Welcome to Grid Brief! Today, we’re looking at the generation mix in America’s major power markets.

What’s Keeping the Lights On?

As usual, let’s begin with a look at nation-wide generation.

Natural gas and nuclear energy provided the top two sources of power over the week nation-wide, save for a brief moment when coal leapt over nuclear. Coal and wind swapped third place several times.

Here’s a map to orient yourself as we move through the power markets:

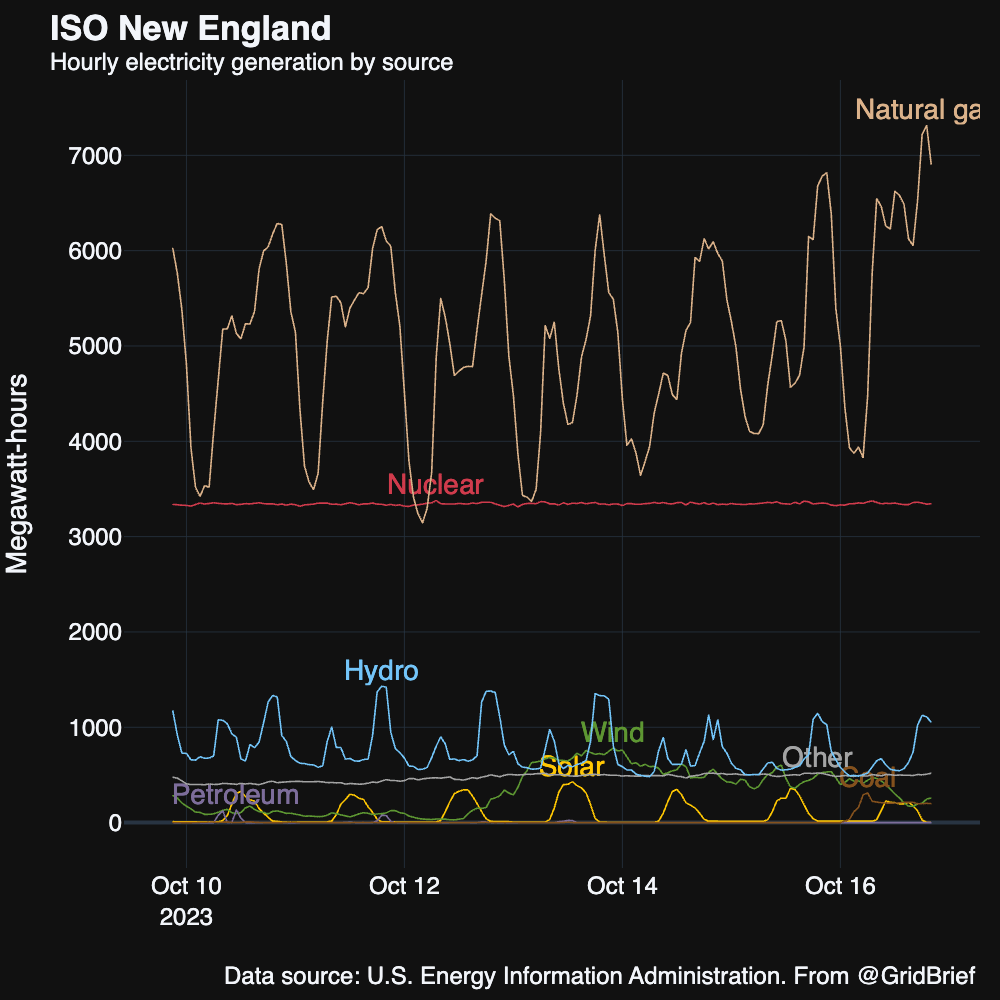

ISO-New England

Natural gas was New England’s main source of power for the week, except for a brief interval in which nuclear moved from number two to number one. Wind and solar had a poor showing and mostly sat below hydro.

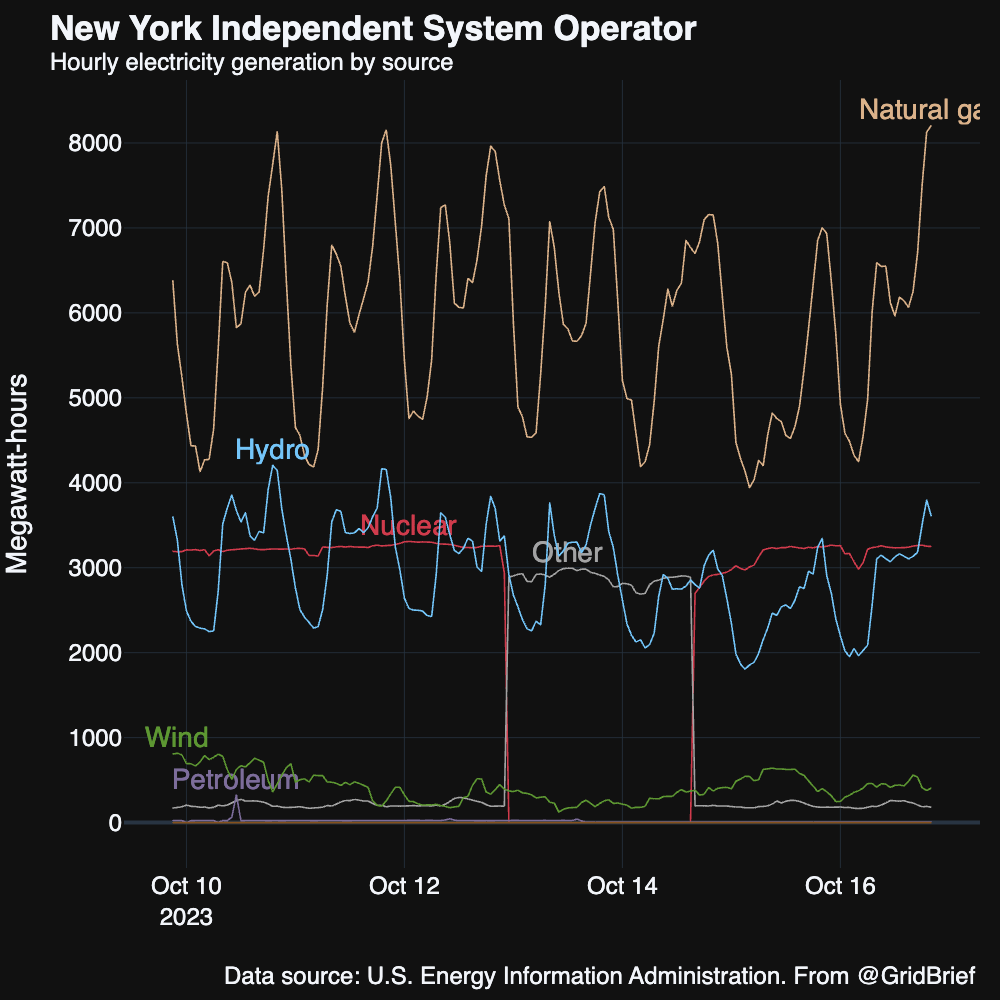

New York ISO

New York saw its normal trio—natural gas, hydro, and nuclear—at the top save for a planned nuclear outage from the 13th to the 15th which was covered by “other” (probably made up of imports from neighbors).

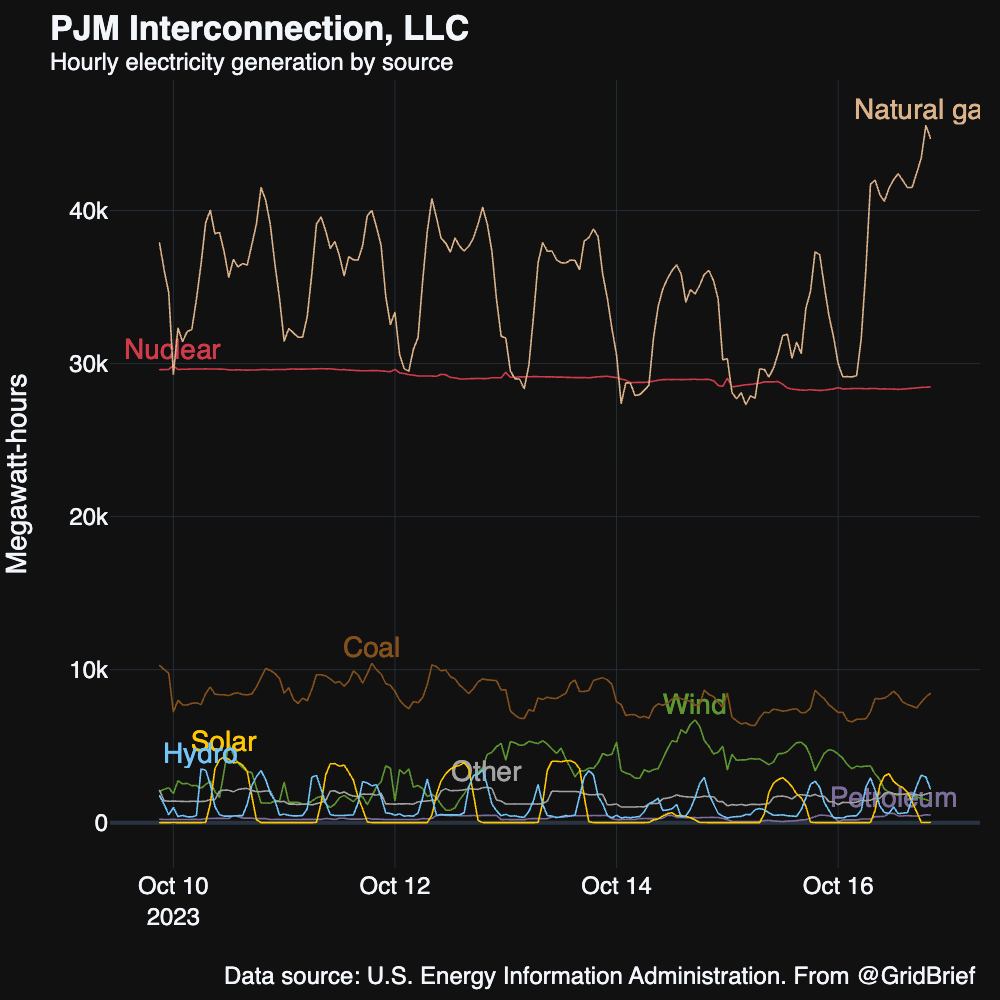

PJM

Natural gas and nuclear were far and away the most prolific generators in America’s largest power market. Coal sat at a distant third.

Last Friday, PJM proposed reforms to its capacity markets to ensure greater reliability. “One filing aims to enhance PJM’s resource adequacy risk modeling and capacity accreditation processes and bolster its testing requirements for capacity resources,” reports Utility Dive. “The other filing centers on its offer cap and capacity performance rules, including taking a forward looking approach for determining energy and ancillary services revenue to calculate the offer cap and minimum offer price.”

PJM’s capacity markets helped keep the lights on during Winter Storm Elliott last Christmas. But Elliott caused major problems for gas pipelines, which in turn kept natural gas plants from generating during the storm. PJM is hoping to refine its capacity planning to account for such difficulties.

MISO

Natural gas and coal were the dominant generators in MISO, but wind usurped the number one spot twice.

According to a recent analysis from the Center of the American Experiment, MISO member Minnesota’s wind and solar fleets generate the most expensive power in the state.

ERCOT

The EIA has a data gap for October 15th in Texas. Regardless, wind had a solid week, snatching the number one spot from natural gas at various intervals. Coal, solar, and nuclear traded third place throughout the week.

As we recently reported, Texas is adding more natural gas generating capacity this year. More than half of standard cycle gas turbine capacity that has come online since 2022 can be found in Texas.

SPP

The EIA had so many data errors in Southwest Power Pool, we’re not covering it today.

CAISO

A typical week in California: lots of natural gas with a bunch of solar. CAISO weathered the 14th’s solar eclipse just fine.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Conversation Starters

Labor tensions in Australian LNG approach resolution. “Chevron and unions at its two liquefied natural gas facilities in Australia have agreed deal on a pay and working conditions, the union said on Wednesday, ending an impasse that had led unions to threaten renewed strikes at the export hubs this week,” reports Reuters. “The Offshore Alliance said in a statement it would call off strikes originally planned for Thursday after members approved the updated pay and conditions negotiated with Chevron. ‘If Chevron tries to alter the deal again our members will obviously have no choice but to consider taking protected industrial action,’ the union statement added.”

GM pauses on opening second EV plant in Michigan amid demand lull. “The company said Tuesday that the conversion of its Orion Assembly plant will move back by a year to late 2025 ‘to better manage capital investment while aligning with evolving EV demand.’ It also plans to make improvements to its electric trucks that could increase profitability, GM said in a statement,” reports Bloomberg. “The move comes as the automaker grapples with both slowing demand for electric models in the US and the prospect of higher labor costs in the next four years stemming from current union contract negotiations. The United Auto Workers has been striking for more than a month despite an offer for a 20% pay increase.”

France and Mongolia set the stage for a uranium project. “An agreement between Orano and Mongolian state-owned investment company Erdenes Mongol LLC sets out the framework for an investment agreement that will lay the foundations for a long-term relationship for the development and industrial operation of the Zuuvch-Ovoo uranium project in south-western Mongolia. The investment agreement is expected to be signed by the end of the year,” reports World Nuclear News.

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.