors in the pandemic year of 2020 and then returned to pre-pandemic levels in 2021.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!