Welcome to Grid Brief! It’s time for our weekly look at what’s keeping the lights on in America’s power markets.

What’s Keeping the Lights On?

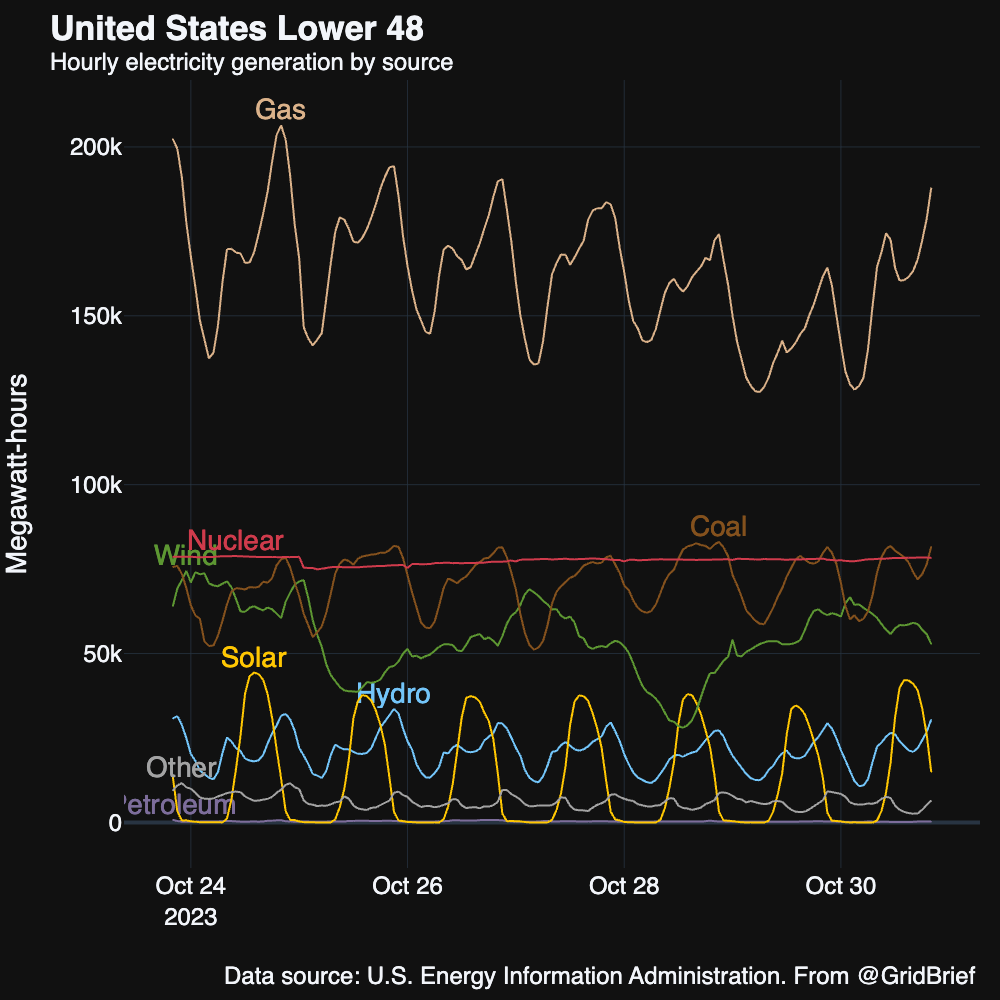

Let’s take a look at generation nation-wide before diving in:

Natural, nuclear, and coal with some surges from wind.

And the region map to orient you:

ISO New England

Natural gas nuclear and hydro power kept New England humming.

ISO-NE released its latest Regional System Plan. Like other grid operators, ISO-NE highlighted the challenges national energy policy poses for grid reliability.

“Results of the recent Future Grid Reliability Study indicate that an exclusive reliance on wind, solar, and battery resources would pose significant reliability challenges,” the grid operator said in a press release. “The interregional exchange of power will become more important as New England and neighboring regions electrify, decarbonize, and diversify. However, since these regions often experience the same weather conditions, counting on import when the grid is most stressed will need to be carefully evaluated.”

In other words: if all states and regions are committed to make wind, solar, and batteries a larger share of their energy portfolios, there will be less dispatchable power to go around for everyone.

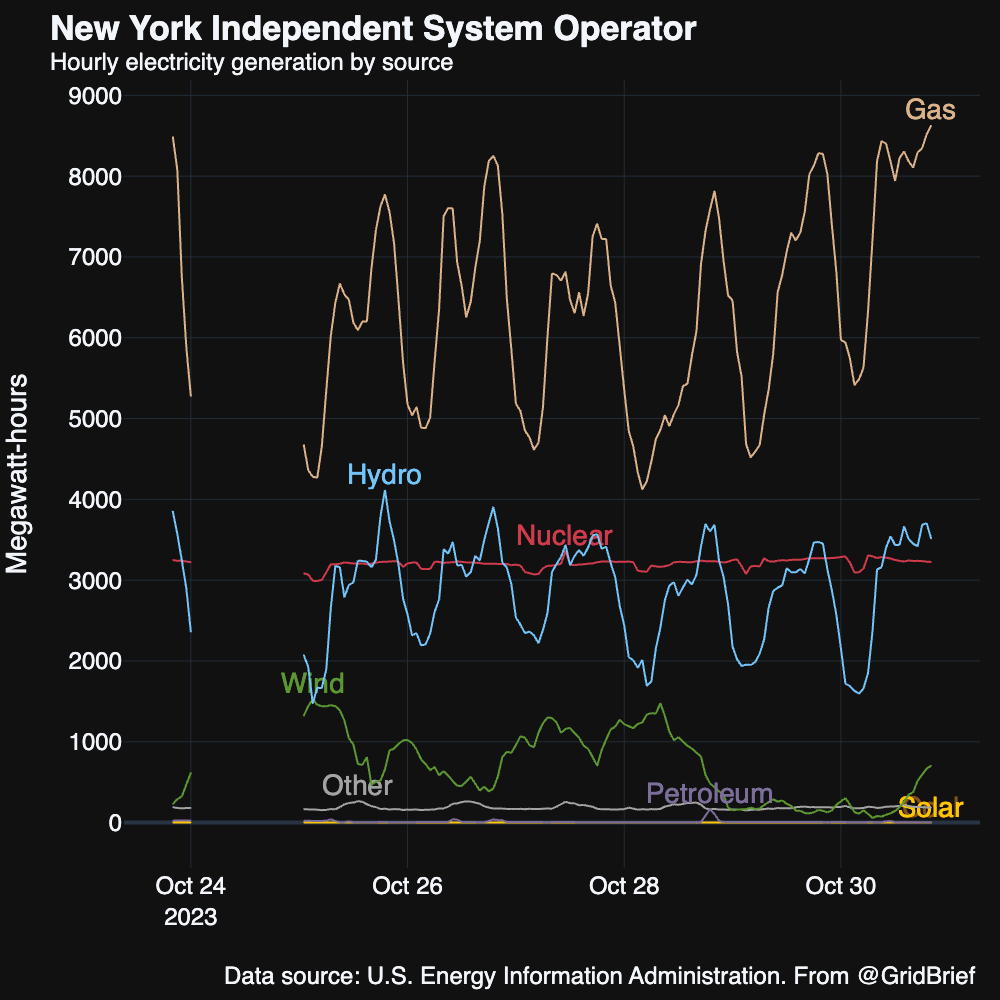

New York ISO

Like New England, gas, nuclear, and hydro powered the Empire State. A data glitch from the Energy Information Administration obscures wind’s output on the 25th, which may have been substantial.

Note: some of the following regions will share the same EIA data gap as NY-ISO.

PJM

Natural gas and nuclear swapped first place for the top generator in America’s largest power market. Coal maintained a distant third.

PJM has selected two FirstEnergy transmission lines (totaling $373m) to handle load from data centers.

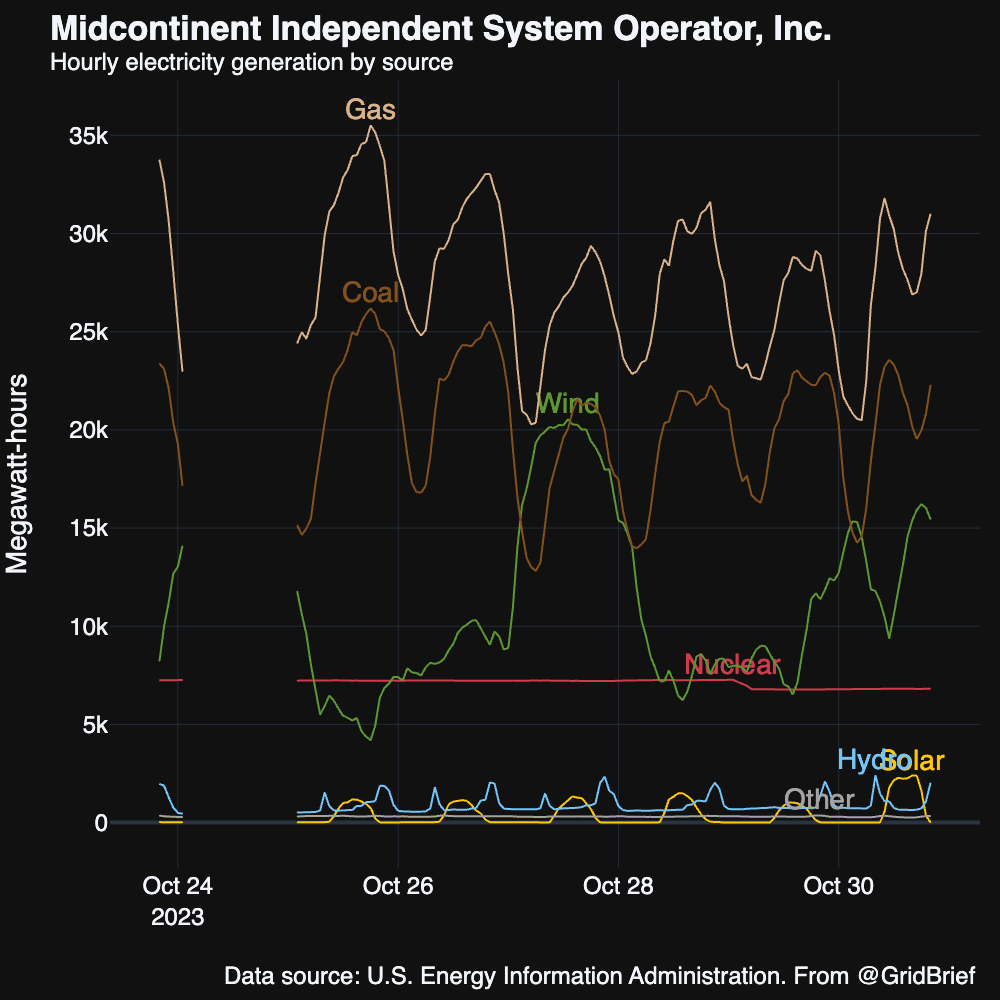

MISO

Natural gas and coal held first and second place in the Midcontinent Independent System Operator footprint—mostly. Wind had a gusty week, overcoming coal at least twice.

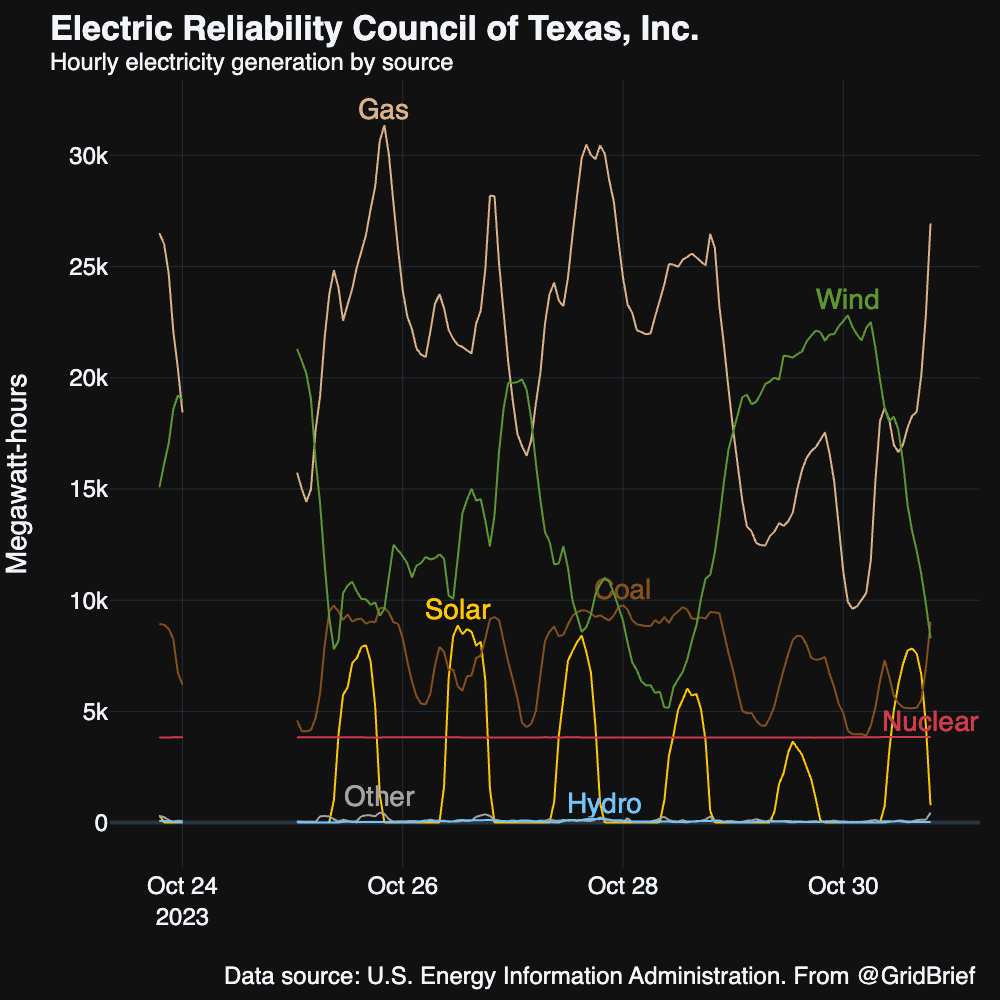

ERCOT

Wind had a big week in Texas, too. It overcame natural gas at least twice to snag the top spot in the Lone Star state. Coal sat in third, though solar did peak above it here and there.

SPP

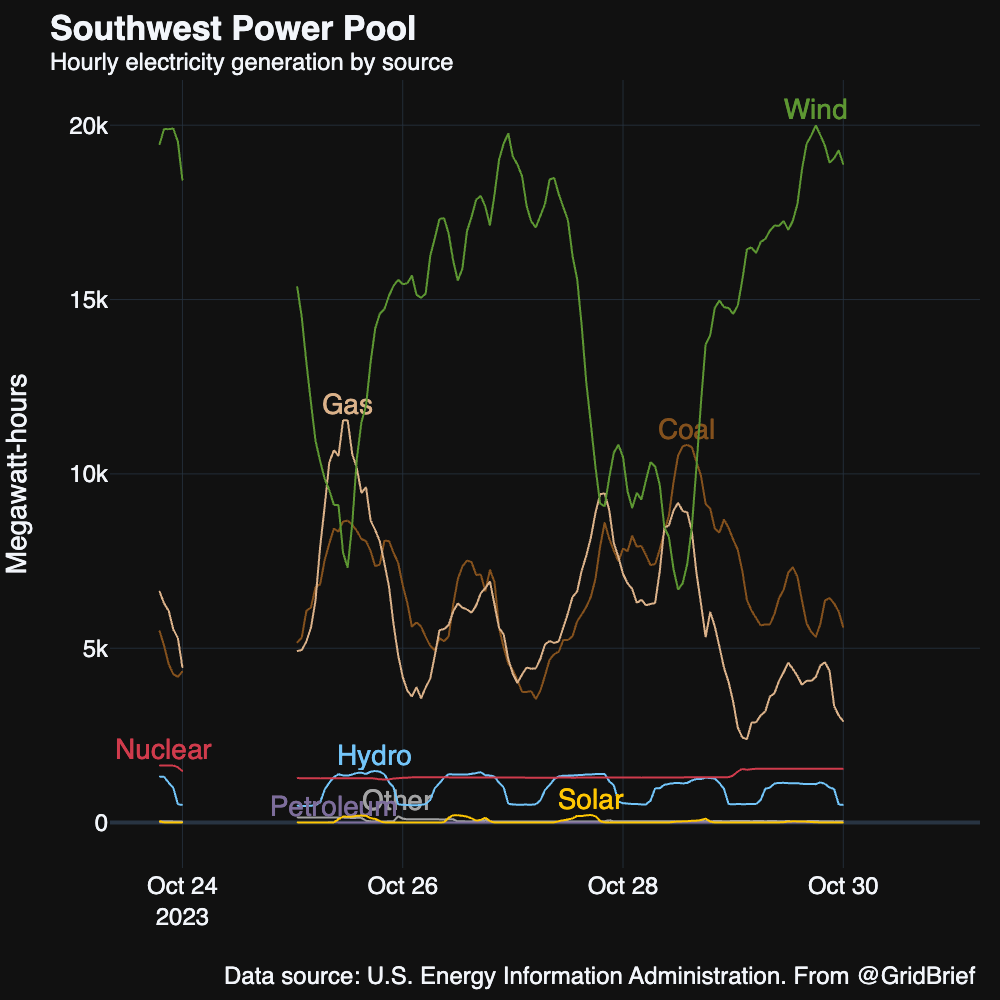

More flowers for wind in the Southwest Power Pool. Natural gas and coal stayed in second and third, but ramped whenever wind fell.

California

In California, natural gas and solar traded off first place while wind and hydro scrummed for third.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Conversation Starters

Canadian Solar is investing in a build cell plant in America. “Canadian Solar said on Monday it would invest $800 million to build a solar photovoltaic (PV) cell production facility at the River Ridge Commerce Center in Jeffersonville, Indiana,” reports Reuters. “The company said the plant would produce cells with an annual output of 5 gigawatts (GW), equivalent to about 20,000 high-power modules per day.”

German oil consumption drops. “Oil consumption in Germany is set for a sharp slump this year as the malaise in Europe’s largest economy subdues demand for vital industrial fuels,” reports Bloomberg. “Germany’s overall oil usage is forecast to drop by about 90,000 barrels-a-day this year, according to the Paris-based International Energy Agency. That decline is being driven by sharp contractions in demand for diesel and naphtha — both closely linked to economic activity.”

Could the fossil fuel industry face credit downgrades? “Much of the fossil fuel industry may be facing an era of credit downgrades if producers prove too slow to adapt to a low-carbon future, according to Fitch Ratings. Oil and gas companies stand out as the most vulnerable issuers in an analysis by Fitch, which sought to gauge how businesses will cope with climate risks such as increasingly stringent emissions regulations,” reports Bloomberg. “Fitch’s models show that more than a fifth of global corporates across regions and sectors face a material risk of a ratings downgrade due to an ‘elevated’ level of climate vulnerability over the coming decade. Half of those issuers are in the oil and gas industry, while coal and utilities also stand out as being particularly exposed to the risk of downgrades, the analysis shows.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.