Welcome to Grid Brief! Today we’re looking at what’s kept the lights on in America’s major power markets.

What’s Keeping the Lights On?

First things first, here’s an overview of nation-wide generation. All images are pulled from the Energy Information Administration. They seem to be a little behind on updating their data, so there are some overlaps between this week’s and last week’s.

And here’s a map of America’s power markets to keep in mind as we move through each market—in other words, every region except the Northwest, Southwest, and the Southeast.

ISO New England

Despite what the data glitch that appears midway through indicates, New England had a typical week. Natural gas satisfied the majority of demand with nuclear in second place. Wind produced little and hydro output picked up toward the end of the week as gas generation fell.

New York ISO

As we saw last week, it appears New York had a planned nuclear outage covered by a variety of power sources. Natural gas generation ebbed with demand towards the end of the week.

PJM

Natural gas, nuclear, and coal kept America’s largest power market going.

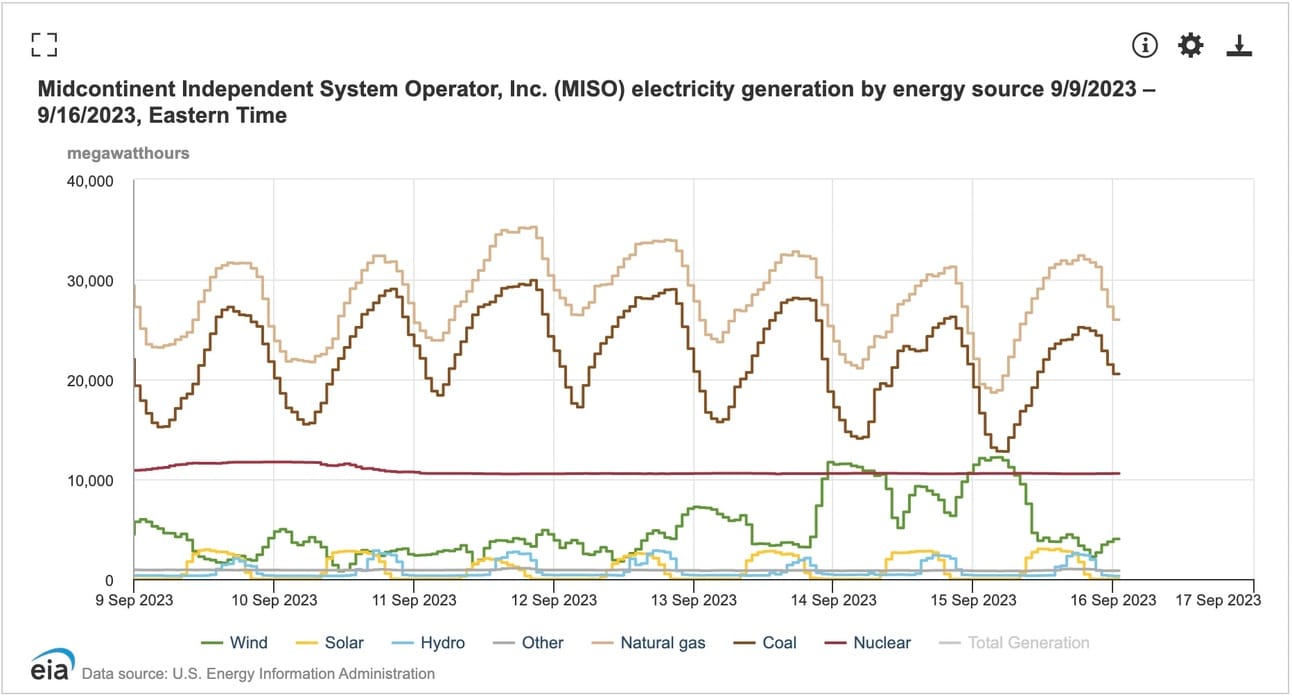

MISO

Natural gas, coal, and nuclear were the major generation sources in the Midcontinent Independent System Operator. When wind really showed up on the 14th and 15th, it brought down gas and (especially) coal generation. MISO recently announced it has nearly 50 gigawatts of interconnection-approved-but-stalled projects, which you can read about here.

ERCOT

Texas started out with natural gas playing lead with wind, solar, and coal duking it out for second place. Over the 13th and 14th, wind and solar lulled.

Southwest Power Pool

Southwest Power Pool saw wind drop from its previously impressive output. Thus, natural gas and especially coal were the star players. SPP also announced its expansion, which you can read about here.

CAISO

California had a typical week with natural gas and solar trading places as the primary generation source toward the end of the week.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Conversation Starters

US court dismisses Westinghouse’s case against Korean nuclear manufacturer. “A US district court has dismissed a lawsuit filed by Westinghouse Electric Company seeking to prevent Korea Hydro & Nuclear Power (KHNP) and its parent company Korea Electric Power Corporation (KEPCO) from exporting the APR1400 reactor design without its permission,” reports World Nuclear News. “Westinghouse filed the case on 21 October last year with the District Court for the District of Columbia. The suit claimed that the APR1400 design includes intellectual property licensed by Westinghouse and requires its permission before being transferred to other countries considering deploying the design.”

UK PM Rishi Sunak is considering easing up on the country’s net-zero commitments. “It could include delaying a ban on the sales of new petrol and diesel cars and phasing out gas boilers, multiple sources have told the BBC. The PM is preparing to set out the changes in a speech in the coming days,” reports the BBC. “There is no suggestion that Mr Sunak is considering abandoning the legal commitment to reach net zero carbon emissions by 2050. But he is expected to declare that other countries need to bear more of the burden of dealing with climate change. If Mr Sunak presses ahead with the plan it would represent a significant shift in the Conservative Party's approach to net zero policy, as well as establishing a clear dividing line with the Labour Party.”

Pemex is back at it with Vitol. “Mexican state energy company Pemex has resumed dealing with Vitol, three sources with direct knowledge told Reuters, nearly three years since deals with the world's largest independent energy trader were banned over a graft scandal.

The ban followed Swiss-based Vitol's public acknowledgement in December 2020, in a deal with the U.S. Department of Justice, that it had paid kickbacks to win business with Pemex, as well as state companies in Brazil and Ecuador,” reports Reuters. “In recent days, two vessels carrying Vitol cargos arrived at two Mexican ports, two sources familiar with the deals told Reuters, speaking on the condition of anonymity because the information was both commercially and politically sensitive. A third senior trading source confirmed that Vitol had resumed business with Mexico.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.