Welcome to Grid Brief! Today we’re looking at power generation in America’s traditional monopoly areas. Some readers have asked that a total generation line and a demand line be added to the graphs to contextualize the generation information. We’re working on integrating those—expect them early next year.

Monopoly Area Monday

Let’s take a look at generation nation-wide.

Natural gas, nuclear, and coal were the top three generators nation-wide until wind usurped coal towards the end of the week.

And here’s a map to orient you as we move through the monopoly regions.

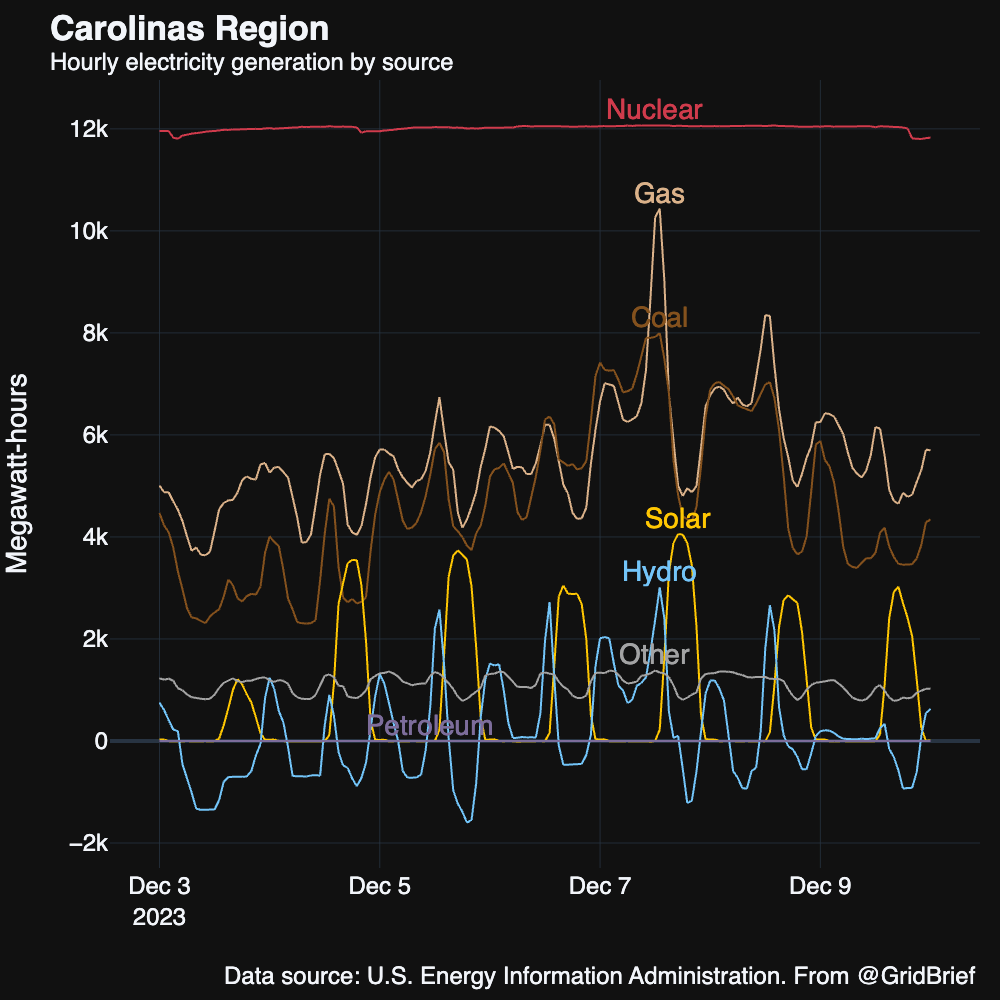

Carolinas

Nuclear, gas, and coal were the big players in the Carolinas, though solar had a productive week as well, despite its lackluster start.

Three thousand Duke Energy customers in the Durham area saw their power go out during severe weather and tornado warnings. By noon, their power had been restored. Duke plans to reduce rates for its customers by January 2024.

TVA

Nuclear, gas, coal, and hydro sustained America’s largest public power entity.

Extreme drought has winnowed the rivers and streams the TVA is tasked with overseeing in its footprint. Finally, some rain has come in and lessened the pain. However, the drought persists, which could lead to wildfires and low hydro power supplies. The TVA has also proposed its eighth gas power plant in three years—a half gigawatt generator in central Mississippi.

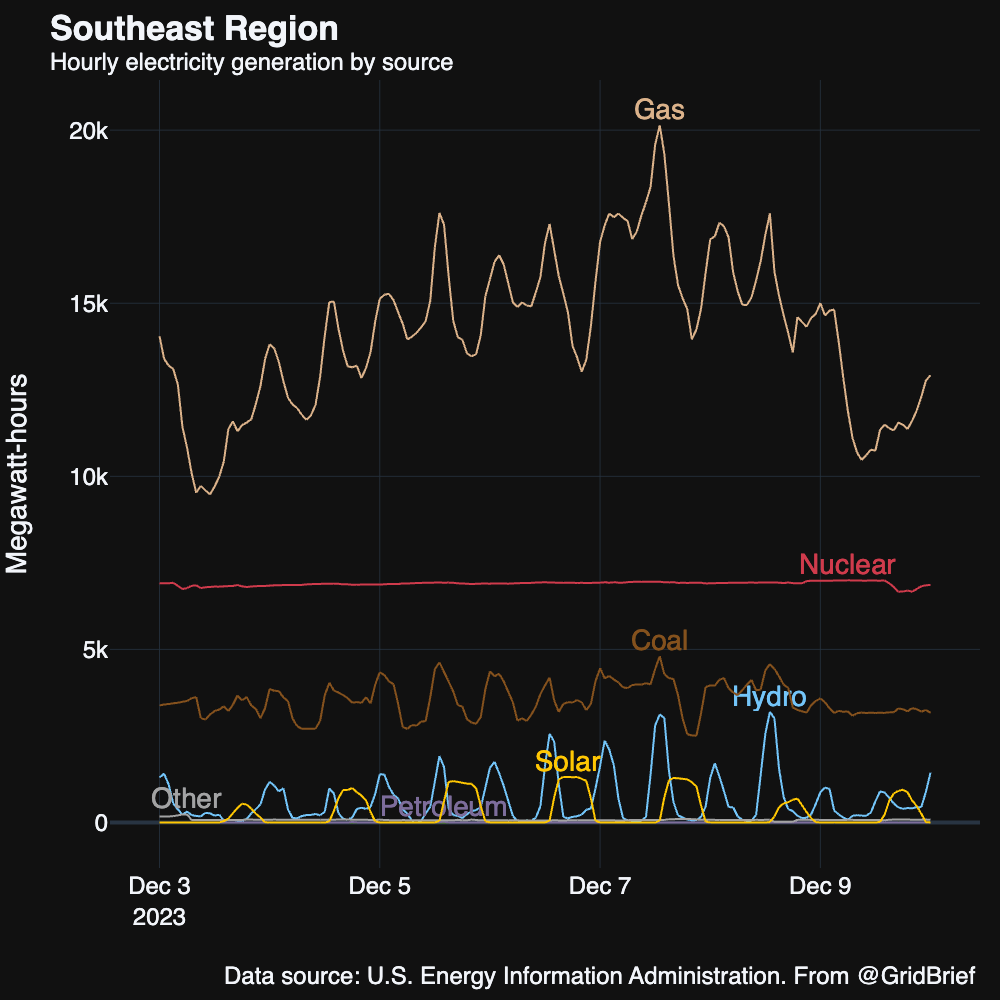

Southeast

Natural gas, nuclear, and coal were the top three generators in Southern Company’s footprint.

Florida

Natural gas, nuclear, and “other” (a smorgasbord of generation types that don’t disclose their classification for various reasons) powered the Sunshine state. Solar had a productive week as well.

For a look into Florida’s power situation, check out last Friday’s premium post:

Northwest

The Northwest generally maintains a steady top four: natural gas, hydro, coal, and wind. This week was no different, though wind was particularly volatile.

Last week, we covered the potential agreement to decommission several hydropower dams in the Pacific Northwest. The Energy Bad Boys took a look into what that would like for consumers: not good.

Southwest

Natural gas, nuclear, and coal were the workhorses of the Southwest, though solar demonstrated solid output while the sun was shining.

New Mexico’s state regulator has recommended rates 3% lower that what customers currently pay, a far cry from the 9.7% increase Public Service Co. of New Mexico was seeking. The Arizona Corporation Commission’s Chairman, Jim O’Connor, published a heated op-ed against ESG over the weekend.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

The US looks to restock its Strategic Petroleum Reserve. “The U.S. Department of Energy on Friday said it wants to buy up to 3 million barrels of crude oil for the Strategic Petroleum Reserve (SPR) for delivery in March 2024, as it takes advantage of lower prices to start to replenish the stockpile,” reports Reuters. “The administration of President Joe Biden last year conducted the largest sale to date from the SPR of 180 million barrels to try to limit an oil price rally after Russia's war on Ukraine began in February 2022. The Energy Department in October said it would buy back oil for the reserve at $79 per barrel or lower, after it had received an average of about $95 a barrel from last year's emergency sales. It plans to release monthly offers to buy crude for the emergency stash through May next year.”

South Africa begins to reconsider coal retirements. “South Africa’s cabinet approved an updated Integrated Resource Plan — a blueprint for the development of electricity provision over the next two-and-a-half decades,” reports Bloomberg. “The plan underpins how the government will address the nation’s energy crisis, Electricity Minister Kgosientsho Ramokgopa said in an online briefing Sunday. It will be released at an unspecified date by the Department of Mineral Resources and Energy for public comment, he said. The first timeframe will help the government ensure that ‘we are able to ameliorate the degree of the energy deficit that we are experiencing now,’ and anticipates that the South African authorities will need to ‘rethink the schedule’ for decommissioning power plants, he said.”

Russian crude may be back on the menu for India. “Easing global oil prices would help India boost imports from Russia, a senior government official said on Friday, as a lower than $60 a barrel price of Russian oil will enable buyers to use Western services such as insurance and ships,” reports Reuters. “The Group of Seven large economies known as G7 and some other nations have imposed a ceiling of $60 per barrel for oil at Russian ports to cut Moscow's revenue seen as funding its war in Ukraine. Russia's flagship grade Ural in Baltic ports has plunged since late November below that level, reflecting subdued global oil prices that are headed for a seventh straight weekly decline. India, the world's third biggest oil importer and consumer, emerged as the biggest buyer of Russian seaborne oil, shunned by the West over Moscow's invasion of Ukraine last year.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!